Boom on Strip helps keep LV economy on even keel

Strong development activity along the Strip has tempered weakness in home construction and helped keep Southern Nevada's economy in check, a local economist believes.

The value of commercial building permits totaled $154.7 million in July, a 52.4 percent increase from the same month a year ago, said the economist, Keith Schwer, director of the Center for Business and Economic Research at University of Nevada, Las Vegas.

Residential permit valuation fell 56 percent from a year ago to $120.8 million as builders pulled just 925 permits in July. The number dropped to 766 in August.

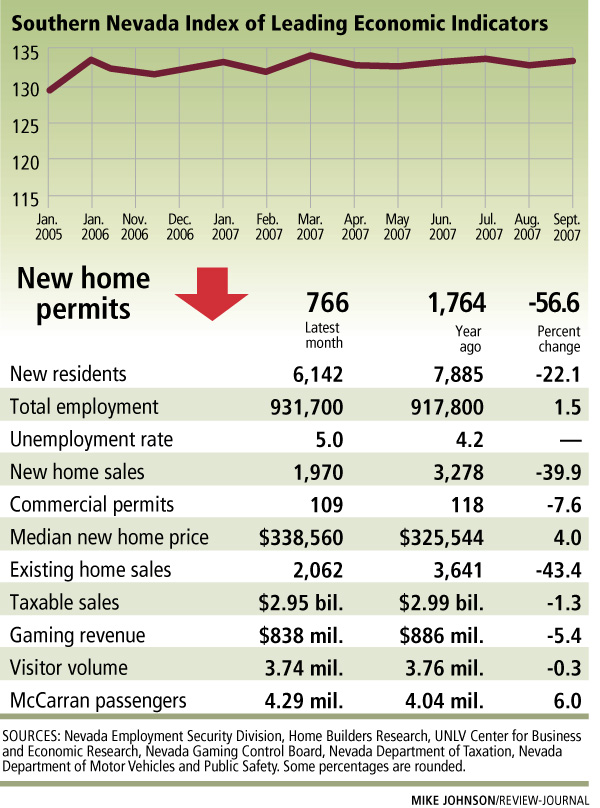

Permits and permit valuation are among 10 series of data tracked by Schwer in compiling the Southern Nevada Index of Leading Economic Indicators, which stood at 133.46 in September. It's up from 133.18 in August and 132.30 in September 2006.

The index continues to show neither growth nor decline but has moved within a fairly narrow range over the past 18 months, Schwer said.

"All in all, the outlook is more of the same for the remainder of 2007," he said.

The index is a six-month economic forecast from the month of the data, July, based on a net-weighted average of each series after adjustment for seasonal variation.

The accompanying Review-Journal chart includes several of the index's categories, along with data such as new residents and employment and housing numbers, updated for the most recent month for which figures are available.

Travel and tourism continue to perform at or near capacity, Schwer said. Passenger count at McCarran International Airport exceeded 4.2 million in July and hotel occupancy rates were 92 percent.

Whereas residential indicators are down by double-digit percentage levels, commercial indicators rose by double digits, he said.

"We do have weak expansion and the probability of recession is up, less than 50-50, but we will grow out of this," Schwer said of the current housing slump.

He laid out two ending-date options for the existing oversupply of housing inventory, which includes 14,000 vacant homes, at a recent presentation for Commercial Alliance.

Population growth has slowed to 3 percent, but there are still 60,000 new residents coming to Las Vegas each year, he said. At 2.5 persons per household, 24,000 additional housing units are needed.

If 1,000 homes a month are built for the next 10 months, the oversupply would be burned off by August 2008, Schwer said. If 1,500 homes a month are built for 20 months, it would take until July 2009.

John Restrepo of Restrepo Consulting Group said the correction occurring in the national housing market is also affecting Las Vegas.

With one of the nation's highest foreclosure rates, Las Vegas has seen new home construction dramatically lowered.

As a result, construction employment in Las Vegas dropped 1.4 percent in August to 111,100, Restrepo reported. Overall, total employment grew 1.5 percent to 917,800.

The construction industry remains significantly more important to the local economy than it does at the national level, Restrepo said. It accounts for 11.7 percent of total employment here, compared with 5.5 percent nationally.

"This is a testament to the health of our commercial and public works sectors. This percent is still very high compared to the national average," he said.

Chief economist Ken Simonson of Associated General Contractors of America reported Nevada construction employment of 139,100 in August, representing 11 percent of the state's 1.3 million nonfarm employment. That's down 2 percentage points from last year, he said.

Construction contributed $12 billion to Nevada's gross domestic product of $118 billion in 2006, Simonson said. Annual construction pay averaged $47,434 in Nevada, compared with $44,485 nationally.

Economic growth will continue to slow through the rest of the year, returning to near normal in the second half of 2008 and into 2009, according to the latest forecast from the Mortgage Bankers Association.

Total loan originations are expected to decline another 18 percent next year as both purchase and refinance activity drops, the bankers said.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or (702) 383-0491.