Nevada gold mines cash in as consumers flock to metal

The recession has pushed Nevada's casino gambling sector off the cliff, but the state's gold mining industry is still enjoying a wild ride that started when the price of gold hit bottom at $251 an ounce in August 1999.

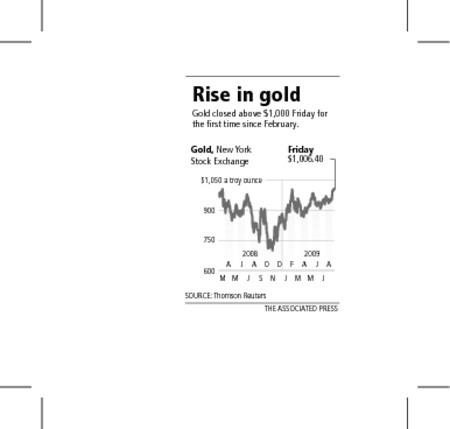

Since then the price of gold has passed $1,000 an ounce -- three times. The first time was in March 2008, and it reached that milestone for the third time on Friday.

The spot price of gold closed at $1,004.90 an ounce Friday on the New York Mercantile Exchange. Gold for December delivery closed at $1,006.40, the highest close on record and the first above $1,000 since February. It reached $1,013.70 earlier in the day, the highest price for a most-active contract since March 17, 2008.

All of that is good news for rural mining towns in Northern Nevada, for the 14,000 direct employees of mines, for businesses that sell goods and equipment to mines and miners, and for gold investors.

Gold's price surge has even helped to offset the slump in state and local government revenue during the past year's recession.

Keith Schwer, director of the Center for Business and Economic Research at the University of Nevada, Las Vegas, however, says Northern Nevada's gold boom is providing only limited economic benefits to Southern Nevada and its tourism-based economy.

"They are not going to take these unemployed casino workers and make them into miners," Schwer said.

It's not like a contractor who fixes air conditioners in the summer and then switches to heater repairs in the winter, Schwer said. In addition, most mining companies are headquartered in other states.

Mining companies also cannot always boost operations quickly enough to benefit from higher gold prices, partly because of delays in obtaining permits, said John Dobra, associate professor of economics at the University of Nevada, Reno, and director of the Natural Resource Industry Institute.

As proof of that he points to Barrick Gold Corp.'s new Cortez Hill underground and open pit mining operations southwest of Elko. About 350 workers are employed there now and expect to start gold production early next year.

"They discovered the gold at Cortez Hill 11 years ago," Dobra said.

Newmont Mining Corp., another gold mining giant, operates eight mines in Northern Nevada, including Gold Quarry, Leeville, Midas and Deep Post.

It employees 3,500 workers in the state.

But state and local governments do benefit from the mining industry, Dobra said.

Gold mining accounts for a large portion of the net proceeds tax on mining, a tax on operating profits in Nevada.

The total net proceeds tax has more than doubled since 2004 when Nevada counted $40 million in net proceeds from mining. In 2007, the total reached $75.7 million and last year it hit $91.9 million.

"It's a huge increase," Dobra said.

In addition, mining companies pay sales and use taxes, business taxes and property taxes. With the exception of property taxes, "Clark County is getting most of the tax money," Dobra said.

He calculated that the state collected $223.6 million in total net proceeds taxes last year, up from $200 million the previous year.

However, some observers say the tax bounty should be even higher.

"The net proceeds on mining is next to nothing," said Jan Gilbert, Northern Nevada coordinator of the Progressive Leadership Alliance of Nevada. "It's less than one-half percent of the general fund."

She argued that mining companies should pay more because they are removing resources that cannot be replenished.

Tim Crowley, president of the Nevada Mining Association, disagreed with her call for additional mining taxes.

"The mining industry recognizes that the state is in fiscal trouble. We want to be a part of the solution," he said.

The mining industry, however, should not be singled out for a higher portion of the tax burden than others, Crowley said.

And while gold prices are up, they can just as quickly drop, he said.

Gilbert said she was disappointed that the Legislature did not raise taxes on mining companies.

"It's really cheating Nevada," she said, "because they are making money at a time when some industries are struggling."

Her group and allies intend to seek enough signatures to get a voter initiative on the ballot to change the state constitution on mining taxes.

Southern Nevada has no significant gold mines, but the area does have some potential.

Searchlight Minerals Corp., a Henderson-based company with stock that trades over the counter, is exploring for gold near Searchlight, home to Senate Majority Leader Harry Reid.

While Dobra has no information about the company's mining claims, he believes the Searchlight area has some gold.

"Harry Reid's father was a miner in Searchlight, and they didn't get it all," Dobra said.

Meanwhile, however, the easiest place to find gold in Southern Nevada is at retail dealers, which are also experiencing a boom in business.

"It's been pretty busy," said Mark Scott, owner and manager of Sahara Coins.

He estimates that his shop has sold more than $20 million in gold this year.

Scott suggests investors use gold as a hedge against declines in the dollar. By holding half of their cash in gold, investors can preserve their wealth because when the dollar goes down in value, gold usually goes up, he said.

Denver-based Newmont Mining Corp. also is bullish on gold.

"Newmont believes that ongoing economic uncertainty, currency devaluation and the threat of inflation are supporting the ongoing strength in the gold price," spokesman Omar Jabara said in an e-mail.

Gold reached a previous high of $850 an ounce in January 1980. The $850 price from almost 30 years ago would equal $2,300 an ounce in inflation-adjusted dollars, Jabara said.

"In addition, the supply of gold being produced from mines around the world is declining while the costs and time frames in permitting and building new mines have increased sharply," he said.

Barrick Gold, a Toronto-based mining company with mines in Nevada, previously entered contracts to protect against a decline in the price of gold. But on Tuesday the company said it intended to buy out the hedges based on an expected increased risk of inflation and decreases in the value of currencies. Newmont does hedge against changes in the price of gold.

Jag Mehta, adjunct professor of finance at UNLV and a chartered financial analyst, recommends that middle-class investors invest no more than 5 percent to 10 percent of their money in gold and said wealthy investors probably should put no more than 1 percent of their investments in gold.

Gold would have value for an investor who "thinks that the whole world is going to fall apart," which Mehta doubts will happen anytime soon.

Gold does work as a hedge against inflation, because its value will hold while currency values are dropping. Mehta said real estate also protects against inflation and is a more attractive investment.

Gold produces no income and costs money to store, in places such as safe deposit boxes, he said. Real estate often generates income, either from rentals or agricultural uses.

For those who want to hold the metal, Mehta recommends buying gold coins, such as the Canadian Maple Leaf or South African Krugerrand.

Cost-conscious coin buyers pay sales tax on purchases at local stores but can avoid the tax by purchasing from some online gold coin retailers.

Better still buy an exchange traded fund, such as SPDR Gold Shares, which holds gold bullion and trades like a stock, he said.

Gold mining stocks and funds that hold these stocks are other options.

Mehta recommends Market Vector Gold Miner, an exchange traded fund. Gold mining companies, unlike the metal, can produce income. After mines cover the fixed cost of producing gold, increases in gold price fall to the bottom line, he said.

Some wonder why gold is doing so well, however. Gold is "trading north of $1,000 this morning," Ken Bott, managing director of Chicago Investment Group's Las Vegas operations, wrote in an e-mail message to clients Monday.

"Gold has rallied in 16 of the past 20 Septembers, usually due to seasonally strong demand," Bott said, quoting CNBC.

"But if gold is really an inflation hedge, then why have bond yields been dropping like a Nutrisystem weight-loss program?" Bott said. "Something just doesn't smell right out there."

Contact reporter John G. Edwards at jedwards@reviewjournal.com or 702-383-0420.