Revenue forecast worsens

The ailing real estate market is pushing property tax revenues into a deeper chasm than in 2009, and one analyst predicts local governments will need years to climb back out of the hole.

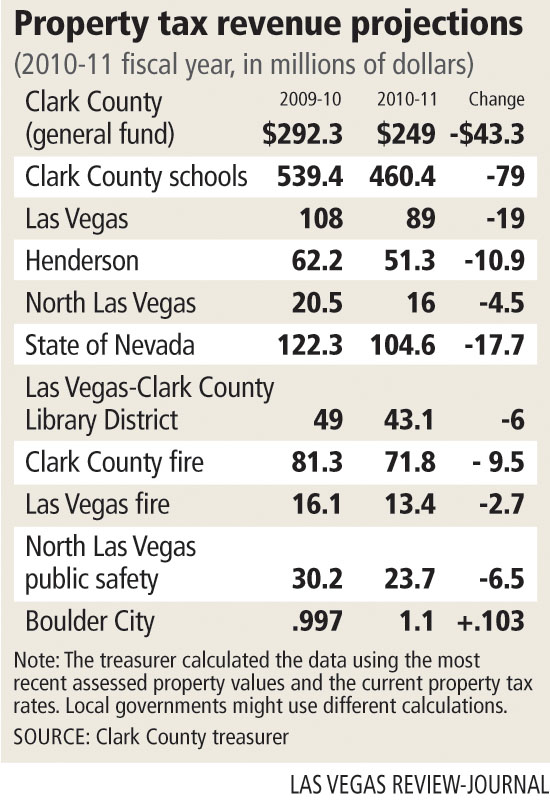

An early forecast from the Clark County treasurer shows property tax revenue falling by $325 million in the next budget year, far surpassing this year's $82 million dip.

While smaller tax bills are happy news for property owners, the sagging revenue puts added pressure on governments to cut jobs, services and wages.

"It's a double-edged sword," said Carole Vilardo, president of the Nevada Taxpayers Association. "It's good for the taxpayers that they're getting relief. On the other hand, it just exacerbates the shortfalls that the governments and (Clark County) School District will have."

The pain is spread across almost 80 taxing districts, including the county, the cities, the schools, public safety districts and outlying areas.

Local leaders say any drop in revenue is significant because it gives governments less money to cover labor costs that go up every year, especially when union contracts require pay raises.

Most officials seemed resigned to taking the latest financial blows.

"None of this comes as a surprise," Clark County spokesman Erik Pappa said. "It's more bad news on top of bad news."

The county is expected to lose more than $43 million in property taxes from its general operating fund. That compounds a $50 million drop in the consolidated sales tax in the first half of this fiscal year.

The growing budget gap, a combined shortfall that could reach $200 million, has led county officials to explore laying off workers and reducing pay raises.

County leaders wouldn't discuss how they might reduce staff and wages, saying they are in the midst of forming the budget and bargaining with employee unions.

County workers earn an average of $93,000 in wages and benefits. That means 2,150 employees would have to be laid off to offset a $200 million gap.

Meanwhile, the school district is facing a $79 million drop in property tax revenue, and Las Vegas could take a $19 million hit.

County Treasurer Laura Fitzpatrick cautions that all of the figures are preliminary. They are based on current property tax rates, which the state could adjust later this year, she said. Plus, the record number of people appealing their assessed property values this month could shave revenues even more.

Revenues are falling in large part because 661,000 of the county's 730,000 parcels have dipped enough in value to produce smaller tax bills for owners.

CAPS TO SLOW RECOVERY

Facing a voter revolt several years ago, state lawmakers capped annual tax increases at 3 percent on residential property and 8 percent on commercial property, based on 2004 levels.

Those caps will suppress the tax revenue that can be generated when properties begin appreciating again and will slow local governments' financial recovery, said Jeremy Aguero, a principal at Applied Analysis, a Las Vegas consulting firm that tracks economic trends.

Local governments will be limited to collecting 3 percent more from homeowners than the year before even if median home values jump by 54 percent, as they did in 2004.

Also, the tax increases will begin from a greatly diminished tax base, Aguero said. "The prices are still falling."

One way to beef up revenue is through new construction, which isn't subject to the caps, Aguero said. But construction is weak, with no signs of revving up in the near future.

Aguero doesn't foresee the local economy or the real estate market recovering this year. In fact, it could take up to five years before Nevada's economy looks anything like it did in 2007, he said.

He said more than 40,000 homes in Nevada are vacant, and people who are unable to find work are leaving the state. Before properties can appreciate again, people must move to Nevada and be employed so they can buy houses, he said.

CITIES, SCHOOLS FEELING THE HURT, TOO

The prolonged recession is being felt throughout the valley.

Las Vegas' property tax revenue is projected to be $89 million in the coming fiscal year, a 17.6 percent drop from the previous year. City officials had expected a decline of 12 percent.

"It's worse than what we thought last November," said Mark Vincent, the city's chief financial officer. "It's not a surprise to us today."

Las Vegas has asked for substantial wage concessions from its union workers to help it meet an expected shortfall next year. City leaders have said layoffs will be necessary if personnel costs aren't cut.

Henderson's share of the revenue decline could approach $11 million in the coming fiscal year, when the state's second-most populous city is projected to receive $51.3 million in property taxes for its general fund. That's down from the $62.2 million expected this year.

Henderson officials were banking on a much smaller decline, something in the neighborhood of $2 million.

Not everyone was caught off guard. Jeff Weiler, chief financial officer for the school district, said the county treasurer's projections "were not unexpected."

"It just makes the hole even deeper."

Property taxes, with the local sales tax and state funding, generates most of the income for the school district's operating budget.

In addition to the drop-off in taxes, the district is bracing for a new round of 10 percent to 20 percent funding reductions from the state.

North Las Vegas' revenues also are falling. The city stands to collect $4.5 million less in property taxes for its general fund and $6.5 million less for its public safety tax fund, according to the treasurer's forecast.

The projected decreases aren't a surprise, Finance Director Phil Stoeckinger said. The city adopted a savings plan based in part on an anticipated $3 million to $6 million loss to the general fund and a $9 million to $11 million loss to its public safety tax fund.

North Las Vegas, which weathered five rounds of budget cuts since 2008, still must trim an additional $33.4 million to make it through fiscal year 2011.

The city announced Thursday it might have to cut 273 jobs starting as early as March.

Meanwhile, the Las Vegas-Clark County Library District is faced with having to reduce staff or labor costs at its 25 branches. It is projected to lose $6 million in property tax revenue, compounding the $5 million drop last year.

Drooping revenue coupled with the 7 percent in combined pay raises required by the union contract will put the district $11 million in the red unless something is done, said Jeanne Goodrich, the district's executive director.

Reduced library funding will show up in subtle ways at first and become more noticeable later, Goodrich said. "I think it's going to be a while before the public sees any change."

Libraries will buy fewer books, she said. As a result, patrons will wait longer for popular books and will have to order obscure titles more often from other libraries.

Some printed materials will be eliminated, with less-used electronic databases, Goodrich said. Libraries also will host fewer events with well-known authors and speakers.

And library hours could be shortened, she said.

The district has 327 full-time workers and 421 part-time employees, Goodrich said.

Ninety-four employees will have a chance to resign and receive a week's pay for every two years of service. That would cost the district $5 million initially but save $110 million in the long run.

Library officials also want to meet with local Teamsters' leaders to discuss reducing pay increases, Goodrich said.

She estimated it will take the library district seven or eight years to rebound.

"It's going to be a long time before we pull out of this," Goodrich said.

Review-Journal reporters Henry Brean, Alan Choate, Lynnette Curtis and James Haug contributed to this report. Contact reporter Scott Wyland at swyland@reviewjournal.com or 702-455-4519.