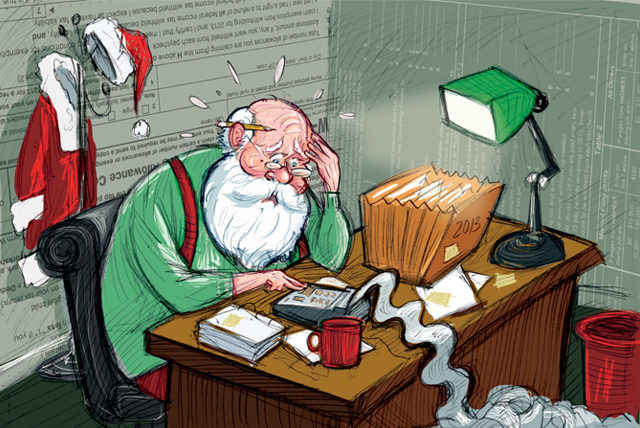

Between holiday parties, make moves to save on 2013 returns

With Christmas just 10 days away, most people are still searching for that perfect gift or planning a lavish holiday party with family and friends. Some people are even looking for a last-minute getaway.

Income taxes don’t make most people’s holiday “to do” lists. But before you know it, Christmas will be over, you’ll have broken your New Year’s resolutions and the rush will be on to file your returns for 2013.

Therefore, it might be worth considering several year-end decisions now that will cut your 2013 tax bill. Kay Bell, a contributing tax editor with Bankrate.com, and Chris Wilcox, a shareholder with Johnson, Jacobson and Wilcox in Las Vegas, have several ideas for you.

Bell said the good news is that federal tax laws are in place, unlike last year, when Congress was still arguing over legislation.

However, thanks to the government shutdown, you’ll get your refund later. The Internal Revenue Service won’t start accepting tax returns until Jan. 28 or maybe Feb. 4.

There’s more bad news. Bell said if you earn a lot of money, you should expect a higher tax bill. The top tax rate is 39.6 percent, and capital gains taxes have risen to 20 percent this year, up from 15 percent in 2012.

Another new tax is called the net investment income tax. Bell said Congress included the investment tax in the American Taxpayer Relief Act that was part of the Affordable Care Act.

“The amount you get from your investments is subject to a 3.8 percent tax,” Bell said. “So if you’re in the 39.6 percent tax bracket, add another 3.8 percent and your total tax bill is 43.4 percent.”

The top rate is 39.6 percent on taxable income of more than $400,000 for single taxpayers; $450,000 for married couples filing joint returns, or $225,000 if filing separately; and $425,000 for head of household taxpayers.

Wilcox recommends bunching up your itemized deductions.

“If you are married filing jointly and earn over $300,000, you start to lose itemized deductions,” Wilcox said. “In some cases, it may save taxes if you bunch up these itemized deductions. For example, by making 2013 and 2014 charitable contributions in 2013.”

Wilcox said if you donate to a church every month, consider donating six months in advance by Dec. 31 to get the full benefit of the deduction for 2013.

“Make the contribution, if it makes sense,” he said.

NEW YEAR’S EVE DEADLINE

Whatever your income, you still have until Dec. 31 to reduce your tax bill.

Bell said some tax moves take some planning and preparation. Others are easy to accomplish. But, she says, all are worth checking to see if they work for you.

Wilcox agreed.

“Now is the time to do a tax test-run. We are doing exactly that for much of our clientele,” Wilcox said. “We are doing tax projections for our clients to see if there are any tax savings. We don’t want them to be surprised with their tax bill in April.”

Start with your home. Bell said if you can afford to make your January mortgage payment in December, you can deduct the interest on your 2013 taxes.

Any energy-efficient improvement should be done by Dec. 31 to capitalize of the residential energy property credit. The maximum credit is $500, and you must count any previous years’ tax credit claims against that limit.

Bell said consider bunching deductible expenses. Many deductions, including medical and business expenses, must exceed a certain amount. Medical and dental expenses, for example, cannot be deducted unless they exceed 10 percent of adjusted gross income.

Business expense claims must be more than 2 percent of adjusted gross income. Bell said now is the time to see whether you’ve met the threshold.

“You don’t want to look down and (discover) you’re $300 short,” Bell said. “You’ve wasted … the tax break. Go through those expenditures and make sure you take advantage of deductible expenses in this tax season.”

If you can’t consolidate expenses, you might want to try adding to your 401(k) by year’s end. Since most contributions are made before taxes, this move will help reduce your taxable income.

The maximum amount employees can stash in a 401(k) annually is $17,500. If you are 50 or older, the figure is $22,500.

“You want to make sure you take advantage of everything you can,” Wilcox said. “Not everybody can afford to do this.”

A popular itemized expense is for other taxes paid. Most people deduct state and local income taxes on a Schedule A, Bell said.

But if you live in Nevada, an income-tax-free state, it might be to your advantage to deduct your state and local sales tax amounts. You can’t claim both, according to the IRS.

The IRS provides tables with the average amount of state sales taxes paid in each state. For the 2011 tax year, the IRS said the general sales tax deduction for a Las Vegas resident was $866.

“The IRS figures a standard amount,” Bell said. “You have the option of taking the standardized deduction or if you have all your receipts … (you) can add it all up.”

She said if you had a “humongous” expense in 2013, such as a wedding, the sales tax might be above average, making it worthwhile to itemize. Bell stressed that if you take the standard tax deduction, you can’t claim the sales tax deduction.

Bell said taxpayers should consider reviewing their medical flexible spending account to avoid wasting it. If there are assets, such as stocks, in your portfolio that have lost value, consider taking advantage of the loss by selling the shares by Dec. 31.

She also suggests being generous to charities, paying college costs early, adjusting your withholding, and deferring your income. Bell said if you get a bonus at work that will push you into another tax bracket, ask your boss to hold it until January.

Wilcox reminds taxpayers that there is a 0.9 percent Medicare tax on salaries of $300,000 if filing jointly. There is a catch, he said: if you make $150,000 and your spouse makes $150,000, filing jointly makes you eligible for the tax.

“About $50,000 is set aside to be taxed,” Wilcox said. “For a couple that’s $450 in additional taxes.”

Bell admitted that some of these ideas amount to “robbing Peter to pay Paul,” but it depends on what works for each taxpayer. She said most of the tips are for people who itemize.

If you don’t itemize, Bell said you can still bulk up your 401(k).

“Paying college tuition early is a tax credit you can take without itemizing,” she said.

Bell understands there may be only one paycheck left in 2013. Nevertheless, she suggested adjusting your withholding at work to get a little more money out now. She said too many people have too much withheld as a “forced savings account.”

Contact reporter Chris Sieroty at 702-477-3893 or csieroty@reviewjournal.com. Follow @sierotyfeatures on Twitter.