Legislature: Nevada delivered balanced budget as taxes stayed same

CARSON CITY -- Ahh, July 1. The glorious day when a handful of taxes would return to 2008 levels. Or so promised both Gov. Brian Sandoval and his defeated opponent, Rory Reid, during the last election.

But July 1 has come and gone, and the sales and business tax breaks they promised aren't happening.

There will be no 0.35 percentage point reduction in the sales tax rate.

The $200-a-year business license fee every business must pay isn't dropping back to $100.

And your employer still must pay a 1.17 percent payroll tax on your earnings.

Did you really think politicians were going to decrease taxes? But while your taxes aren't dropping, they're at least staying the same. Proposed tax increases never made it past the no-new-taxes governor's desk.

A tsunami hit state government on May 26. That day the state Supreme Court ruled that state government no longer could raid most local government and school district funds to balance its budget.

Within days of the decision, Sandoval and many legislators had broken their promises not to extend $620 million in taxes that were scheduled to expire at midnight on the last day of the fiscal year, which was Thursday. In the end, only 12 of the 63 legislators voted against extending those "sunset tax" increases for another two years.

So Nevadans will continue to pay an extra $70 in sales taxes on any new $20,000 pickup and $200 for the privilege of doing business in the Silver State.

Instead of paying $315 a year in payroll taxes on your $50,000 salary, your boss will pay $585.

Of course, Sandoval -- during the let's-see-who-can-smile-the-brightest news conference in which he and legislators announced their agreement on a $6.24 billion budget -- quickly emphasized that 70 percent of businesses won't pay any business taxes.

That sounds great, but how much will they really save?

The answer is a maximum $1,250, enough to buy a nice office computer or copy machine and still take the staff to McDonald's for lunch.

The agreement frees only the first $250,000 in payroll of any business from the payroll tax. That portion of a company's payroll previously had been taxed at a 0.5 percent rate.

STATE BUDGET DETAILS

The $6.24 billion general fund budget is about the same as the spending plan approved in 2009 over Gov. Jim Gibbons' veto.

But financial legerdemain was used to achieve the budget parity.

About $210 million in room taxes, used to balance the state budget in 2009, was given directly to schools as the Nevada State Education Association originally intended in an enabling petition, and no longer will be considered a general fund tax.

County school districts still must lay off some employees because of declining local revenue, although state support to education increases during this new fiscal year.

School districts this fall will receive state support that averages $5,263 per student. That compares with the $5,192 paid during the 2010-11 school year. And in the fall of 2012, state support climbs to $5,374 per student.

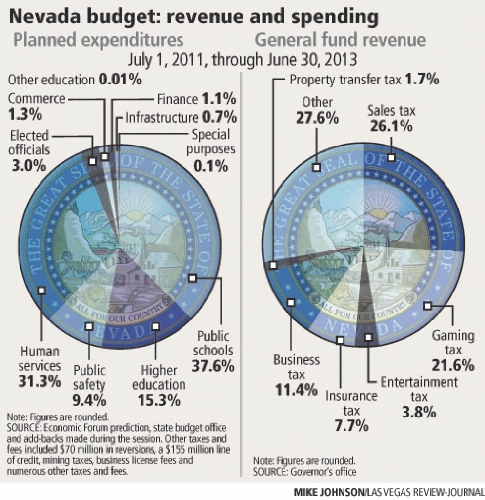

Public schools, under the new spending plan, will receive 37.6 percent of all state dollars. Higher education will be given 15.3 percent. That means nearly 53 percent of the $6.182 billion, two-year spending plan goes for education.

Human services -- welfare, Medicaid, mental health, foster children, etc. -- receive 31.3 percent of all state dollars. Public safety agencies, meaning the Nevada Highway Patrol, the Department of Corrections, and Parole and Probation, take 9.4 percent.

SPENDING LESS THAN AVAILABLE REVENUE

But unlike the federal government and California, Nevada legislators and the governor once again delivered a balanced budget. In fact, spending is expected to be $40 million less than the available revenue.

To get there, Nevada might have to borrow $155 million from an local government investment pool. That loan is built into the budget, but if the economy improves, the state might never tap into the fund.

The budget balances because of passage of two bills taking more money from specific industries also went into effect Friday.

About $16.6 million in unredeemed slot machine winnings now will flow into state coffers. Casinos used to collect this money, which represents thousands of winning slot tickets that patrons do not cash out.

State government also is reducing some of the deductions mining companies can take before figuring their net proceeds of minerals taxes. The change will bring in another $23.8 million for the state.

Of course, gold sold for $1,482.30 per ounce Thursday. Nevada mines produce nearly 80 percent of the nation's gold.

The industry successfully fought off proposals for a bigger tax increase, a movement that was supported by popular opinion but not by many lawmakers.

Contact Capital Bureau Chief Ed Vogel at evogel@reviewjournal.com or 775-687-3901.