Borders files for bankruptcy

NEW YORK -- Borders was slow to get the message as the big-box retailer lost book, music and video sales to the Internet and other competition. The result: It filed for Chapter 11 bankruptcy Wednesday, and will close nearly a third of its stores, including one in Las Vegas at 2323 S. Decatur Blvd.

Less nimble than rival Barnes & Noble, Borders now begins what analysts expect will be a quickly resolved struggle for the survival of its remaining stores. It's the latest cautionary tale about the dangers retailers face when they fail to keep up with swiftly changing technology and consumer habits.

"It's almost a case of hit-and-run," said Al Greco, marketing professor at Fordham University. "They were crossing the street and they didn't pay attention, and that tractor trailer (of technology) hit them."

Borders plans to close about 200 of its 642 stores over the next few weeks, from San Francisco to Fort Lauderdale, Fla., costing about 6,000 of the company's 19,500 employees their jobs. The closures are also a blow to publishers already owed tens of millions of dollars by the company, which stopped paying them in December.

Borders said it is losing about $2 million a day at the stores it plans to close, all of them superstores. The company also operates smaller Waldenbooks and Borders Express stores.

The company will still have three stores in Las Vegas and one in Henderson.

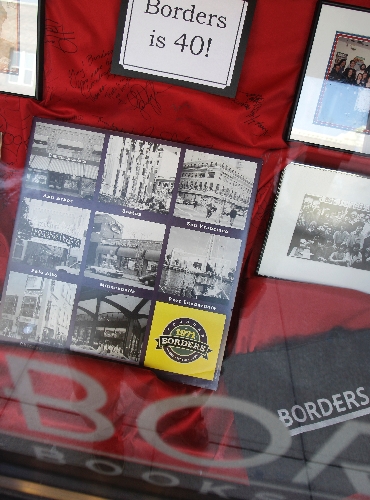

Fifteen years ago, Borders superstores dotted the United States and seemed to be the future of bookselling. Its sprawling stores, comfortable chairs, cafes and widespread discounts epitomized the "bigger is better" retail philosophy that spelled the end of many mom-and-pop bookstores that couldn't compete on selection or price.

Americans today are more likely to pick up the latest best-seller anywhere from Costco to Amazon.com, or download a digital version, than make an extra trip to a strip mall.

Analysts say a key error for Borders came in 2001, when it contracted out its e-commerce business to Amazon.

"Amazon had no incentive whatsoever to promote Borders," Simba Information senior trade analyst Michael Norris said. "It really marked the beginning of the end."

That relationship lasted until 2007. By then, Borders lagged far behind Barnes & Noble, which began selling books online in 1997.

Borders also was slow to react to the growing popularity of e-books and e-book readers. After Amazon launched its popular Kindle e-book reader in 2007, Barnes & Noble followed with the Nook in 2009 and invested heavily in its electronic bookstore. Borders entered the electronic book market with Canada's Kobo Inc. last year but failed to gain much traction.

Borders also didn't react quickly enough to declining music and DVD sales, and hired four CEOs without bookselling experience in five years.

Barnes & Noble, which has 29.8 percent of the book market compared with Borders' 14.3 percent, according to IBIS World, has done better by adapting to e-commerce and electronic books more quickly and keeping management stable.

Norris said Borders' problems mean that publishers will have to immediately cut their 2011 revenue estimates by 1 percent to 10 percent. "I think Borders' fall will cause a lot of publishers to realize they can't just count on a few giant entities to sell their products, and the best retailing partners are going to be those who have to sell books in order to draw their next breath," Norris said.

If Borders emerges from bankruptcy protection, it won't be the first big retailer to do so -- Kmart succeeded in 2002. But more recently, with credit tighter, retailers including Circuit City Stores Inc. and Linens 'N Things have been forced to close.

"In the bankruptcy world today, people are given very short strings -- GM took 90 days to emerge," said Scott Peltz, head of the national corporate recovery practice at McGladrey consultancy in Chicago. "This is not the type of restructuring that could be accomplished in short order."

Some see problems ahead for Borders.

"Chapter 11 does not solve any business problems at all," said Jim McTevia, managing partner of turnaround firm McTevia & Associates, in Bingham Farms, Mich. "They are going to have to be an entirely different company than the one that went into bankruptcy protection if they want to emerge successfully."

200

Estimated number of stores Borders plans to close

6,000

Estimated number of employees who will lose their jobs

$2 million

Amount per day Borders says it is losing at the stores, all of them superstores, it plans to close

4

Number of Borders stores to remain open in the Las Vegas Valley