Regulator says he won’t relax write-down rules

Nevada's top banking regulator is advising state-chartered banks that he won't waive a law requiring them to charge off the value of repossessed real estate over 10 years.

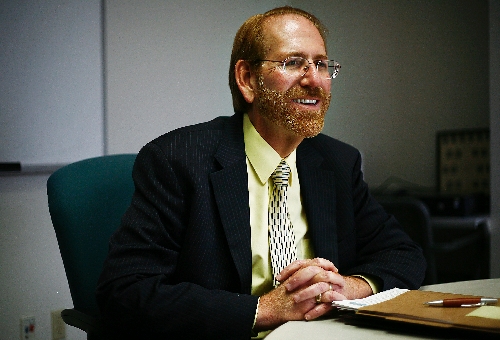

George Burns, commissioner of the Nevada Financial Institutions Division, issued the advisory opinion in response to questions from SouthwestUSA Bank, a Las Vegas bank with $218 million in assets.

The community bank asked the commissioner to waive a law that requires state banks to gradually make accounting write-downs on the value of foreclosed real estate held for long periods.

Each year for 10 years, state banks must write off one-tenth of the value of real estate seized for collection of a debt. At the end of 10 years, state-chartered banks must sell the foreclosed real estate.

Burns denied the requested waiver in a letter dated March 26 and posted the letter on the division's Web site.

The issue arose as local banks are struggling to deal with the worst area real estate depression in decades.

In the letter, Burns said the law is designed to discourage banks from keeping foreclosed real estate for long periods of time.

"The law was enacted to ensure that banks engage in the fundamental business of banking; that is, taking deposits and making loans, and not real estate speculation," he wrote. Banks sometime delay the sale of foreclosed properties in hopes the market value of the property will increase, analysts say.

Burns also said he would oppose any bill that seeks to relax the 10 percent rule.

Attorney Matthew Saltzman, who requested the opinion on behalf of SouthwestUSA, said he is disappointed that Burns is unwilling to be more flexible in enforcement of the 10 percent rule and will not back changes in the law.

The advisory opinion will increase financial pressure on community banks, Saltzman said.

"This is an incredibly unprecedented real estate depression that we're in, and we are seeing things we've never seen before," Saltzman said.

The law may force banks to sell large amounts of commercial real estate quickly, which could depress prices, he said.

"It may accelerate banks having to raise additional capital or be sold off," Saltzman said. "There probably will be much fewer community banks in Nevada in the next year or two."

Saltzman considers that unfortunate, because independently owned community banks usually are locally managed and have officers who deal directly with small-business borrowers.

Federal regulators don't subject national banks, such as Bank of America and Wells Fargo Bank, to a similar rule, Saltzman said.

"There are advantages and disadvantages to being a state-chartered bank, as there are to being a national bank," Burns said in a phone interview.

"The law is the law regardless of whether you are in an (economic) upturn or a downturn," Burns said. "We do not have circumstantial law."

Contact reporter John G. Edwards at

jedwards@reviewjournal.com or 702-383-0420.