Analyst sees LV home prices near bottom

Las Vegas may be among the first markets to emerge from the housing slump clutching the nation as monthly sales have picked up and prices appear to be reaching the bottom, a local housing analyst said Tuesday.

While prices did not rise in October, they were remarkably close to September levels, Larry Murphy of Las Vegas-based SalesTraq said.

New home median prices slid less than $4,000 to $249,000 and existing home prices dipped just $2,000 to $184,000.

It's the first hopeful sign Murphy has seen this year.

"We're all straining and stretching and hoping and praying for positive news," he said. "We're closer to knowing we're near the bottom. It's going to hit bottom and float on the bottom for another year before prices start to creep back up."

New home prices are down 17.3 percent from a year ago. Prices may fall a little more, but they've got to be at or close to the bottom, Murphy said.

Builders simply can't afford to sell for much less than today's pricing levels, he said.

"We have a few builders with products at $100 a square foot. There's very little profit at $100 a square foot. That's their basis in land in some cases. After that, you're just building for practice or building for fun or to keep your employees," Murphy said. "You're just treading water and doing what you've always done because you don't want to quit."

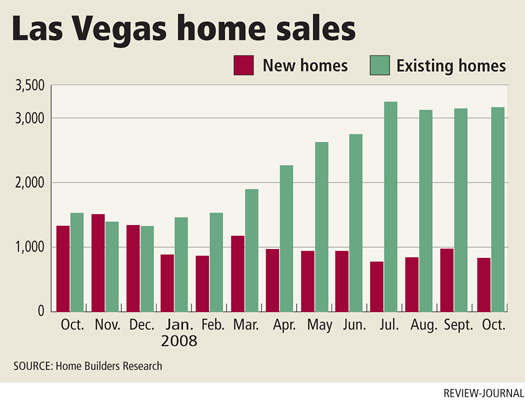

Home Builders Research reported 842 new home sales in October, compared with 1,324 sales in the same month a year ago. For the year, new home sales have declined 46 percent to 9,134 recorded closings.

There were 3,140 resales during the month, bringing the year-to-date total to 24,985, a 13.1 percent increase from a year ago.

"Once again, in our opinion, the primary story this month was the weak building permit totals," Home Builders Research president Dennis Smith said.

He counted just 329 new building permits in Las Vegas, North Las Vegas, Henderson and Clark County. North Las Vegas issued a meager 32 permits in October for 124 units, including 101 units in two condo communities.

The Altos 10-City Composite Price Index showed a decline in asking prices of 1.5 percent in October and 2.9 percent for the past three months. Asking prices in the United States fell at the fastest rate in Las Vegas, down 3.7 percent in October and 7.1 percent over three months.

It's the seventh straight month that Las Vegas has posted the fastest rate of declining prices among the 26 major markets tracked by Altos Research and Real IQ market analysis firm.

"The fleeting signs of price stability that we saw during the summer have now completely vanished," said Stephen Bedikian, research director for Mountain View, Calif.-based Real IQ.

Foreclosures, or real estate-owned properties, have accounted for 60 percent to 70 percent of home sales in recent months, but that may decline in coming months with the $700 billion Troubled Assets Relief Program, Smith said.

"Have banks finally figured out that it is beneficial to keep people in their homes and getting a lower monthly payment is better than getting nothing? Or has the threat of government intervention caused them to move a little quicker trying to resolve the glut of REO properties?" Smith asked.

SalesTraq reported 3,476 existing home sales in October, more than twice the number from the same month a year ago. The caveat, Murphy said, is that 61 percent of those sales were bank-owned homes with a median sales price of $166,000. The median price of the rest of the homes was $217,000, up from $210,000 the previous month.

Murphy estimates there are about 15,000 REO properties in Las Vegas, including a majority of the vacant homes on the market for sale. With roughly 2,000 foreclosure sales a month, it would take seven months to go through the current supply, assuming no more REOs come on to the market.

"Instead of seven months, we probably have twice that -- a 14-month supply of REOs. That's why I see another year of tough sledding," Murphy said.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.

FORECLOSURES BRING PRICES DOWN ACROSS U.S.

WASHINGTON -- Home prices fell in a record four out of five U.S. cities in the third quarter as low-cost foreclosures flooded the market and the U.S. housing market's decline spread across the country.

Among 152 metropolitan areas included in the trade group's survey, 120 posted declines in median home sales prices compared with a year ago, the National Association of Realtors said Tuesday. Nationally, sales fell by almost 8 percent in the third quarter compared with the same period a year ago.

Sales of foreclosures and other distressed properties made up around 40 percent of transactions in the quarter, bringing down the median price by 9 percent from a year ago to $200,500.

Sales fell in all but four states in the Realtors' group's report. The exceptions were Nevada, California, Arizona and Virginia, where buyers have been able to snap up foreclosed homes at a bargain.

"A very large proportion of distressed home sales are taking place at discounted prices compared to more normal conditions a year ago," Charles McMillan, the Realtors group's president, said in a statement.

A nasty brew of strict lending standards, falling home values and a tough economy is filtering through the housing market. By the end of the year, foreclosure listing service RealtyTrac Inc. expects more than a million bank-owned properties to have piled up on the market, representing around a third of all properties for sale in the U.S.

THE ASSOCIATED PRESS