Nevada governor wants $12M tax credit for child care facilities in economic plan

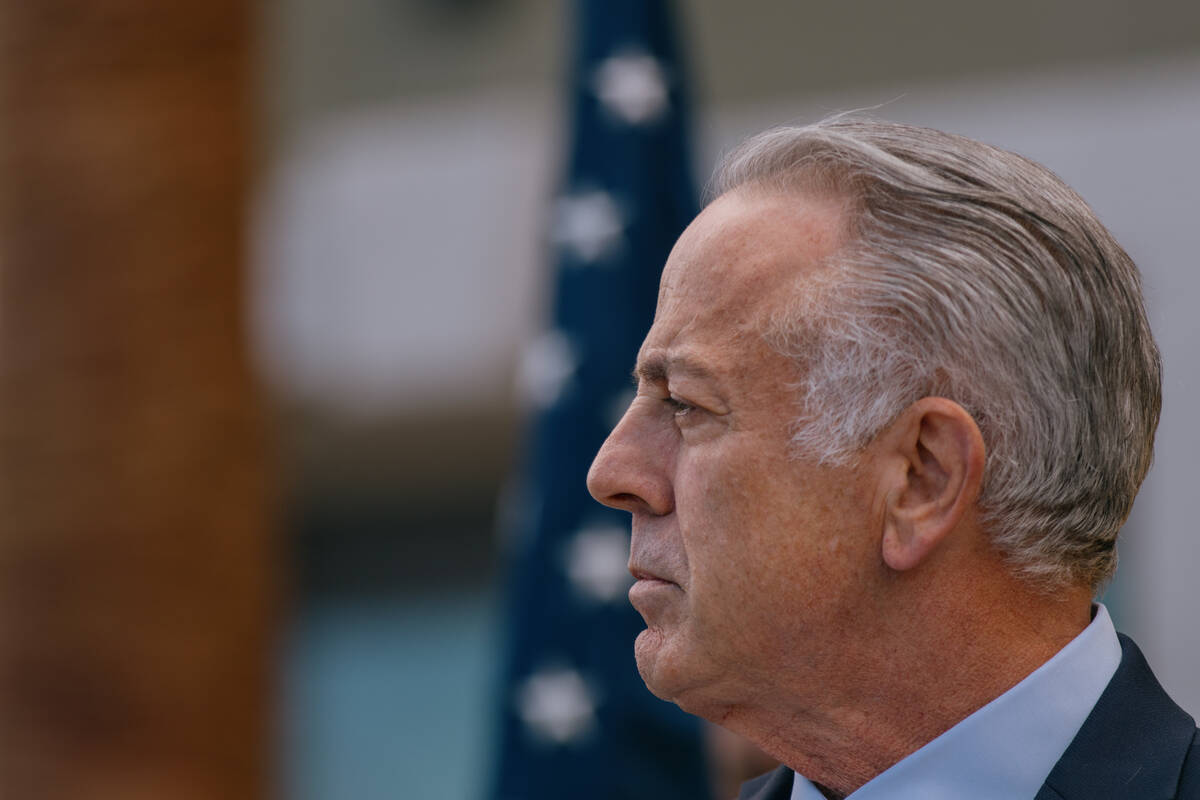

Gov. Joe Lombardo introduced his legislative proposal for economic development last week that would provide incentives for companies that move to Nevada.

Senate Bill 461 — called the Nevada Forward Economic Development Policy Reform Act — would provide up to $12 million in tax credits to build child care facilities, offer tax deductions for “high impact” businesses and a create a $100 million community infrastructure investment fund.

The economic development bill is one of five priority bills the governor highlighted in his State of the State address in January. The long-awaited bills received exemptions to deadlines, and the bill texts are slowly being released. Lombardo has unveiled his education, crime and housing bills so far; his health bill is the only one left.

“As Gov. Lombardo seeks to build a resilient, diversified economy, this legislation positions Nevada as a leader in innovation and economic growth by addressing workforce development, infrastructure investment, environmental sustainability, new child care tax credits and industry diversification,” Lombardo spokesperson Elizabeth Ray said in a statement.

The bill’s unveiling follows a tepid economic forecast for the 2026-27 biennium in Nevada. The forecast predicted the state will collect $191 million less general fund revenue than originally thought, and bills with high price tags might be on the chopping block.

The Nevada Assembly Democratic Caucus declined to comment, and the Senate Democrats did not return a request.

The details of the bill

SB 461 calls for a number of proposals that would be led by the Governor’s Office of Economic Development, which would have the authority to approve, limit or reduce incentives based on environmental impacts, water use and social objectives.

The legislation proposes a partial deduction of selected property taxes, business taxes and sales and use taxes for businesses in advanced manufacturing, electric battery production, clean energy and water technology, defense technologies, aerospace systems, national security solutions and advanced health care technology.

The deduction would be no more than 60 percent of the total amount of taxes that would be due in a tax year, and they will expire up to 10 years after they are issued. The tax deduction would not reduce the Local School Support Tax.

The bill also authorizes the office of Economic Development to grant a partial abatement of property taxes to businesses involved with biofuels, biomass or other fuels from recycled material for use in energy production, or recycled materials that were used to produce or store renewable energy.

It proposes removing restrictions on tax abatements for businesses already established in Nevada to encourage reinvestment and ensure that long-standing contributors to the economy are not overlooked, according to the governor’s office.

On child care, the bill authorizes the Office of Economic Development to establish a transferable tax credit of up to $12 million per year for investments in child care facilities to support working families and enhance workforce stability, according to the governor’s office.

Lombardo’s bill would also create the Community Infrastructure Grant Program, a $100 million biennial fund to support infrastructure projects to aid business expansion and relocation. It also provides a mechanism to address infrastructure needs for workforce housing development in rural Nevada, according to the governor’s office.

The initial fund would comprise a one-time allocation of $25 million from the general fund then $75 million in recurrent investments from the state infrastructure fund. The fund would be used over the two-year 2026-27 biennium and renewed in the next budget cycle.

If passed, the bill would also require the Office of Economic Development and Department of Employment, Training &Rehabilitation to establish a program to reimburse expenses of students who complete a career and technical education program in a trade-related field provided by a school district.

To the extent money is made available, the bill requires the State Board of Education to establish a program to provide stipends to employers whose employees teach in career and technical education programs. The employee can donate the stipend to their school district for costs associated with the career and technical education program, according to the bill text.

A “talent pipeline” would also connect students in career and technical education programs with local businesses to facilitate internships, apprenticeships and short-term career expenses. Using funds from the Workforce Innovations for a New Nevada Account, the Office of Economic Development would establish a program to award grants to school districts with active talent pipeline agreements.

This article has been updated to correct when the proposed tax deduction would expire.

Contact Jessica Hill at jehill@reviewjournal.com. Follow @jess_hillyeah on X.