Home prices tumble at record rate

NEW YORK -- U.S. home prices, led by sharp declines in Las Vegas and Miami, tumbled in April at the fastest rate since a widely followed index was begun in 2000, with all 20 metropolitan areas surveyed posting annual declines for the first time.

Las Vegas and Miami both continue to post the largest declines, falling 26.8 percent and 26.7 percent, respectively.

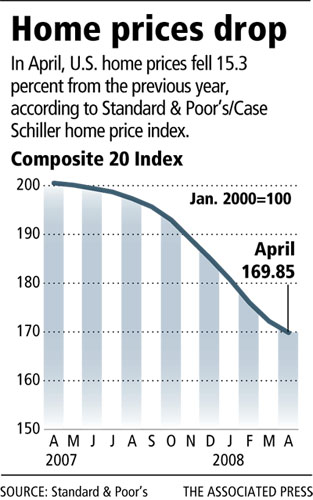

The Standard & Poor's/Case-Shiller home price index of 20 cities fell by 15.3 percent in April versus a year ago, according to Tuesday's report. Prices nationwide are at levels not seen since August 2004.

The narrower 10-city index declined 16.3 percent in April, its biggest decline in its more than two-decade history.

Las Vegas-based Home Builders Research reported a median price of $225,000 for 2,606 existing-home sales in May, a decline of $53,000, or 19.1 percent, from the same month a year ago. It's down $65,000, or 22.5 percent, from the peak median in October 2006.

"In our opinion, the unknown factor that can affect the resale prices during the upcoming months is the short sales," Home Builders Research President Dennis Smith said.

About one-fourth of available home listings in Las Vegas are short sales, offered at less than the mortgage owed, which means they must be approved by the bank before closing escrow.

"And by now, most have heard the stories about how long that can take," Smith said.

Meanwhile, a report from the Office of Federal Housing Enterprise Oversight said U.S. home prices fell 4.6 percent in April from the same month last year, when the index peaked. That was the biggest decline ever in the agency's monthly index, which dates back to January 1991.

The government index is calculated using mortgage loans of $417,000 or less.

While the government report has shown nationwide price declines, the Case-Shiller index has shown far greater drops because it focuses on larger cities where prices rose further during the boom years, and includes riskier loans.

No surveyed city stayed above water, according to the Case-Shiller index. The last holdout, Charlotte, N.C., finally succumbed to the national housing downturn, with prices there slipping 0.1 percent from a year ago.

However, the annual declines in Denver, Dallas and Cleveland were less severe than in the previous month, but Maureen Maitland, a S&P vice president, is reluctant to peg that as an indication of stabilization.

"We wouldn't call a trend on one-month data," she said.

The report also showed prices in eight metro areas increased in April from March, but the gains could be seasonal blips as the home-buying spring season starts up rather than a sign of a turnaround, Maitland said.

Review-Journal writer Hubble Smith contributed to this report.

CONFIDENCE LEVEL PLUMMETS U.S. consumer confidence fell sharply in June, sinking to its lowest level in more than 16 years, according to a private industry group.The report Tuesday also said the group's reading of consumers' expectations hit an all-time low as home prices tumbled while gasoline and food prices rose. A separate index of home prices saw the largest drop since its inception in 2000. The news sent stocks lower in morning trading. The Conference Board's consumer confidence index fell to 50.4 this month, the lowest since February 1992. The index dropped from 58.1 in May, a much steeper decline than economists expected. The consensus estimate of economists surveyed by Thomson/IFR was 56.5 for June.Inflation, political flux and job insecurity have created an "uncertainty more acute, perhaps, than any time since 9-11," said William Hummer, chief economist at Wayne Hummer Investments. "I don't think this can be purged immediately by an election or anything else," he said. "I think it's endemic, deep-rooted and likely to persist." The reading, based on a survey of 5,000 representative U.S. households, suggests "the economy remains stuck in low gear," said Lynn Franco, the Conference Board's director of consumer research. THE ASSOCIATED PRESS