Observers: Proposed tax might sweeten education spending but leave state with fewer jobs

Passage of a new business margins tax in November might bring the state more money for education, but it would leave graduates with fewer job opportunities, panelists at a Las Vegas Metro Chamber of Commerce luncheon said Wednesday.

A panel of four industry professionals talked about the tax at the Four Seasons. Their conclusions? A levy on gross revenue would confuse businesses and government agencies alike. It would also boost hiring by about a third at the state Department of Taxation, even as it encouraged the private sector to change how it hires to avoid it.

“It’s a flawed tax, and it will have a chilling effect on business,” moderator and Nevada Taxpayers Association President Carole Vilardo told 250 attendees.

The Nevada State Education Association is behind the proposal, which it’s calling the “Education Initiative.” The law would raise up to $750 million for K-12 schooling. The question’s proponents say it’s time for businesses to pay more to support education. And they argue the state’s underfunded schools scare away businesses as much as — or more than — any tax.

The business-oriented chamber panel saw things differently.

The chamber held the luncheon to explain to members how the tax will work and how it will affect businesses — and to rally opposition.

First, the basics: Ballot measure 3 on the November ballot would impose a 2 percent tax on gross revenue, or every dollar a company takes in. That’s different from a corporate income tax, which applies only to profits.

To calculate the margin, businesses can use 70 percent of total revenue; total revenue minus the cost of goods sold; or total revenue minus total compensation for employees. Companies choose the path of lowest liability.

A company’s first million is exempt, but once that threshold is breached, a company owes on the entire amount, not just sales over $1 million. Make $999,999, and you’ll owe nothing. Make a dollar over $1 million, though, and you’ll shell out about $14,000, said Joe Henchman, vice president of legal and state projects for The Tax Foundation, a Washington, D.C.-based think-tank.

A few unknowns could complicate Nevada’s law, Henchman added.

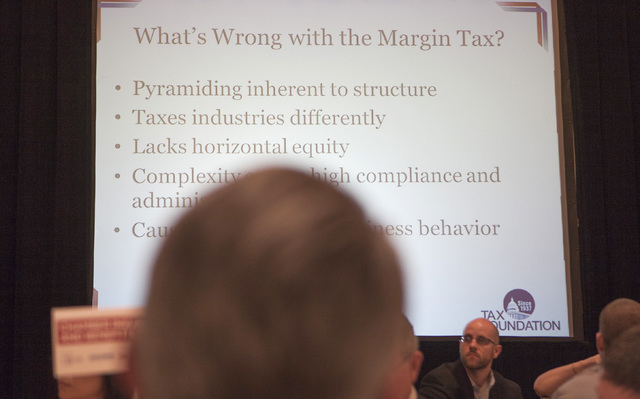

First, the state won’t recognize federally allowed cost-of-goods categories including advertising, litigation or sales and distribution. The law also treats industries differently: It doesn’t exempt health care, but it does exempt gambling revenue. It could punish businesses that hire employees rather than use independent contractors. It will raise administrative costs, as businesses follow separate state and federal definitions of write-offs. And it could distort business behavior, as companies operate to avoid it.

The tax would also put Nevada at a competitive disadvantage because margins levies “are mostly dying,” Henchman said. Few states have them anymore; states that have tried them — Texas, Michigan, Kentucky, Washington — have either repealed or modified them.

“The winners will be tax accountants and attorneys, as well as states that compete with Nevada for jobs and entrepreneurs, because Nevada is going to look a whole lot worse,” Henchman said.

But one entity would get a jobs lift from the tax.

Chris Nielsen, executive director of the state Taxation Department, said his 300-employee staff would grow by about 100 over two or three years to implement the levy.

The agency would have from passage on Nov. 3 to Jan. 1’s effective date to put a framework in place, though regulatory tweaks would continue for years.

Nielsen said he would need management and information-technology staff immediately, and auditors and other compliance people after 2016.

“It’s going to take a while to ramp up hires and go through the regulatory process,” Nielsen said. “This frustration and timing will turn into frustration for the business community.”

Nielsen added that it would be difficult early on to counsel tax professionals on the new law. He said the attorney general’s office doesn’t have a margins tax expert to help him interpret the rules, either.

“It will be a learning curve for everyone in government,” Nielsen said.

Even the panel’s resident CPA, who said he stood to collect big fees on the change, came out against the proposal.

“You can lose your posterior and still owe this tax,” said Curt Anderson, CEO of Fair, Anderson &Langerman CPAs and Business Advisors in Las Vegas.

“The only word I can think of in polite company is that this is an abomination, an absolute abomination,” Anderson added.

“It’s an indictment of our processes in the state of Nevada. … All of these kids we’re trying to give a better education — we’ve messed them up (if the law passes), because we lost jobs. What are we doing to ourselves?”

Contact reporter Jennifer Robison at jrobison@reviewjournal.com. Follow @J_Robison1 on Twitter.