Gaming stocks suffer in June

Call it the June swoon.

Gaming stocks nosedived during the month as investors became nervous about the trajectory and speed of any economic recovery.

The nine publicly traded gaming companies followed by Las Vegas-based financial consultant Applied Analysis for the company's gaming index -- six casino operators and three slot machine manufacturers -- experienced retreats in their average daily stock prices.

The drops ranged from slight -- shares of Pinnacle Entertainment were off 0.25 percent in June compared with May -- to double-digit declines -- Boyd Gaming Corp. shares averaged 14.25 percent lower on an average daily basis in the month.

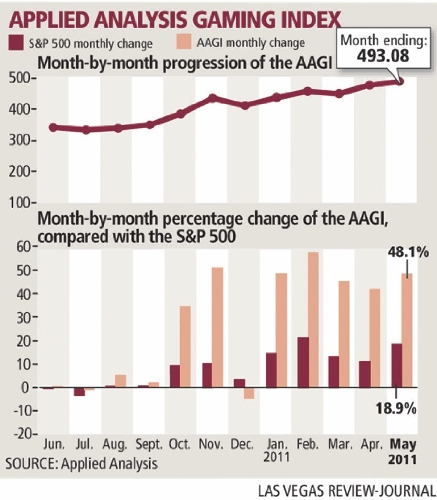

The Applied Analysis Gaming Index, which takes into account more than 300 market variables, fell more than 22 points because of the stock declines.

"Prospects about broader domestic economic improvements remain somewhat uncertain and international markets continue to face challenges of their own," Applied Analysis principal Brian Gordon wrote in a report to the firm's clients.

The news came two days after Moody's Investors Service put out a dismal report on the state of the gaming industry, saying Nevada's slow recovery in gaming revenues could suffer if a minor blip in the national economy occurs.

Gordon said the Moody's report seemed to be more directed at companies like MGM Resorts International and privately held Caesars Entertainment Corp., which operate a combined 20 hotel-casino on and near the Strip.

"The doom-and-gloom connotations are generally directed at leveraged operators and those with fairly sizable operations in the Las Vegas market," Gordon said.

Shares of MGM Resorts were down 12.25 percent on an average daily basis during June.

Wynn Resorts Ltd., which has two casinos in Macau, and Las Vegas Sands Corp., which operates properties in both Macau and Singapore, saw their average daily stock prices decline half as much as those for MGM Resorts.

"Operators with a more diverse portfolio appeared to benefit from investments, and presumably returns, in international locations," Gordon said.

Slot machine makers also suffered in June. WMS Industries suffered the largest decline in its average daily stock price, down 8.22 percent.

Gordon said national consumer confidence levels continued to wane during June. The Conference Board, which produces the Consumer Confidence Index, said that assessments of the economy fell for the second consecutive month.

"Overall, consumer confidence levels reached their lowest point since November of last year," Gordon said.

Morgan Joseph gaming analyst Justin Sebastiano said that despite dire predictions most gaming operators are optimistic about June gaming revenues.

On the whole, he said gaming revenue in the quarter that ended Thursday could mark the fourth straight quarter of year-over-year gains.

"Several trips to different gaming markets and our discussions with industry contacts and property level managers support this positive outlook," Sebastiano told investors. "Results for the month of June may not be as strong as they were in April, but we expect much better data than the May figures."