Trade unions call for Nevada film studio bill in special session, others urge against

Lobbying efforts over whether to lure Hollywood studios to Summerlin were in full force on Wednesday, with trade unions drawing hundreds of supporters to a town hall while opponents urged the governor to reject the attempt.

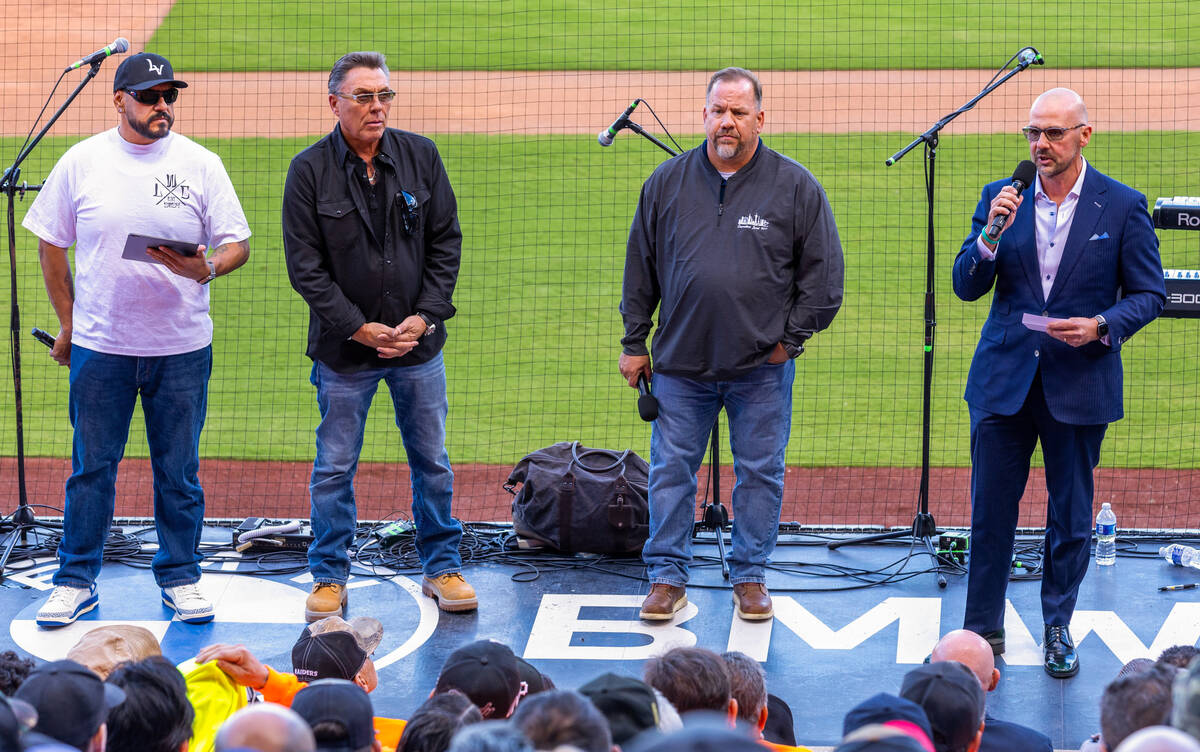

Union members from building and trade groups across Southern Nevada gathered in the Las Vegas Ballpark, seated in about four sections in front of the third-base dugout. The event was part of a push by their political action committee, Nevada Jobs Now, to put tax incentives for the film industry on the agenda for a special legislative session expected later this year.

“The elected officials need to hear from you, because otherwise they think I’m just a union crybaby up here crying for jobs,” Vince Saavedra, executive secretary-treasurer of the Southern Nevada Building Trades Unions, said to the crowd of members in matching, bright colored union shirts. “It’s important for them to see your faces, but it’s more important for them to hear from you guys.”

Gov. Joe Lombardo said on Oct. 6 that he planned to call state lawmakers back to Carson City to address “unfinished” business from the end of the regular session. That could include a proposal to build a Sony Pictures Entertainment, Warner Bros. Discovery and Howard Hughes Corp.-backed studio campus through transferable film production tax credits.

That bill fell short of the support it needed to pass during the session that ended in June. It passed out of the Assembly in a tight 22-20 vote but did not come up in the Senate before adjournment.

More than a dozen lawmakers were also seen in attendance at the town hall.

Trade groups lead push

Assemblymember Daniele Monroe-Moreno, one of the bill’s sponsors, said she was glad the union leaders called the event.

“We kind of need butts in beds in our state,” the North Las Vegas Democrat said. “We see what happens when our one economy, the hospitality industry, is impacted. We have a lot of people who work in the industry that travel out of state. They can stay at home, work at home, recycle their dollars here at home.”

Sen. Majority Leader Nicole Cannizzaro, D-Las Vegas, voiced her support for the union-backed effort.

“Honestly, that is why I am excited about this particular bill,” she told the crowd. “I know that there are jobs associated with this. And I am no stranger to being asked to come and talk about investing state dollars and making sure that we are employing Nevadans, that we are creating good-paying jobs, and that things are being built with union labor.”

Saavedra said there are 4,000 members on the out-of-work list for his unions and more than 1,000 people traveling for work. The projected 19,000 construction jobs tied to the studio project would be covered by project-labor agreements that have been signed or are in the works, union and Howard Hughes representatives said.

Critics have argued that job projections are inflated by gig and part-time work. But Apple Thorne, business representative for stagehand union IATSE Local 720, said industry workers saw contract work with union benefits as “a good career.”

“Sometimes those jobs are only two or three days or a week or a couple of weeks, but those keep adding up,” she said.

One major union that did not wade into this week’s public efforts was Culinary Local 226. The powerful hospitality workers’ union supported the Summerlin Studios proposal at the end of the regular session. Officials told the Las Vegas Review-Journal on Thursday that the union will continue its support and pointed to a May statement from secretary-treasurer Ted Pappageorge in which he called the legislation “critical to diversifying our economy and creating good union jobs in Las Vegas.”

Opponents decry special session push

Hours earlier, a coalition of progressive action groups, education associations and the state employees’ union delivered a letter to Lombardo urging him against including a film tax credit program expansion bill on the special session agenda.

Opponents pointed to a state-commissioned report from the Governor’s Office of Economic Development published in May. That study reviewed the two film tax credit bills introduced during the regular session that proposed a significant expansion of the state’s film tax credit program. It concluded that state and local governments would get back 52 cents for every $1 in tax credits spent. The state would receive 23 cents, according to the report.

“Nevada is staring down serious financial uncertainty,” the coalition wrote. “Every dollar we lock into a corporate handout is a dollar we can’t put toward our rainy-day readiness, public education, healthcare, wildfire mitigation, housing, and the basic services Nevadans rely on when times get tight.”

The group argues that fiscal return on investment must be the basis of the state’s choice, not economic impact, which can be different based on how the report is calculated.

AFSCME Local 4041 member Blaine Harper, a staff research associate at the University of Nevada, Reno said a potential film bill would favor “an unreliable industry over public services and our communities.”

“When the state must make tough budget decisions, state workers are always the ones who are asked to make sacrifices first,” Harper said at a press conference Wednesday morning. “Over the years, we’ve been asked to take furloughs, forgo cost-of-living increases and take on extra work while jobs are held vacant.”

Committing public funds

If the proposal makes it to the special session, it would be the third time lawmakers debated an expansion to the film tax credit program. It’s currently capped at $10 million annually. The Summerlin Studios project asked for $95 million in transferable tax credits annually over 15 years beginning in 2028 and only available after $400 million in new capital investment, excluding a hotel.

Bills introduced in the special session could have different language and specifics than what was debated in the regular session.

Michael Brown, a fellow at UNLV’s The Lincy Institute think tank and a former head of the Governor’s Office of Economic Development during Democratic Gov. Steve Sisolak’s administration, said he was concerned about adding another tax credit burden to the state’s books.

There are eight transferable tax credit programs already obligated to the state’s general fund, including the existing film production program, the Athletics’ baseball stadium and affordable housing projects.

“In a state without income taxes, it’s very hard to recover the taxes on the induced benefits that come from this. Where you do see robust film programs are also where you see states that have income taxes,” Brown said, adding that transferable tax credit obligations are considered negative revenues to the state budget.

“I am concerned about the rising level of commitments that are being made in transferable tax credits, because it is done on the basis of hoping that the induced benefits will cause all this to be paid for,” he continued. “The evidence shows in every single state that it doesn’t.”

Monroe-Moreno said she and co-sponsor Assemblymember Sandra Jauregui, D-Las Vegas, wrote in the capital investment guardrails to make sure the industry remains in Nevada when the tax credits run out.

“We’ve learned from some of the mistakes in the past and tried not to do those in this bill to make it the best bill for the state of Nevada,” she said.

Lombardo’s call

No date has been announced for the special session. Nor have the specifics of the agenda, which could also include other priority legislation from the governor’s office on crime and health care.

Lombardo has largely kept out of the studio debate. During the regular session, he declined to comment on the pending legislation, saying only that he would evaluate whatever makes it to his desk.

But more recently, his comments have changed. He told KTNV-TV, Channel 13, in an August interview that the studios’ bill could make it on the special session agenda and should be considered a job creation bill.

An earlier version of the story incorrectly identified where the speakers stood.

Contact McKenna Ross at mross@reviewjournal.com. Follow @mckenna_ross_ on X.