Local index can’t tell us the future

To the editor:

Since my arrival in Las Vegas in 1992, I have waited for the right opportunity to say something contrary to the various kinds of data brought to our attention by Keith Schwer and his gang at UNLV's Center for Business and Economic Research ("Forecast grim for Southern Nevada," Feb. 10 Review-Journal).

The gang will show us gaming "win," tourist numbers, home starts and other bits of data in a moveable feast of indices that are supposed to reveal what lies ahead for Las Vegas. Review-Journal reporter Hubble Smith treats us to the center's weighted-average consolidation of this data in what UNLV's center refers to as "The Southern Nevada Index of Leading Economic Indicators."

I am unimpressed with this consolidation because Mr. Schwer, a UNLV economist and the center's executive director, never ties together any of his work with any known economic theory, as if the index and the data collected for the index have predictive power.

Say what you will about economics, but it is no different from any other subject matter. It needs a bridge between the vast array of material we can collect about events and our understanding of those events. Otherwise, if we are looking for purely non-causal connections, we may as well incline ourselves to learn whether Harrah's executive and former Las Vegas Mayor Jan Jones has fried or scrambled eggs on Jan. 1, a Punxsutawney Phil kind of event for predicting what kind of year lies in store for Las Vegas.

Mr. Schwer's data have about as much connection with the cause of a good or bad year in Las Vegas as Ms. Jones' culinary choice. They are results or effects, not causes.

Something much, much bigger and more powerful than a bunch of indices or a weighted-average of these indices is responsible for the sorry state of our local and national economies. The bigger picture to the Las Vegas slump: The ridiculous growth in our money supply

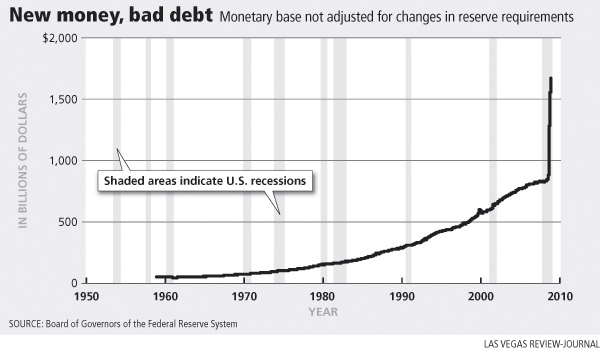

Your Feb. 10 article included a chart showing a falling off of the Southern Nevada Index of Leading Economic Indicators. If you like charts, take a look at the one below. Allow me to interpret. It means that we have printed as much money in the past year as we did in the 40 years before.

Although "we" are printing the money, we are printing it on behalf of the Federal Reserve Board. That's right, America purchases its own money through a request for this money from an independent, third-party, for-profit entity whose shareholders mostly comprise foreign banks and individuals. America pays dearly for this confused way of doing things, but I shall for now allow this pet peeve of mine to fall into the background to make a bigger point here.

Unlike Mr. Schwer and his gang, I provide you a theory -- it is called the Theory of Interest and Prices, or what is often referred to as the law of supply and demand. Too much of any one thing seeking too few of any other is a recipe for declining prices, lower productivity and all the other things that falling indices wish they could explain.

In Las Vegas, we have too many gaming venues seeking too few gamblers; too many homes seeking too few home buyers; and in construction, too little financing to support too much development. In this Federal Reserve chart that accompanies my letter to the editor, we have too much paper seeking too few productive endeavors.

Throwing paper money at bad debt might correct that debt, but it doesn't bring a dime of profit or productivity into the economy. You don't make profit for the economy by taking government money and repositioning balance sheets. Balance sheets are as illusory as the indices I criticize above.

Unless and until the American economy is boosted by a genuinely productive effort, we will see the continuing rise in our money supply, and, therefore, the continuous fall in both the indices the national pundits like to point to as well as the local indices that our own gang points to here in Las Vegas.

The heart of the problem is our monetary policy, from which all the other bad stuff happens.

THOMAS A. CLIMO

LAS VEGAS

THE WRITER IS A FORMER PROFESSOR OF ACCOUNTING AND FINANCE AT THE UNIVERSITY OF KENT AT CANTERBURY, ENGLAND, AND A MEMBER OF THE AMERICAN ACADEMY OF ECONOMIC AND FINANCIAL EXPERTS.