Cosmopolitan sale just the latest billion-dollar deal on the Strip

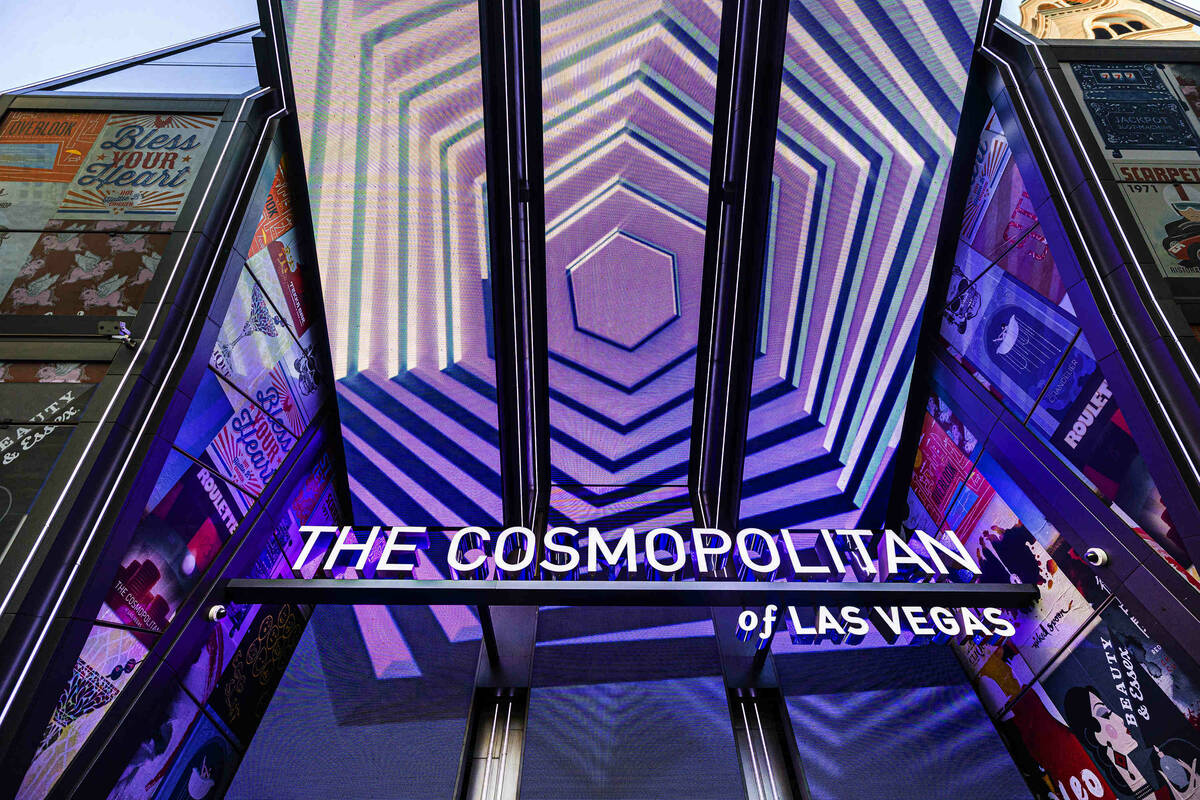

The multibillion-dollar sale of The Cosmopolitan of Las Vegas has not only put the flashy, once-financially troubled resort in new hands.

It also marks the latest in a string of hotel deals on the Strip between two powerhouse companies and another investment on Las Vegas Boulevard from the CEOs of fast-food chain Panda Express.

New York financial conglomerate Blackstone announced Monday that it is selling the Cosmopolitan for $5.65 billion, nearly $4 billion more than its purchase price several years ago. As part of the deal, casino giant MGM Resorts International is acquiring the Cosmopolitan’s operations side for more than $1.6 billion, while a trio of groups, including Blackstone, will own the real estate and collect rent from the new operator.

Under the terms of its lease, MGM said, it will pay an initial annual rent of $200 million.

The transaction is expected to close next year.

MGM and Blackstone have inked multiple billion-dollar-plus deals on the Strip over the past few years as the famed tourist corridor transforms into a miles-long collection of leased megaresorts.

Such deals likely have little, if any, impact on hotel guests or employees, as they mostly involve sending rent checks to a new company. The Cosmopolitan sale, however, will put the two-tower, roughly 3,000-room resort under a new operator — one that already runs several high-profile hotel-casinos on the Strip.

“The Cosmopolitan brand is recognized around the world for its unique customer base and high-quality product and experiences, making it an ideal fit with our portfolio and furthering our vision to be the world’s premier gaming entertainment company,” MGM Resorts President and CEO Bill Hornbuckle said in a news release.

‘Irreplaceable location’

Under the deal, Cosmopolitan’s real estate will be owned by Blackstone, investment firm Stonepeak Partners and the Cherng Family Trust, the family office of Panda Express operators Andrew and Peggy Cherng.

Neither Blackstone nor MGM disclosed the landlords’ individual ownership stakes in the property in news releases Monday.

Tyler Henritze, head of real estate acquisitions in the Americas for Blackstone, said in a news release that the transaction “underscores Blackstone’s ability to acquire and transform large, complex assets.”

Phill Solomond, Stonepeak’s head of real estate and a former managing director at Blackstone, said in a release that the Cosmopolitan is “a solid asset with an irreplaceable location, durable cash flows and the potential for additional upside.”

Meanwhile, the Cherngs, co-chairs and co-CEOs of Panda Restaurant Group, have dealt with MGM before.

In 2018, they acquired what’s now the Waldorf Astoria Las Vegas from MGM and its partner in the multitower CityCenter complex for $214 million.

The Cherngs were unable to comment on the Cosmopolitan sale, said a representative for Panda Restaurant Group.

Billion-dollar deals

New York developer Ian Bruce Eichner broke ground on the Cosmopolitan during the frenzied mid-2000s real estate bubble. But the economy soon soured, and project lender Deutsche Bank foreclosed on the partially built resort in 2008.

The German financial giant finished construction and opened the property in late 2010 amid the worst recession in decades. The Cosmopolitan proved a trendy gathering spot but was deeply in the red, losing an average of almost $100 million per year from 2011 through 2013, a securities filing shows.

Blackstone, which had already kicked off a real estate buying binge in Southern Nevada after the market imploded and property values collapsed, acquired the Cosmopolitan in 2014 for $1.73 billion.

The Cosmopolitan’s total development cost had exceeded $4 billion, and Blackstone spent around $500 million in improvements, the firm previously told the Review-Journal.

Even before the Cosmopolitan sale was announced Monday, Blackstone had a history of big-money deals in Las Vegas with MGM.

As announced in July, Blackstone reached a deal to buy the Aria and Vdara hotels for nearly $3.9 billion from MGM Resorts and lease them back to the casino operator.

Blackstone also partnered with MGM Resorts’ real estate spinoff, MGM Growth Properties, on a $4.6 billion deal early last year to acquire the MGM Grand and Mandalay Bay and lease them back to MGM Resorts.

Moreover, Blackstone bought the Bellagio in 2019 for about $4.2 billion from MGM Resorts and leased it back.

Contact Eli Segall at esegall@reviewjournal.com or 702-383-0342. Follow @eli_segall on Twitter.