Senate votes along party lines to advance tax-reform bill

WASHINGTON — A sweeping tax-reform bill cleared a key procedural hurdle in the Senate on Wednesday as Republicans moved forward with their plan to pass the legislation this week.

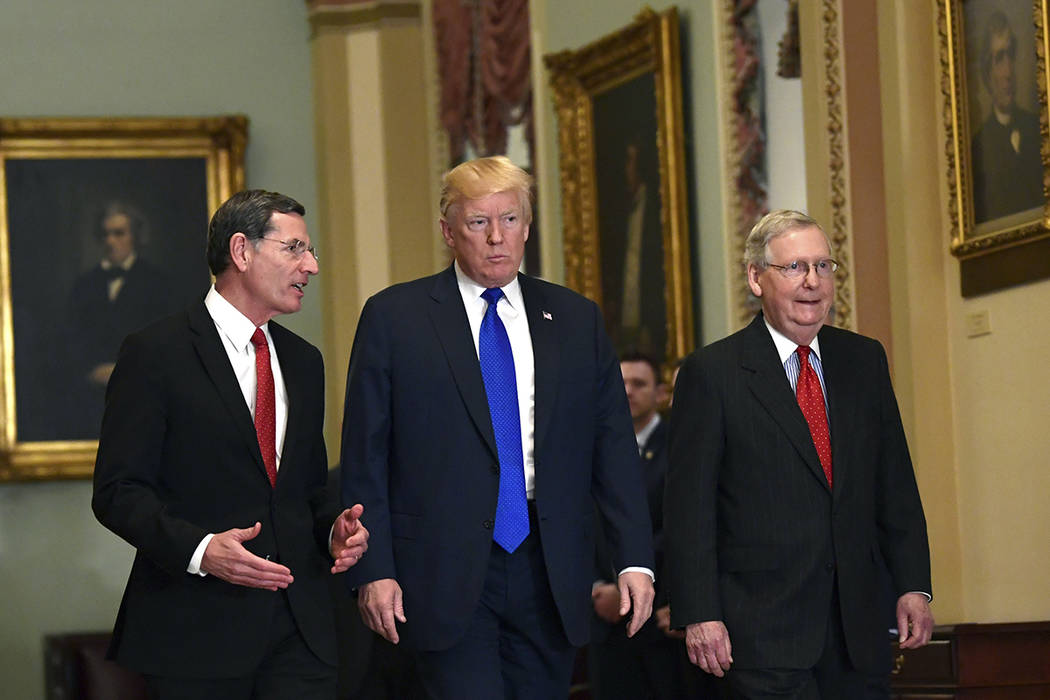

The Senate voted 52-48, along party lines, to open debate on the $1.4 trillion package of tax cuts and reforms championed by President Donald Trump and congressional Republican leaders searching for a legislative victory before next year’s elections.

Senate Majority Leader Mitch McConnell, R-Ky., said before the vote that passing tax reform is the “single most important thing we can do right now to shift the economy into high gear.”

Hours before the vote, Sen. Dean Heller, R-Nev., told a news conference that he would put “$100 down” that the procedural motion would be approved and the Senate would move toward final passage of the bill.

He said the bill would help families in Nevada, the state with the most people “living paycheck to paycheck.”

But Heller and Republican leaders were less certain about the final outcome of the bill. Several GOP lawmakers said they would vote to begin debate, but still had major concerns with the legislation.

Democrats have remained united against the bill, which they claim disproportionately benefits corporations and the wealthiest Americans at the expense of middle-class taxpayers, who would see modest tax cuts disappear after 2025.

Sen. Catherine Cortez Masto, D-Nev., said this week that 500,000 Nevada families would see their taxes go up in 2027 when individual tax cuts would sunset. The tax cuts in the Senate bill for corporations are permanent.

20 hours of debate

The Senate tax plan would add $1.4 trillion to the debt over a decade, drawing criticism from the Committee for a Responsible Federal Budget and GOP deficit hawks like Sen. Bob Corker, R-Tenn., who is seeking a “trigger” mechanism that would end the cuts if debt projections increase.

Senators will debate the bill for 20 hours, and then begin a “vote-a-rama” on amendments that is expected to last into the night Thursday. A vote on final passage would follow the whirlwind procedure on the Senate floor.

The House passed its $1.5 trillion version of the bill on Nov 16. That bill would eliminate federal deductions for medical expenses, state and local income taxes, and cap the mortgage interest rate deduction at $500,000.

The National Association of Realtors said the proposed changes in both bills would result in a drop in home values by an average of 10 percent and eliminate the incentives that help 90 percent of American families.

A provision in the Senate bill would eliminate the individual mandate to purchase health care insurance under the Affordable Care Act, which currently results in an IRS penalty for those who fail to comply.

The non-partisan Congressional Budget Office estimates the provision would cost $338 billion and reduce the number of people insured by 4 million in 2019, and by 13 million in 2027.

Both versions of the legislation would permanently cut corporate tax rates to 20 percent from 35 percent.

Trump said the corporate tax cuts would bring $4 trillion in corporate investment back into the United States, creating millions of new jobs and raising wages for American workers.

At a rally in Missouri, Trump called tax reform a once-in-a-lifetime opportunity that would “bring Main Street roaring back.”

But that prognostication was tempered Wednesday by a Bloomberg Politics report that executives at major companies said they expected to turn over gains from the proposed tax cuts to shareholders.

Hurdles remain

The Senate bill still faces hurdles as GOP lawmakers await a final bill following floor amendments.

A defection of just three Republican senators would tank the legislation, which is being pushed through Congress under special budget rules that allow for simple majorities in the House and Senate.

GOP efforts to repeal the ACA, commonly referred to as Obamacare, died in the Senate earlier this year when Sen. John McCain, R-Ariz., cast a deciding “no” vote that killed that legislation.

McCain remains a wildcard on the tax reform bill. Although he voted to advance the legislation for debate, he has said he has many concerns over the bill and the process in which the Senate has rushed the legislation to a vote.

Many Republicans have campaigned on tax reform and incumbent lawmakers are looking for a victory before the 2018 elections.

Heller, considered the most vulnerable GOP senator, is facing a Republican primary challenge from Las Vegas lawyer Danny Tarkanian, and from Rep. Jacky Rosen, D-Nev., one of several Democrats eyeing the seat.

A member of the Senate Finance Committee, which wrote the tax bill, Heller tucked a provision into the legislation that would double the child tax credit to $2,000.

At a news conference Wednesday, Heller said there were “political implications” to the tax bill, but he said the ultimate goal was to help middle-class families.

Contact Gary Martin at gmartin@reviewjournal.com or 202-662-7390. Follow @garymartindc on Twitter.