Everi Holdings fires CEO, selects Mike Rumbolz as interim top executive

Casino equipment provider Everi Holdings has replaced its CEO with a long-time board member and gaming industry figure until a permanent leader is named.

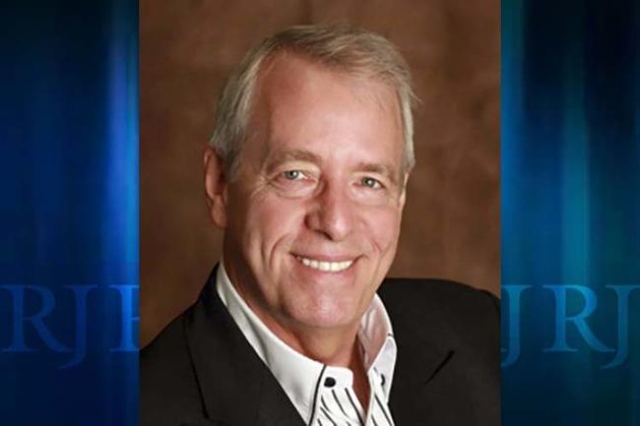

In a statement Tuesday, Everi named Mike Rumbolz as interim CEO. Rumbolz, 61, has been a member of the company's board since 2010. He replaces CEO Ram Chary, who was fired over the weekend and removed from his board position.

"While this was a difficult decision, the board believes this move is in the company's best interest," Everi Chairman E. Miles Kilburn said in a statement.

Everi, formerly known as Global Cash Access, provides payment processing and financial services to casinos. In 2014, the company bought slot machine maker Multimedia Games for $1.2 billion.

Everi's board has formed a search committee to find a permanent CEO.

Rumbolz was independent consultant to Everi and had previously been the CEO of Cash Systems Inc., an Everi competitor that was acquired by the company in 2008. He previously served as chairman of Casino Data Systems and CEO of slot machine provider Anchor Gaming. Rumbolz is a former chairman of the Nevada Gaming Control Board.

Rumbolz said there would "no disruptions" in the company's daily business.

"I will continue to execute the existing corporate strategy ’in our games and payments businesses for the gaming industry," Rumbloz said.

In a statement, Everi said it would consider both internal and external candidates for the CEO position.

Chary had been CEO of Global Cash for eight months when the company surprised the gaming industry with the planned purchase of Austin, Texas-based Multimedia Games. He led the company's name change last summer, saying it reflected its move beyond financial transaction equipment and into slot machines.

According to Fantini Gaming Research, investors are concerned with Everi's gaming and payments business results, specifically its slot machine segment with Indian casinos in Oklahoma. The company lost a multi-state customer last year.

Everi said it the company will report fourth quarter and year-end earnings next month.

Shares of Everi fell 23 cents, or 8.27 percent, on Tuesday to close at $2.55. They have traded in a 52-week range between $2.14 and $8.53.

Contact reporter Howard Stutz at hstutz@reviewjournal.com or 702-477-3871. Find @howardstutz on Twitter.