Las Vegas land sales show dramatic rise

Land sales in Las Vegas Valley hit a two-year high in the first quarter with $40.3 million in total sales volume, a 38 percent increase from $29.1 million in the year-ago quarter, Bill Lenhart of Sunbelt Development & Realty Partners reported.

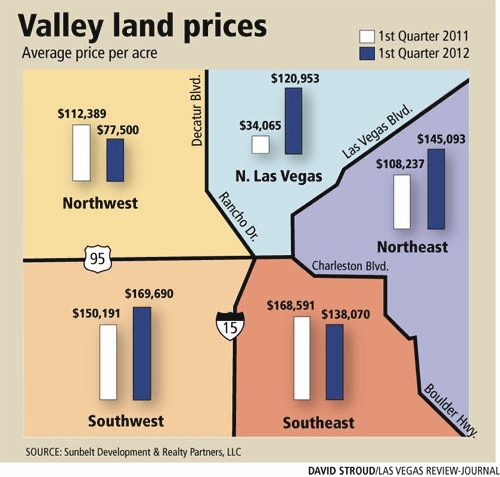

The southwest submarket recorded the highest average price at $169,690 an acre, up from $150,191 a year ago, Lenhart said. It's still a steep drop from the peak in 2005 and 2006, when single-family residential land in the southwest was going for $600,000 per acre.

North Las Vegas showed a dramatic jump to $120,953 an acre, compared with $34,065 a year ago. Lenhart attributes that increase to several factors, including low transaction volume and bulk parcels that net a lower price per acre. For example, one sale last year involved 1,300 acres at an average price of $15,000 an acre.

The southwest also dominated land sales volume with $26.1 million, or 65 percent of the market, as homebuilders have increased buying activity in that area, Lenhart said.

"There are more buyers in the market," the land broker said. "A lot of homebuilders are reacting to a surge in new home sales. That has to do with the reduction in existing inventory. The question is what happens when banks figure out how to get around (Assembly Bill) 284. Does that inventory trickle to the market? It will definitely have an influence."

The robo-signing law, Assembly Bill 284, went into effect in October. Its requirement that lenders provide an affidavit of authority to foreclose on has slowed the process, choking off the flow of properties coming onto the market.

Circumstances driving the market are "tenuous and eerily familiar" to the Federal Home Buyer Tax Credit, which spurred new home sales in the first and second quarters of 2010, Lenhart said. Land prices also spiked then, but five quarters of declining new home sales, lower median prices and falling land values followed, he said.

Homebuilders are getting more aggressive at buying land to promote their business, said John Prlina, president of land acquisition and development for Discovery Homes, which purchased several lots this year in the southwest valley.

"Things are coming back in the valley because there's nothing in the resale market and the foreclosure process is just a drip," Prlina said. "We don't know what the banks are going to do. As a builder, that's OK as long as they don't pour them out at one time."

Residential building permits have increased 40 percent from a year ago, and home prices have ticked up for three straight months in Las Vegas, yet concerns remain about the so-called shadow inventory of bank-owned homes yet to be released on the market. Those homes could drag prices back down.

Michael Feder, chief executive officer of Radar Logic analytic firm, warns that a rise in home prices is the result of temporary market forces. While some analysts say housing prices have hit bottom, Feder said the market could drop further still. He said he expects home prices to decline over the next 18 months as the market works through the oversupply.

Some homebuilders are depleting their inventory of finished lots at a time when the buyer pool is growing, Lenhart said.

Many homeowners who lost their homes through foreclosure or short sale in 2009 and 2010 are becoming eligible again for Fannie Mae or Freddie Mac financing.

Homebuilders with a land deficit are forced to buy in the current environment to meet that demand, Lenhart said.

Builder D.R. Horton recently acquired 275 lots at Whitney Mesa Estates in Henderson for $7.5 million, though it probably will be at least 18 months before any homes are built there.

"The temporary stall in resale inventory levels appears to be creating an opportunity for residential homebuilders, even if only on a temporary basis," said Brian Gordon, analyst for Las Vegas-based real estate data firm SalesTraq.

By one measure of demand, SalesTraq reports that the number of Las Vegas subdivisions with new homes for sale has decreased to 220, down

10 percent from a year ago. During the peak of the building boom in 2005, there were about 500 active subdivisions in the valley.

Residential land values are determined by how many homes can be built on the parcel, average price and development costs to prepare the site and build the homes, Lenhart noted.

High-density residential land - 14 or more units an acre - sold for an average of $191,347 an acre in the first quarter, up from $168,836 at the end of 2011; medium-density residential (six to 14 units) sold for $104,000 an acre, down from $110,011; low-density residential (three to six units) was $35,135 an acre, down from $90,023; and rural residential (one to two units) was $42,398 an acre, down from $63,008.

While land values appear to be regaining traction in Las Vegas Valley, they may never reach the level of the boom years.

"Right now, it could be decades before we return to the peak that we saw five or six years ago, with lots of peaks and valleys in between," Lenhart said.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.