Rhodes expects to keep companies running

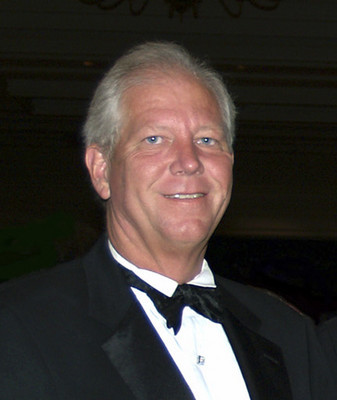

Homebuilder James Rhodes, who filed for bankruptcy court protection in late March, expects his companies to continue operating after emerging from bankruptcy, one of his attorneys said Thursday.

The Rhodes Cos. then would have lower debt levels, attorney Shirley Cho said at a meeting of creditors.

The first and second lien secured creditors, which include investment bank Credit Suisse, don't believe that this is "the optimal time for liquidation" of real estate, she said.

"Surely, there will be better markets than this," Cho said.

Credit Suisse and other secured lenders earlier asked bankruptcy Judge Linda Riegle to appoint a trustee to run the companies, but the lenders withdrew that motion.

Rhodes' 32 companies in bankruptcy have $400 million in liabilities and have $100 million in assets. His companies employ fewer than 100 workers.

He continues to build out Tuscany, a community in southeast Las Vegas, and Rhodes Ranch, a community in southwest Las Vegas.

The updated information on Rhodes came out during a meeting of creditors presided over by August Landis, assistant U.S. Trustee, at the Foley Building in downtown Las Vegas.

Rhodes did not participate in the meeting, but consultant and former Chief Financial Officer Paul Huygens and executive Joseph Schramm testified on the companies' behalf.

Creditors heard how Rhodes was borrowing from banks and hard money lenders in 2005 and decided to consolidate the debt in a loan from Credit Suisse and others. Rhodes obtained $480 million in financing and used it to pay down $300 million in existing debt. About that time, home sales peaked, only to be followed by a collapse of housing and real estate values.

"The company has been doing extreme cost-cutting for the past two years," Huygens said. "The company has cut and cut and cut."

The company sold a fleet of trucks and some heavy equipment.

Rhodes' companies that owed money to first and second lienholders or that had guaranteed the loans filed for bankruptcy. Others did not.

Rhodes and his staff worked until 10:30 p.m. or 11 p.m. one night in late March, unsuccessfully seeking to reach an agreement with creditors as the bill for $20 million in interest and principal came due. Rhodes' companies also were violating loan covenants governing interest coverage from cash flow and the value of its assets, Huygens said. The companies had been marking down values to market values as reflected in distressed sales, Huygens said.

The following day, attorneys for Rhodes filed for bankruptcy court protection.

"What it came down to was, the company believed the creditors would seize the cash ($2 million) first thing in the morning," Huygens said.

In late April, Rhodes' attorney Zachariah Larson filed a motion seeking bankruptcy court approval to continue paying Rhodes his $400,000 salary through late June.

"Mr. Rhodes skills, knowledge and relationships are essential to the debtors' ability to implement the 13-week budget," Larson said in the motion. The motion said his salary is comparable to chief executives at other homebuilders. It listed base salaries for CEOs at publicly held homebuilders DR Horton, Toll Brothers, KB Homes and others.

Contact reporter John G. Edwards at jedwards@reviewjournal.com or 702-383-0420.