Community One gets new owner

A giant Utah credit union on Wednesday announced it took over Community One Federal Credit Union, a $159 million-asset Las Vegas financial institution with 21,000 members.

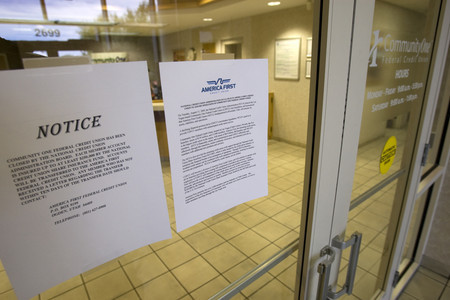

The National Credit Union Administration put Community One into liquidation, and America First Credit Union, a $4.9 billion-asset credit union, assumed its assets, liabilities and operations.

The Las Vegas credit union had lost most of its net worth because of bad loans associated with the recession. The NCUA insures deposits at Community One, and none of the members will lose money as a result of the takeover, said John Lund, executive vice president of America First Credit Union.

"It should have a very minimal impact to the Community One members," Lund said. "It should be business as usual."

America First is "happy to be here" and will be a good corporate citizen, he said. "It should be good news for your community."

The Riverdale, Utah, credit union received an undisclosed amount of federal financial assistance to absorb some of the losses associated with the takeover of the Las Vegas credit union.

Community One was approaching insolvency, with net worth representing 0.55 percent of assets on June 30.

Among Southern Nevada credit unions, only Ensign Federal Credit Union had a lower net worth at 0.44 percent, according to financial reports. By comparison, the net worth of America First was 9.3 percent.

Federally insured credit unions with net worth of 7 percent or more are considered well capitalized and those with net worth of 6 percent to 7 percent are adequately capitalized.

While a "very fine credit union," Community One "got caught in this severe downturn of the economy, and they just didn't have enough capital to weather the storm," Lund said.

The National Credit Union Administration issued a statement, saying Community One's "declining financial condition led to its closure." NCUA officials did not return calls for further comment.

America First in 2000 completed its merger with the last financially ailing credit union that the NCUA took over in Nevada, the Virgin Valley Credit Union in Mesquite, according to the Financial Institutions Division and America First.

Four Nevada banks have been shut down since last summer.

Among the 500 credit unions in California, regulators have taken over five credit unions and merged them with other credit unions during the past year and this year to date, according to the California and Nevada Credit Union Leagues.

Community One lost $3.1 million in the first six months of the year. Delinquent loans were 5.23 percent of total loans and it had charged off 3.74 percent of total loans this year.

Federal regulators terminated Chief Executive Officer Alan Pughes, but America First retained the institution's other 65 employees and officers.

"We've been working with America First several months (to) have a stronger partner," Pughes said. "It's just unfortunate the regulators didn't allow me to finish it. Community One was a good credit union. We just got caught in the declining real estate values."

America First will retain Community One's five branches and continue to operate them as Community One, a division of America First, Lund said.

The Utah credit union is expected to be a strong competitor of banks and credit unions.

"We welcome American Federal Credit Union to Las Vegas and wish them the best luck," said Brad Beal, chief executive officer of Nevada Federal Credit Union.

However, Nevada Federal also plans to take out a newspaper advertisement inviting former Community One members to join it: "Why do business with an out-of-state credit union? We're locally owned and ready to serve you." The ad will offer a $50 bonus to former Community One members.

The Utah credit union already had two branches in Mesquite and 7,600 members in Clark County.

"Having additional branches will better serve these members," Lund said. "Short term there are obviously some real difficult situations that Nevada is having with its economy. Long term, we felt it was a good strategic move."

America First was founded in 1939. It served personnel at Fort Douglas, which was closed in 1991. It is the sixth largest credit union nationally, with 496,000 members.

Community One, which serves residents of Clark County, was established in 1960.

Contact reporter John G. Edwards at jedwards@reviewjournal.com or 702-383-0420.