EDITORIAL: Lawmakers should embrace efforts to better gauge the effectiveness of economic development subsidies

For years, states have rushed to offer tax breaks and other financial goodies to lure companies promising jobs and economic bounty. Nevada recently joined the big boys, handing out more than $1 billion to attract the coveted Tesla battery factory to the Reno area. The state has about $1.7 billion in taxpayer incentives on the books going to companies such as Amazon, Switch and Faraday Future in addition to Elon Musk’s electric car company.

But do state taxpayers have any way to determine whether the investments merit the return? Not really.

The Pew Charitable Trusts announced this week that Nevada is one of 23 states that lacks a mechanism to measure whether tax subsidies and abatements issued under the guise of economic development actually produce the desired results. While 10 other states do have programs that “rigorously measure the economic and fiscal impact” of their efforts, “there is no regular, systematic process for studying the results of [abatement] programs and using that information to improve policy,” noted the Pew report.

Given the soaring costs of these incentive packages — Nevada expects to shell out about $80 million over the next four years to favored businesses — this lack of accountability is troubling, to say the least. The Nevada setup in particular raises questions. The Governor’s Office of Economic Development is, in essence, charged with both handing out the tax breaks and assessing their effectiveness, creating an obvious conflict. Even Still Hill, who leads the state’s economic development efforts, advocates reform.

“I think it would be helpful for the Legislature to have an opportunity to interact on this subject more than the way it’s structured,” he said.

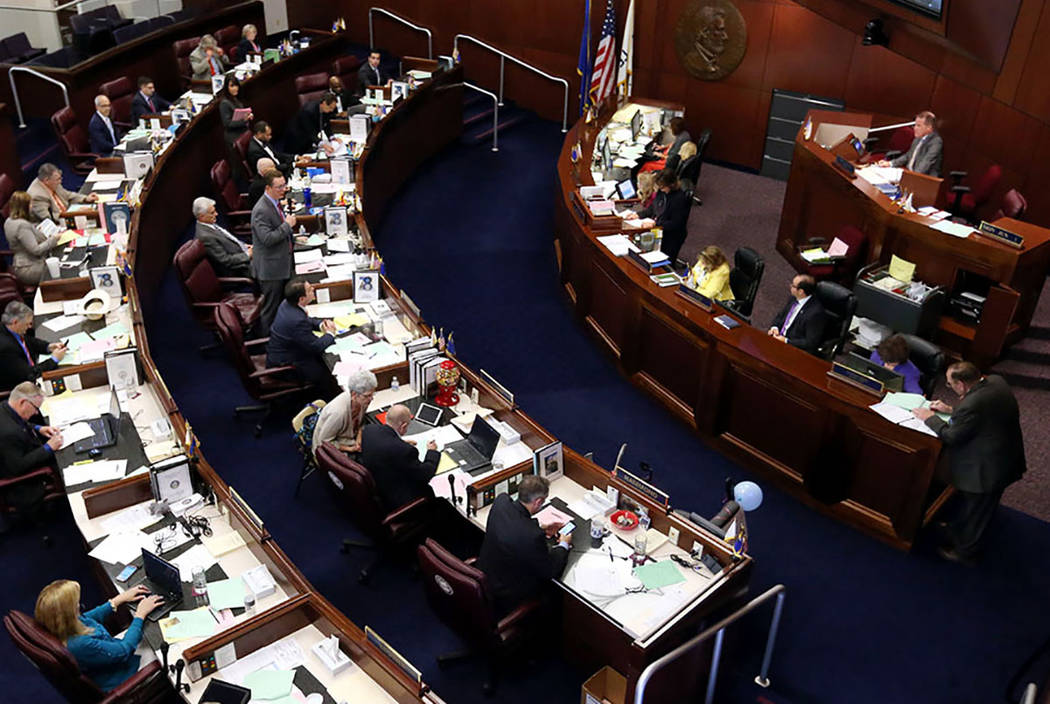

That soon might happen. Assemblywoman Irene Bustamante Adams, a Las Vegas Democrat, has offered Assembly Bill 143 to create a legislative committee that would conduct an assessment every six years of the state’s corporate incentive efforts. The reviews would be carried out by private consultants or academic organizations.

A second proposal, Assembly Bill 404, might also help. It would create a state inspector general to monitor agencies for waste, fraud and other taxpayer abuses. There’s no reason that such auditors couldn’t also delve into a cost-benefit analysis of the state’s economic development policies.

The current legislative session has featured more than the usual partisan rancor. But ensuring the judicious use of taxpayer funds when it comes to economic development should be a bipartisan endeavor and is just plain common sense. Both AB 143 and AB 404 deserve support from fiscally responsible Republicans and Democrats.