Assembly OKs Sandoval’s big tax package

CARSON CITY — The Nevada Assembly late Sunday approved Gov. Brian Sandoval’s $1.1 billion package of new and extended taxes, embracing the popular Republican governor’s ambitious education agenda and determination to position Nevada’s workforce for a high-tech economy.

On a 30-10 vote, the Assembly amended Senate Bill 483, the so-called “sunset bill” that also adds a $1-per-pack increase in cigarette taxes, with provisions of Assembly Bill 464, Sandoval’s latest tax compromise that includes a business gross receipts “commerce tax” imposed on revenue of $4 million or more.

Sandoval, who lobbied hard for his tax plan, praised the Assembly’s action.

“I am incredibly proud of the men and women of the Assembly who today affirmed that Nevada is ready to lead,” Sandoval said in a statement. “This vote moves us one step closer to cementing the legacy of improving public education by both raising accountability as well as increasing investment in order to suit the needs of generations to come.”

The bill was immediately sent to the Senate, which is scheduled to vote on it Monday morning.

PASSIONATE DEBATE

Debate in the Assembly was passionate on both sides of the issue. A vocal group of anti-tax Republicans urged their colleagues to delay the vote or defeat it, arguing that supporting the tax hike would go against the will of voters.

Opponents called the tax plan a margins tax in disguise and reminded the body that voters overwhelming rejected a gross receipts tax in November.

“The voters voted no back in November to the margins tax,” said Assemblywoman Shelly Shelton, R-Las Vegas. “The people of Nevada do not want this and I implore my colleagues to vote no.”

Assemblyman Brent Jones, R-Las Vegas, said a yes vote was betraying constituents who elected them.

“We are going to betray the very people who ushered us in and they spoke very loudly,” he said.

Former opponents, meanwhile, explained their change of heart to support the largest tax package in state history.

“We owe this to the rising generation,” said Assemblyman Erven Nelson, R-Las Vegas, who said he came to the Legislature with a goal to oppose taxes.

“I was uninformed. I made a mistake,” he said in a passionate floor speech.

Majority Leader Paul Anderson, R-Las Vegas, who helped usher the plan through the lower house, said “the sky is not falling” by raising taxes. It’s time, he said, for Nevada to “put the status quo in the rearview mirror.”

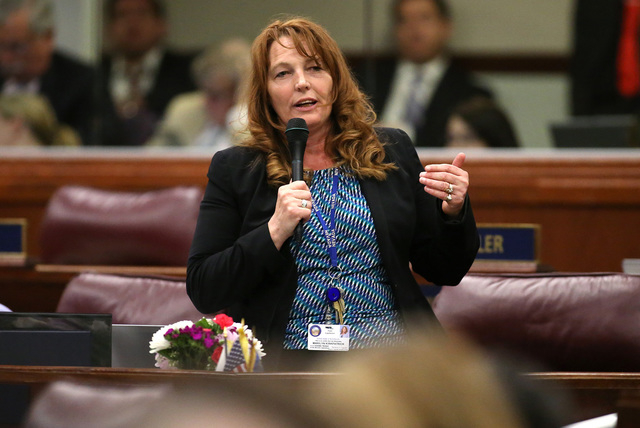

Assembly Minority Leader Marilyn Kirkpatrick, D-North Las Vegas, said Nevada for too long has ignored pressing needs and rebuked critics who argued that voting for taxes would taint the legislators’ integrity.

“This is not personal. This is not about integrity, for heaven’s sake,” she said.

“At some point you have to stand up and take a stand.”

All Democrats supported the bill.

TAX PACKAGE

The package includes $400 million for the general fund in so-called “sunset” taxes that were enacted in 2009 and originally set to expire in 2011 but have twice been extended. Another $376 million from a bump in the state sales tax rate goes to school. SB483 makes those levies permanent.

The bill also raises $200 million in new cigarette taxes and about $500 million in higher payroll taxes, corporate business license fees and gross receipt business taxes.

The commerce tax was the component that gave Republican lawmakers the most angst, though Sandoval was able to tweak his proposal to swing enough votes necessary to secure a two-thirds majority, or 28 votes, needed for passage by lowering other tax components in the legislation.

Assemblymen Derek Armstrong, R-Henderson, and Nelson announced Saturday they would support the governor’s plan. On Sunday, conservative Assemblyman James Oscarson, R-Pahrump, did the same.

Oscarson, who served on the Assembly Ways and Means Committee, said the panel cut millions of dollars out of the governor’s initial budget proposal “without jeopardizing core needs.”

“Still, it became painfully obvious that we would not be able to do justice to Nevada’s future without additional investment,” he said.

Oscarson called his decision to support the tax hike “one of most difficult choices of my life.”

CAUCUS MEETING REQUEST REJECTED

Tensions ran high as a midafternoon vote was delayed and anti-tax Assembly members lashed out at GOP leadership — Speaker John Hambrick and Majority Leader Paul Anderson, both of Las Vegas — for refusing to allow a caucus meeting to discuss the tax bills.

“All we’re asking is to have a meeting to discuss the ramifications of the largest tax increase in Nevada history,” Assemblyman Ira Hansen, R-Sparks, told reporters at a hastily called news conference.

Taxes were the focus of the session after Sandoval proposed a $7.4 billion general fund budget and hundreds of millions of dollars more spending to improve Nevada’s education system, routinely sitting at the bottom of national rankings.

Under the governor’s plan, business license fees will remain a flat $200 annually for most businesses while corporations will pay $500.

Modified business taxes assessed on payroll will rise to 1.475 percent for general businesses, up from the current 1.17 percent. Mining and financial institutions will pay 2 percent. An existing exemption for $85,000 in quarterly wages will be reduced to $50,000.

The measure also will allow the payroll tax rate to be lowered to no less than 1.17 percent if combined commerce and payroll tax collections exceed projections by 4 percent or more.

Companies subject to the commerce tax can also deduct 50 percent of what they pay from any payroll tax liabilities.

Contact Sandra Chereb at schereb@reviewjournal.com or 775-687-3901. Find her on Twitter: @SandraChereb.

RELATED STORIES

Sandoval tweaks tax plan to squeeze more votes out of Assembly

Aviation industry tax breaks bill sent to Sandoval

Nevada Gov. Brian Sandoval’s compromise tax plan gets guarded legislative reception

Nevada legislators struggle to fix live entertainment tax

See all of our coverage: 2015 Nevada Legislature