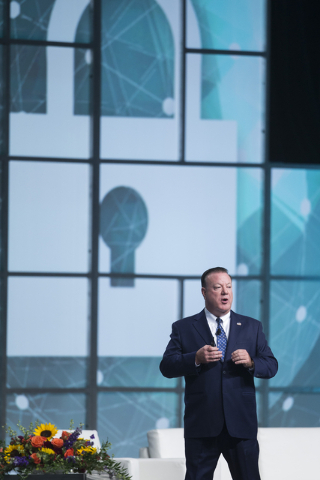

It’s good guys vs. bad guys, speaker on cybersecurity says

In the world of cybersecurity, Stephen Orfei says it comes down to good guys and bad guys.

Speaking in Las Vegas, Orfei said that the rollout of cards with chip technology is leading to a decrease in fraud domestically for in-person payments. The problem is, fraudsters are instead shifting online in response.

“It’s critical that we remain current, current on the threats, current on the technology,” said Orfei.

Orfei, general manager of the Payment Card Industry Security Standards Council addressed several hundred attendees Tuesday at a meeting at The Mirage. The PCI Council, which develops standards for payment cards internationally, was founded in 2006 by American Express, Discover Financial Services, JCB International, MasterCard, and Visa Inc.

He said one solution to prevent online fraud is added verification online for payments.

Orfei said that research has shown that many of the security breaches companies experience are because of known vulnerabilities or fixable patches.

The usual issues such as weak passwords continue to be problematic. Hackers are also scamming users and businesses by scouting social media information and using it to trick users into opening emails packed with viruses, Orfei said.

Orfei singled out the hospitality and health care industries as two sectors that are under heavy attack.

The hospitality industry deals with an immense volume of transactions which entices “bad guys” he said.

Orfei added that the PCI Council is doing more outreach to smaller merchants and expanding global partnerships.

To assist small merchants, the PCI Council is producing brochures with infographics that attempt to cut through the jargon of security threat prevention.

The event was attended by CEOs, cybersecurity experts, compliance risk managers and many others.

Contact Alexander S. Corey at acorey@reviewjournal.com or 702-383-0270. Find @acoreynews on Twitter.