Local economy keeps sinking, index shows

Southern Nevada's economy is dropping sharply and has now fallen below the national level, a local economist said Thursday.

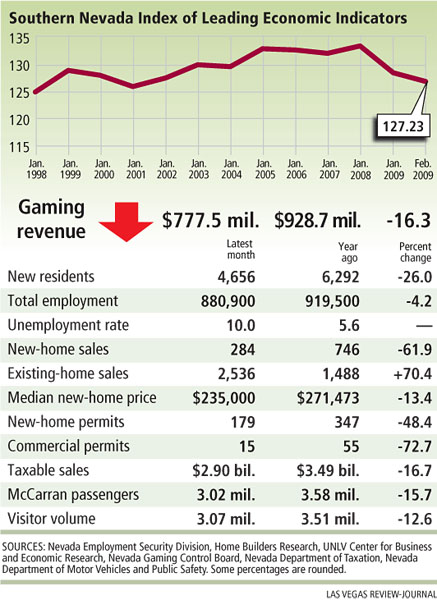

All 10 indicators contributed negatively to the Southern Nevada Index of Leading Economic Indicators, which fell to 127.23 in February, down from 127.96 the previous month and from a high of 133.93 in February 2008.

The index shows no sign of change and no sign of economic recovery, said Keith Schwer, executive director of the Center for Business and Economic Research at University of Nevada, Las Vegas.

"It's what we refer to as a cliff-diving chart," he said. "There (are) still issues out there."

Eight series of data declined by double-digit percentages from a year ago, led by a 75 percent drop in residential building permit valuation to $36.7 million. Commercial permit valuation was off 72 percent to $16.1 million.

With the housing slump and foreclosure crisis snuffing out new-home sales, builders have no need to pull permits. Home Builders Research reported 284 new-home sales in January and 179 new-home permits, among the lowest numbers on record.

The commercial real estate market has seen rising vacancy and notices of default, which has curtailed local construction. Office construction fell to 2.2 million square feet in fourth quarter 2008 from 3.6 million square feet in the year-ago period, and industrial construction is down to 500,000 square feet from 4.7 million square feet a year ago, reports Applied Analysis, a Las Vegas business advisory firm.

Southern Nevada has arguably been among the nation's hardest-hit metro areas by the current economic downturn, Applied Analysis principal Jeremy Aguero said.

He points to the region's 10 percent unemployment rate, which is higher than the national average, along with home foreclosures and sharp drops in key tourism measures.

Clark County gaming revenue declined 16.3 percent in January to $777.5 million and visitor volume was down 11.9 percent to 2.76 million. Billion-dollar resort projects have been halted, leaving skeleton structures on the Strip and thousands of people out of work.

"There is little ambiguity in the numbers or the anecdotal reports," Aguero said.

As Nevada began slipping into recession in late 2007, hotel occupancy rates started to sag.

With historical rates above 90 percent, the Strip's hotel industry remained profitable and secure for some time, but visitor volume as measured by hotel occupancy rates declined further when the national economy tanked, Schwer said.

"November and December, months that we often see smaller crowds in Las Vegas, were no exception this year," he said, "but occupancy rates in the 70 percent range offer ample evidence of weakness to this key sector, pinching industry profitability."

The index, compiled by the Center for Business and Economic Research, is a six-month forecast from the month of data, based on a net-weighted average of each series after adjustment for seasonal variation. February's index is based on December data.

The accompanying Review-Journal chart includes several of the index's categories, along with data such as new residents and employment and housing numbers, updated for the most recent month for which figures are available.

"The stock market was up again today, so perhaps we're at the beginning of the end, but it's far from over," Schwer said Thursday. "Given the nature of a recession, the national economy is going to have to pick up before us. We are beginning to see some signs."

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.