Gaming stocks navigate rough waters as September closes

If the stock market performance by the gaming sector was considered "choppy" during September, then the last day of the month was certainly rough waters.

The prices for publicly traded casino companies, particularly those with holdings in Macau, were hammered Thursday and Friday as investors grew worried over a boarder economic slowdown in China.

For the month, eight of 10 casino operators and slot machine companies charted by Las Vegas financial consultant Applied Analysis for the company's gaming index saw their average daily stock prices tumble compared with August.

Wynn Resorts Ltd., which has two casinos in Macau, and Las Vegas Sands Corp., which operates three casinos in the Chinese market, suffered large declines Friday. But their average daily stock prices for September didn't reflect their final closing price in the month.

"Despite the late-month nosedive, Las Vegas Sands and Wynn Resorts posted month-to-month increases when factoring in the full month's activity," Applied Analysis principal Brian Gordon told his firm's clients in a report Friday.

Las Vegas Sands' average daily share price for the month was up almost 6 percent over August while Wynn's rose just less than 2 percent.

On Friday, however, Las Vegas Sands shares fell $2.99, or 7.23 percent, to close at $38.34 on the New York Stock Exchange. Wynn dropped $10.46, or 8.33 percent, to close at $115.08 on the Nasdaq Global Select Market.

Wynn also fell $9.95 on Thursday, giving back over two days much of the good will it earned from investors after announcing earlier in the month it agreed to terms with the Macau government to develop a resort on 51 acres of land on the Cotai Strip.

"Concerns about economic pullback in China late in the month drove stock prices south for the major players with interests in Macau," Gordon said. "The uneasiness that emerged toward the end of September followed a report earlier in the month demonstrating that August gaming revenues in Macau rose 57 percent from the prior year."

Deutsche Bank gaming analyst Carlo Santarelli said the concerns in Macau rival 2008, when the world credit crisis sank the market for a time. He said Macau's casino industry is not showing any signs of slowing down its rapid growth with has made it the world's largest gaming revenue-producing destination, more than five times the production on the Strip.

"We have yet to uncover a shred of evidence that the Macau market has seen any softening," Santarelli told investors. "Our message is simple, this is not 2008."

Santarelli said worries over Macau in 2008 also involved the failure of a junket operator whose business imploded because of a bad deal at the height of the economic downturn.

"That is not the case today," he said.

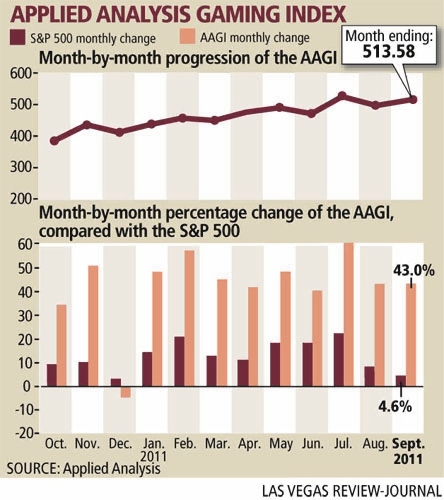

The Applied Analysis Gaming Index rose 2.9 percent during September to close at 513.58, primarily fueled by early month gains reported by Las Vegas Sands and Wynn Resorts, despite the late-month fall-off. All other components of the Index dipped in September.

Five of the companies charted by Applied Analysis had double digit declines in their average daily stock prices, including slot machine makers WMS Industries (down 13 percent) and Bally Technologies (off 12 percent).

Boyd Gaming Corp. and Ameristar Casinos suffered 11 percent declines in their average daily stock prices in September. Both companies operate in regional gaming markets, while Boyd also has a significant presence in the Las Vegas locals sector and downtown.

Credit Suisse gaming analyst Joel Simkins thought the decline in Boyd's share price was driven by "macro headwinds, concerns about near-term debt maturities," and how the company plans to fund its purchase of the IP resort in Biloxi, Miss.

The IP deal is expected to close Tuesday with Boyd paying $278 million in cash, plus making a contribution of $10 million to the Engelstad Family Foundation, for the 1,100-room hotel-casino.

"Boyd stands to benefit from a broader Las Vegas recovery," Simkins said. "We are however watching a ramp in the competitive environment with Station Casinos."

Contact reporter Howard Stutz at hstutz@reviewjournal.com or 702-477-3871. Follow @howardstutz on Twitter.