Senate hears plans to speed unemployment system

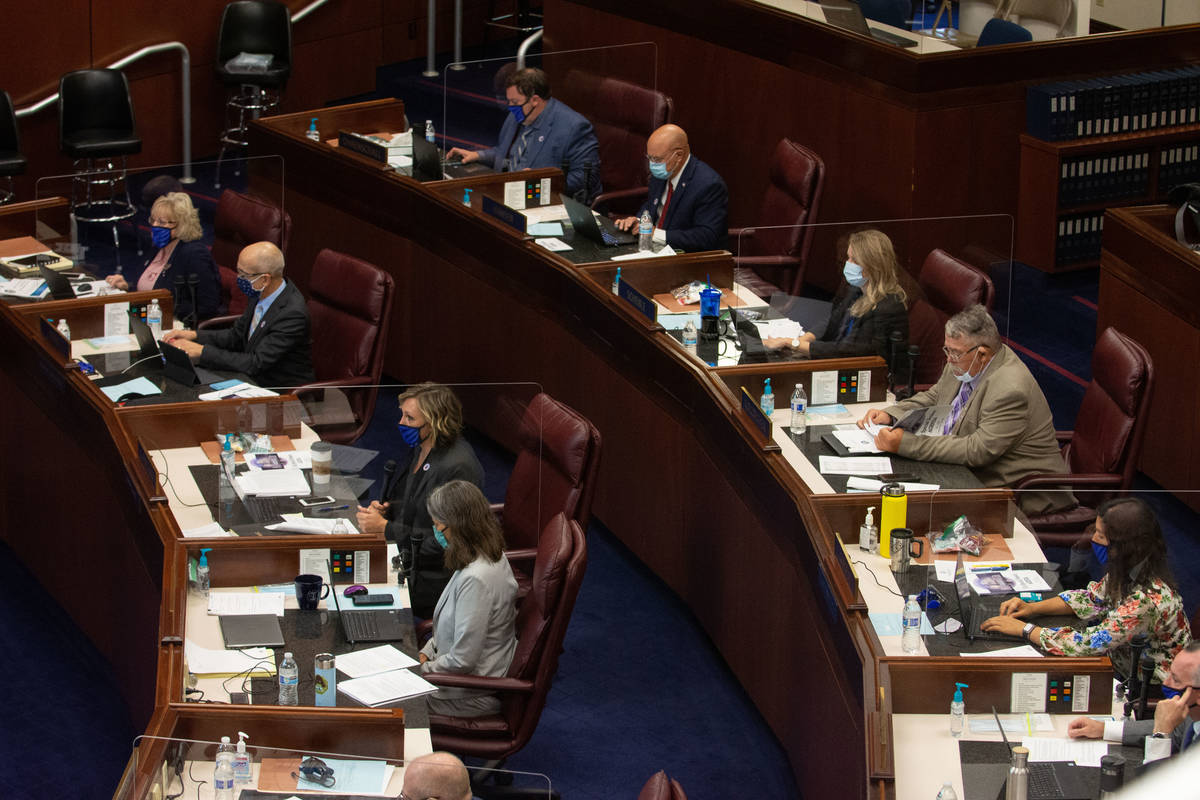

CARSON CITY — The Nevada state Senate heard a bill Sunday night to address ongoing problems with the state’s beleaguered unemployment system, which has been swamped with applications since the start of the coronavirus pandemic.

That hearing capped a day during which lawmakers gave final approval to a trio of proposed constitutional amendments that may eventually increase mining taxes in the state.

Senate Bill 3, introduced and heard Sunday evening, seeks changes that would make submitting and processing unemployment claims simpler and faster, expand benefits for some claimants, make it easier for the state to react quickly to policy changes at the federal level and enact policy changes during a state of emergency or after a disaster declaration.

Some of the changes are as basic as allowing documents or communications related to unemployment insurance to be transmitted electronically instead of by mail.

Most significantly, it would make changes that qualify Nevada claimants for an additional seven weeks of benefits beyond the standard 13-week period. It addresses a glitch that potentially prevented people from receiving the extra pandemic-related $600 a week payout if they worked less than full-time but made even slightly more than the weekly benefit they would receive.

That extra payout program expired Friday, but some version of it may be restored in a future federal aid effort.

The bill also relieves employers from having to paying higher unemployment taxes if they were forced furlough or lay off employees because of the pandemic.

Francisco Morales, Gov. Steve Sisolak’s director of public relations and community affairs, told lawmakers during a hearing on the bill that the changes would “remove some barriers” that have hindered the Department of Employment, Training and Rehabilitation’s ability to quickly process unemployment claims.

The bill was not released publicly until after the Senate meeting started just before 7 p.m. Sunday, and some lawmakers noted while asking questions that they had received a copy of the 33-page bill shortly before the meeting started.

Kimberly Gaa, the administrator of the Nevada Employment Security Division, said that the changes would free up some staff time that could be used to address the backlog of unpaid claims.

Emotional hearing

Lawmakers listened for more than an hour to gut-wrenching stories from Nevadans whose unemployment claims had been stuck for various reasons, many dating to March and the early throes of the pandemic.

Some Republican lawmakers questioned whether the bill does enough to speed up the claim process or address the backlog of unpaid claims.

“I guess I expected something more, something different from the bill,” said Sen. Pete Goicoechea, R-Eureka. He added that he’s not sure that the expansion of benefits in the bill will solve the major problems plaguing the system.

Lack of staffing, Gaa said, has been one of the biggest challenges in tackling both that backlog and fraudulent claims.

Gaa said that the department has requested additional funds from the governor’s office that would be used to hire more investigators to dig into the fraudulent claims.

Gaa added that “we fully expect to be audited and we fully expect them to find fraudulent payments.” When asked about the number of fraudulent claims, Gaa said that “we don’t know the total number.”

Sen. Pat Spearman, D-North Las Vegas, agreed that lawmakers could do more, but they need help from the federal government in the form of federal relief dollars to realistically accomplish that.

“Yes we should do better. But we can only do better with money. I don’t know anyway we have a magic wand, or pixie dust, to make this better. It’s going to be money,” Spearman said.

Sen. James Settelmeyer, R-Gardnerville, said the bill was overdue. “The citizens of Nevada need help. They’ve needed help for a long time,” he said. “We should have made this a priority on Day 1 of the first special session.”

Lawmakers met in special session in July to address the state’s budget shortfall caused by the coronavirus outbreak.

Sen. Heidi Gansert, R-Reno, went further, saying the state should have anticipated the surge in unemployment claims when the state’s casinos began shutting down and Gov. Steve Sisolak issued closure orders to nonessential businesses. The state, she said, should have shored up its unemployment system then. “I really think we need to do more,” she added.

Mining measures approved

The Senate on Sunday approved two more proposals for changing how Nevada taxes its mining industry, proposals that will now come back to lawmakers for a confirmation vote in the 2021 session.

If approved then, one or more of the measures would go before voters in 2022.

The mining tax debate draws a divide between rural mining areas and more urban parts of the state and, hence, typically pits Republicans against Democrats. Sunday’s votes on the two measures ran mostly true to form along party lines, with one defection.

Initial Senate and Assembly proposals, Senate Joint Resolution 1 and Assembly Joint Resolution 1, would remove the constitutionally prescribed 5 percent tax cap on net proceeds of minerals and replace it with a 7.75 percent tax on mining’s gross proceeds. The difference, based on 2019 industry revenues and tax collections, could be an additional $350 million in revenue annually.

Both of those proposals would sweep in revenue from the tax that now goes to counties where the mines are located, with the Assembly version allocating a portion to education and health care.

A third one introduced Saturday, Assembly Joint Resolution 2, would set the net mining tax at the local property tax rate, capped at no more 12 percent. All three measures passed the Assembly on Saturday. The newest proposal was crafted with input from mining interests, whose representatives testified as neutral on the measure in both houses.

The Senate approved SJR 1 on Saturday in a 13-8 party line vote. Its vote on AJR1 Sunday reflected the same partisan split. But AJR2 was approved 14-7, with Sen. Joe Hardy, R-Boulder City, opting for it, saying he anticipated more conversation on the proposal in the Legislature next year.

“I think realistically mining is going to be under the microscope of how much they’re going to pay and how much the constituents that we have are going to require of them,” Hardy said, explaining his vote. “I think this also gives people an opportunity to look at something that may not be as egregious as some of the other things that they may end up voting on, so I will be voting yes on this.”

Contact Capital Bureau reporter Bill Dentzer at bdentzer@reviewjournal.com. Follow @DentzerNews on Twitter. Contact Capital Bureau Chief Colton Lochhead at clochhead@reviewjournal.com. Follow @ColtonLochhead on Twitter.