Ex-hedge fund manager warns against bitcoin during Money Show

Cody Willard had what any conference speaker dreams of: A packed, attentive crowd anxious for the presentation to start.

For the 45-year-old former hedge fund manager, it was a bad omen.

Willard gave a presentation on cryptocurrencies — the most profitable and volatile asset class of 2017 — during the Money Show at Bally’s, which runs through Wednesday.

There were not enough seats to hold the 200 attendees, mainly graying seniors, in the room. As Willard prepared to start, two retirees in the fourth row discussed their investments in bitcoin and NEO, another cryptocurrency.

“I am very scared right now because this room is packed,” Willard told the audience within the first few minute of his speech.

When Willard asked the audience if they were “chasing cryptocurrencies” to become “really, really rich,” an older woman called out, “Yeah.”

Willard warned the crowd.

“This is not the time to get rich. Wait for the crash. Everybody here is in a frenzy.”

100-fold surge

Bitcoin surged as much as 20-fold in 2017 while Ethereum, the second-largest cryptocurrency, jumped 100-fold. A $1,000 investment in Ethereum in January 2017 was worth about $100,000 by mid December.

Willard told attendees that even the maitre d’hotel and waitstaff at Wynn Resorts Ltd. were talking about investing in cryptocurrencies when he visited the hotel during the CES conference in January.

He warned the audience that the crypto craze was reminiscent of the dot-com burst in the 2000s. The Nasdaq-100, an index of leading technology companies, lost 80 percent of its value between March 2000 and October 2002 as many internet companies went bankrupt.

Willard said he predicts that nearly all cryptocurrencies will go to zero. He warned them from buying shares of companies exposed to cryptocurrencies, such as exchange traded funds or investment companies, as a way to minimize the asset class’ risk.

“Don’t buy any penny stocks related to blockchain. They are scams,” Willard said, highlighting Riot Blockchain as an example.

Bioptix, a NASDAQ-traded company making machinery for the biotech industry, changed its name to Riot Blockchain in October as it planned to switch its business focus to cryptocurrency investments.

That announcement caused the shares to surge about 10-fold from $4 to nearly $40 in under three months. The shares have since taken a nosedive back to $7.80.

Cryptocurrencies like bitcoin are digital assets based on blockchain technology. Startup companies seeking to employ blockchain technology to disrupt an industry, such as financial services, often issue coins in exchange for investment.

The process is known as an initial coin offering. The coins can trade on specialized exchanges, rising and falling in value like currencies.

Chaff from wheat

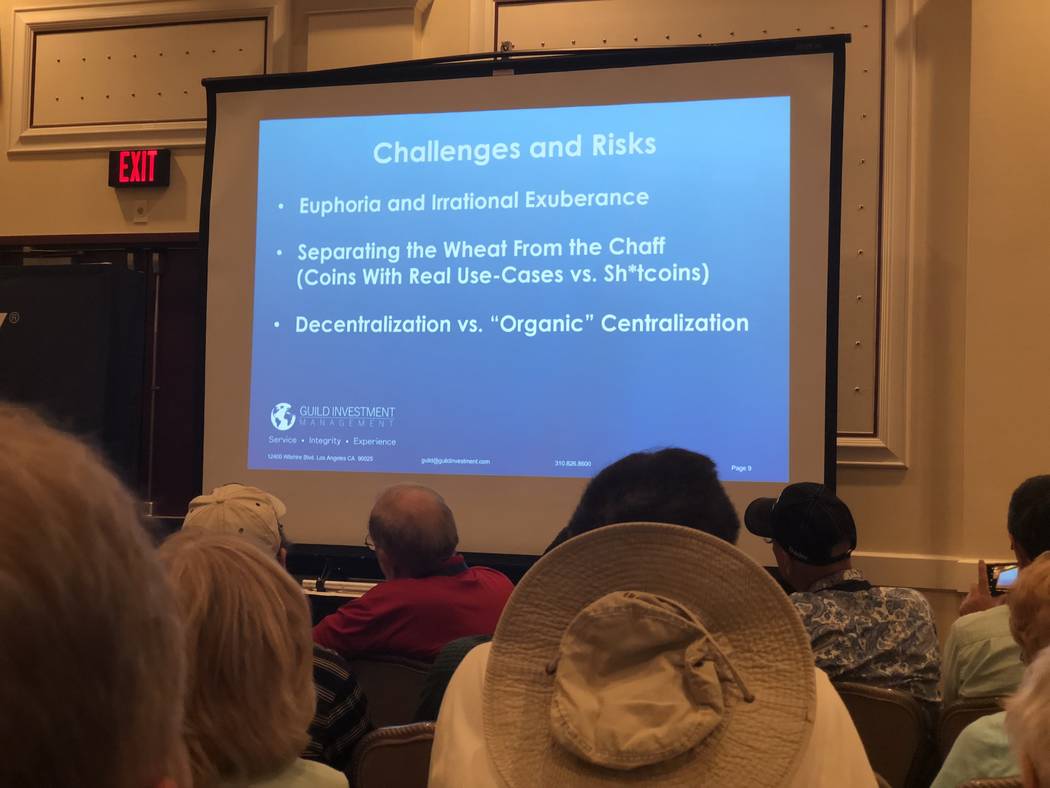

There are about 1,500 cryptocurrencies, said Rudi Von Abele, a senior analyst at Guild Investment Management, who took the floor at The Money Show before Willard.

Abele also warned the crowd that cryptocurrencies were high risk and said most of the 1,500 coins in circulation wouldn’t survive.

About a tenth of the audience raised their hands when Abele asked who had invested in cryptocurrencies.

“There is a lot of chaff and very little wheat,’’ he said of the currencies. “This is highly reminiscent of the dot-com frenzy, but orders of magnitude worse.’’

Abele said many of the companies selling coins aren’t offering an actual service. Rather their goal is to make a token, generate buzz “and unload it” onto investors.

Abele’s colleague Tim Shirata said some people are using bots on social media to create excitement around a particular initial coin offering in order to pump up the price.

“It’s absolutely amazing how (coins) can be manipulated,” Shirata said.

Bright future

Despite the overvaluations and scams associated with cryptocurrencies and the blockchain-based companies that issue them, Abele and Willard said the technology is real and here to stay.

Some blockchain companies could eventually become the next Facebooks, Amazons and Googles of the world, Willard said, but there will be an opportunity to buy them at much lower prices.

“There is a need and a demand for them. There is going to be some incredible opportunities. But I am just telling you, this moment is not it,’’ Willard said.

Contact Todd Prince at 702-383-0386 or tprince@reviewjournal.com. Follow @toddprincetv on Twitter.