Gaming revenues drop 6 percent in November

Hope you enjoyed it while it lasted.

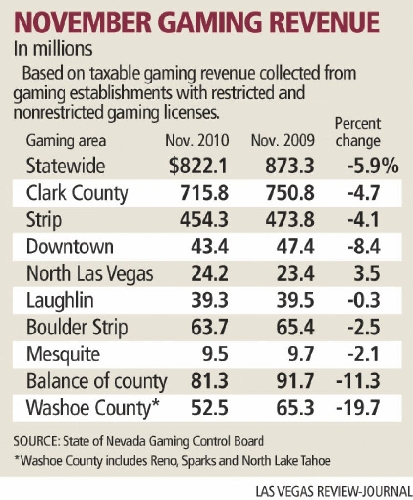

Statewide gaming revenues fell almost 6 percent in November, ending a three-month rally by Nevada casinos. On the Strip, gaming revenues declined 4.1 percent, which halted four straight months of either increases or flat results.

Analysts, however, quickly wrote off the November numbers, chalking up the results to declines in volume, revenue and hold percentage for baccarat.

The focus was immediately trained on December, which is expected to close out 2010 on an upbeat note as casinos could benefit from a strong New Year's Eve holiday.

"Strip results came in exactly within our expectations and (we) believe the seasonally important December results will likely show a solid year-over-year gain," JP Morgan gaming analyst Joe Greff told investors.

Stifel Nicolaus Capital Markets gaming analyst Steven Wieczynski also focused on December, where New Year's Eve is expected to fuel higher than anticipated occupancy rates and play levels for the final two weeks of 2010.

"While Strip (comparisons) turned negative for the first time since June of 2010, we believe today's results simply reflect a minor bump along the road to a broader Las Vegas recovery," Wieczynski told investors. "Our conversations with local operators lead us to believe the fourth quarter of 2010 results largely exceeded expectations."

The Gaming Control Board said Tuesday the state's casino industry collected almost $822.1 million from gamblers during November, compared with $873.3 million collected in November 2009.

On the Strip, casinos collected $454.3 million in gaming revenues, compared with $473.8 million in the same month a year ago.

The Strip story in November was two-fold.

Gamblers wagered $562.7 million on baccarat, an 18.5 percent decline compared with November 2009. Baccarat revenues of $48.8 million were a 25.8 percent decline. The casinos' hold percentage was also down by a single percentage point.

Analysts said the Strip's November 2009 baccarat figures were increases of more than 100 percent compared with the November 2008 numbers. Also, the baccarat room at Wynn Las Vegas was closed during November for renovations.

"We knew going into the month that this was going to be a tough comparison," said Gaming Control Board senior research analyst Michael Lawton. "Baccarat is a very volatile game."

While baccarat revenues were down, Strip casinos were helped by slot machine play. Revenues from slot machines increased 10.3 percent to $254 million while the amount wagered was $3.1 billion, a decline of 3.3 percent.

Thanks to the revenues from slot machines, if baccarat figures are removed from the November equation, Strip gaming revenues would have grown 1.1 percent during the month.

"That's obviously a positive sign we can take away," Lawton said.

Other positive signs, Lawton said, were the 11-month revenue figures. Statewide, gaming revenues are up 0.3 percent through November while Strip casinos are up 4.5 percent.

Jefferies & Co. gaming analyst David Katz told investors the casino operators had commented about fourth-quarter figures trending positive.

"Overall, Nevada casino revenue results were within our expectations of a prospective market recovery whose trajectory would be tentative in nature," Katz said.

All the major reporting areas in Nevada reported monthly gaming revenue declines during November.

In Clark County, where gaming revenues fell by more than 4.7 percent, only North Las Vegas saw a gaming revenue increase, with casinos collecting $24.2 million from gamblers, a 3.5 percent jump.

The largest decline in Clark County came from the area designated as Balance of the County, which is predominately a locals market. Gaming revenues fell more than 11 percent.

"November gaming revenues continue to support our views that the Las Vegas locals market continues to struggle," Union Gaming Group principal Bill Lerner told investors. "We estimate that the Las Vegas locals market (as a whole) was down 6.2 percent in November.

The northern part of Nevada also suffered steep declines. Gaming revenues fell more than 19 percent in Washoe County and almost 21 percent in the area's largest city, Reno.

Nevada collected almost $49.8 million in gaming taxes based on November's gaming revenues. The figure was a 12.7 percent decline compared with the same reporting period a year ago.

For the first six reporting months of the fiscal year, Nevada's gaming tax collections are up 2.5 percent compared with the same time period a year ago.

Contact reporter Howard Stutz at hstutz@reviewjournal.com or 702-477-3871.