August less cruel to gaming investors than July

OK, so August wasn't as cruel to gaming investors as July.

Still, it was a tough month, especially if you own shares of gaming equipment manufacturers.

If you were an investor in regional casino operator Pinnacle Entertainment, however, you still have a smile on your face.

Just three of the 12 publicly traded casino operators and equipment suppliers tracked by Las Vegas-based financial adviser Applied Analysis saw increases in their average daily stock prices in August. In July, only table game maker Shuffle Master saw its average daily stock price increase.

Pinnacle, which is headquartered in Las Vegas but operates regional casinos primarily in the South and Midwest, saw its average daily stock price jump more than 17 percent in August.

This week, however, Pinnacle suffered a setback. Hurricane Isaac postponed the company's planned opening Wednesday of its much-anticipated $368 million hotel-casino in Baton Rouge, La., but it will now open today .

Pinnacle's Boomtown New Orleans casino was also closed because of the hurricane, but was expected to reopen Friday.

Other than Wynn Resorts Ltd. and Las Vegas Sands Corp., the rest of the gaming sector had a down month.

"Stocks generally continued to report sluggish performances during August, barring a select few," Applied Analysis partner Brian Gordon said Friday in a report to the firm's clients.

Gordon noted that Wynn and Las Vegas Sands, which derive the bulk of their gaming revenues from casinos in Macau, experienced mid-month increases in the stock prices, due in part to anecdotal reports of better-than-expected gaming performances in the Chinese gaming region and analyst upgrades.

"Other market movements were sourced to second quarter earnings reports that were released early in the month, several of which included little to no growth in top-line revenues and deteriorating earnings," Gordon said.

The largest monthly decline among casino operators went to Caesars Entertainment Corp., which saw its average daily stock price slide more than 14 percent in July. In two months, the company's average daily stock price has dropped from almost $12 a share to $8.

Slot machine makers International Game Technology and WMS Industries suffered even larger declines in August than Caesars' one-month drop. IGT's stock was off more than 19 percent in average daily price while WMS slipped more than 17 percent.

In a research report to investors, however, Janney Montgomery Scott gaming analyst Brian McGill said the outlook for gaming equipment manufacturers is not as dire as stock prices might reflect.

He said slot machine makers will benefit from sales of video lottery terminals into Canada and Illinois this year. He said 2013 could include game sales into Ohio to newly established racetrack casinos.

"Trends are not as bad as Wall Street believes and multiples have compressed to levels that could now allow for upside from here," McGill said.

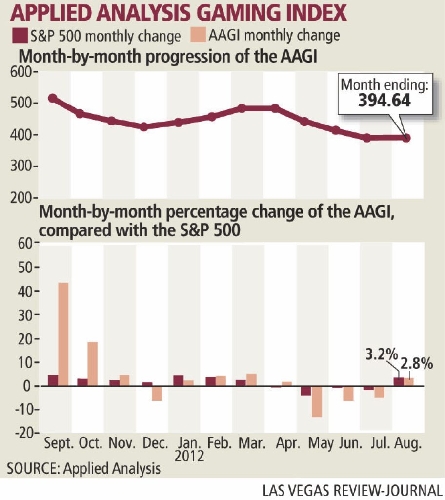

Despite the down month for stocks, the Applied Analysis Gaming Index, which takes into account about 300 market variables, rose 10 points to 394.64.

Gordon said the lower values posted by equipment makers during the month offset any gains from the casino operator component of the index.

Contact reporter Howard Stutz at hstutz@reviewjournal.com or 702-477-3871. Follow @howardstutz on Twitter.