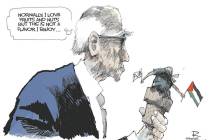

COMMENTARY: Trump tax plan brings out the Reagan revisionists

“Trump’s Tax Cuts May Be More Damaging Than Reagan’s” was the headline The New York Times put over an article by Steven Rattner, a money manager who served in the Obama administration.

The headline made me chuckle, because “more damaging than Reagan’s” seemed like a pretty low bar. The Reagan tax cuts, after all, like John F. Kennedy’s, weren’t “damaging” at all. Instead they spurred economic growth and job creation, powering Reagan to a landslide re-election and sealing his status as one of our most popular presidents.

Here is how the Rattner article in the Times described the “damage”: “the Reagan tax cut increased the budget deficit, helping elevate interest rates over 20 percent, which in turn contributed to the double-dip recession that ensued. The stock market fell by more than 20 percent. Fiscally, the revenue loss totaled 2.9 percent of the average gross domestic product between 1981 and 1985.”

Let’s take these accusations one at a time.

It’s true that the federal budget deficit modestly increased during the Reagan years, from 2.6 percent of gross domestic product in 1980, the year Reagan was elected, to 2.7 percent in 1989, the year he left office, according to the White House Office of Management and Budget’s historical tables.

But that rise in the deficit was not because the federal government took in less money. In fact, even with the lower Reagan income-tax rates, tax revenues soared. Federal receipts were $991 billion in 1989, up from $517 billion in 1980. During this same period, the top individual income tax rate decreased to 28 percent in 1989, from 70 percent in 1980.

The main driver of the increased deficit was defense spending, which rose to $304 billion in 1989 from $135 billion in 1980. Given that the Reagan military buildup helped defeat the Soviet Union, liberating hundreds of millions of people from communist oppression, an increase in the federal budget deficit of 0.1 pecentage points of GDP seems an acceptable price.

The idea that Reagan’s tax cuts were to blame for high interest rates is just flaky. In January 1981, when Reagan was inaugurated, the effective federal funds rate was 19.08 percent. In January 1989, when he left office, it was 9.12 percent. The interest rates were controlled not by President Reagan but primarily by President Carter’s appointee as chairman of the Federal Reserve, Paul Volcker, who had raised rates to fight the inflation plaguing the 1970s economy.

“Recession”? It’s true that GDP growth under Reagan didn’t really kick in powerfully until the first quarter of 1983. But once it did, it wasn’t a recession, but a boom — a 4.6 percent annual real growth rate in 1983, 7.3 percent in 1984, 4.2 percent in 1985, and so on for “The Seven Fat Years” that one of the intellectual engines of Reaganism, Robert L. Bartley, labeled the period in his book of that name.

As for the claim that “the stock market fell,” though precise figures vary slightly depending on what index you use and whether one measures starting from Election Day or inauguration day, the stock market more than doubled during the Reagan years.

Rattner’s mention of the years 1981 to 1985 signals part of what he is up to. By his account, Reagan’s first round of tax cuts went too far and required subsequent repairs, which Rattner describes as “additional tax increases.” Actually, the top individual federal income tax rate kept declining, to 28 percent in 1988 from 38.5 percent in 1987 and 50 percent in 1986.

In an earlier New York Times column, Rattner complained that President Trump’s “public remarks continue to be laden with the same mischaracterizations, misrepresentations and, yes, lies as his campaign.”

Mischaracterizations and misrepresentations are indeed troubling. At least Trump, unlike Reagan, is around to defend himself.

Ira Stoll is editor of FutureOfCapitalism.com and author of “JFK: Conservative.” His column appears Sunday.