IN BRIEF

NEW YORK

Greener cars displayed at New York auto show

Battered automakers are unveiling greener, hipper cars at the New York International Auto Show that they hope will satisfy scared buyers, while the company with the most to prove went the furthest Wednesday to show it still has a future.

Chrysler LLC President Jim Press surprised reporters at the automaker's news conference by arriving on stage in an Fiat 500 subcompact. Other automakers showed off their cleanest, most forward-looking vehicles during the show's first day of media previews.

Mercedes-Benz debuted four new vehicles, including a high-performance version of its E-Class sedan and two hybrid models, and Land Rover unveiled a trio of new models. Toyota Motor Corp.'s Scion brand showcased a concept based on its iQ microcar, and Acura unveiled the ZDX, a sport sedan that Honda Motor Co.'s luxury brand said will go on sale this fall.

WASHINGTON

Wholesalers reduce inventories sharply

Wholesalers cut their inventories in February by the steepest amount in more than 17 years, while sales rose for the first time since the summer, encouraging signs that companies may be getting their inventories under control.

The Commerce Department said Wednesday that wholesale inventories dropped 1.5 percent in February, the most on records dating to January 1992 and more than double analysts' expectations.

Wholesale sales rose 0.6 percent, the first increase since June and a sharp reversal from January's revised 2.4 percent drop. That shows retailers and other businesses have begun to replenish their supplies.

WASHINGTON

Program to supply parts to carmakers

Treasury Department opened a $5 billion financing support program on Wednesday to help auto suppliers keep parts flowing to General Motors Corp. and Chrysler LLC as they try to rebound with billions in government aid.

General Motors and Chrysler, which have received $17.4 billion in federal aid and face upcoming deadlines to restructure their companies, will designate the auto parts suppliers that need the financing, giving them a large role in determining which suppliers will survive. Ford Motor Co., which has not sought the government aid, has said it does not intend to use the program.

GM said in a statement that its suppliers were allocated $2 billion and the company was working to put it into operation.

Chrysler said in a statement it would receive $1.5 billion under the program.

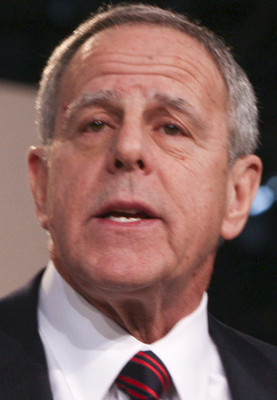

Chrysler chieftain says Fiat deadline workable

Chrysler President and Vice Chairman Jim Press said Wednesday the government's May 1 deadline for the automaker to complete a deal with Fiat allows "ample time" to reach a definitive agreement that is key to saving Chrysler from bankruptcy.

"We prefer having a shorter time frame to get through this period, get all the questions out of our minds, and get back to business as usual," Press said during the first day of media previews at the New York International Auto Show.

One way or the other, Chrysler will once again have new owners after April 30.

Instead of Cerberus Capital Management and Daimler AG holding 80.1 percent and 19.9 percent, respectively, of Chrysler LLC, there will be a larger cast.

Under the latest scenario proposed by the U.S. government, Fiat SpA will have the largest block of Chrysler, at 20 percent. The remaining 80 percent will be allocated among a variety of secured creditors that include at least five banks and U.S. taxpayers.

COLUMBUS, Ohio

Oil prices increase on news of inventories

Oil prices took off Wednesday after new government data showed bulging crude inventories grew less than what analysts expected, but settled only slightly above where they started the session.

Benchmark crude for May delivery rose as high as $51.30 a barrel on the New York Mercantile Exchange, $2.15 above Monday's settlement. But prices beat a retreat by afternoon, settling up 23 cents at $49.38.

Monster pursuing leakers of information

Monster Worldwide Inc. obtained an Illinois court order directing Yahoo! Inc. and Microsoft Corp. to disclose the names of people the online jobs-posting company said revealed confidential information about it on the Internet.

Using pseudonyms "salisoostupid," "igotoutjustintime" and "cluelessmanagement," a person or people from Nov. 21 to Jan. 6 posted on a Yahoo investors' forum Monster's acquisition plans, internal sales department results and management departures that would be known only to current or former employees bound by confidentiality agreements, Monster said in court papers seeking the order.

New York-based Monster, through a subsidiary, operates www.monster.com, the world's largest Internet job-search site.

DENVER

Ex-Qwest chief aims to delay arrival at prison

Former Qwest Chief Executive Joseph Nacchio is still trying to put off the day he must report to prison.

On Wednesday, his lawyers asked the 10th U.S. Circuit Court of Appeals to stay a judge's order that Nacchio report to a prison in Minersville, Pa., by noon April 14 to start a six-year term for insider trading.

U.S. District Judge Marcia Krieger issued that order Tuesday.

She also denied Nacchio's request to stay free on bail while he appeals his conviction to the Supreme Court.

Nacchio's lawyers on Wednesday said they'd appeal Krieger's decision to the Supreme Court, too.

OMAHA, Neb.

Berkshire Hathway loses triple-A rating

Billionaire Warren Buffett's company lost its pristine triple-A rating from Moody's on Wednesday because the recession has diminished Berkshire Hathaway's financial strength.

Ratings agency Moody's downgraded the credit rating for Berkshire and several of the company's insurance subsidiaries.

Moody's says Berkshire and its insurance companies, including National Indemnity and Geico, aren't as strong financially because the market value of their investments has fallen. Also, Moody's says the recession hurt Berkshire's noninsurance businesses.

Moody's also said Berkshire's earnings and capital base are volatile because of fluctuations in the value of its portfolio of equity derivatives.

NEW YORK

Treasury prices rise after sale of notes

Treasury prices moved mostly higher Wednesday after the government's successful sale of three-year Treasury notes.

The benchmark 10-year Treasury note rose 0.38 points to 99.09. Its yield fell to 2.84 percent from 2.90 percent late Tuesday.

The 30-year bond rose 0.96 points to 97.06, and its yield fell to 3.66 percent from 3.73 percent.