Rise in state taxable sales is first in two years

A key revenue source for Nevada posted its first upturn in two years in April, as consumers lifted spending on discretionary purchases.

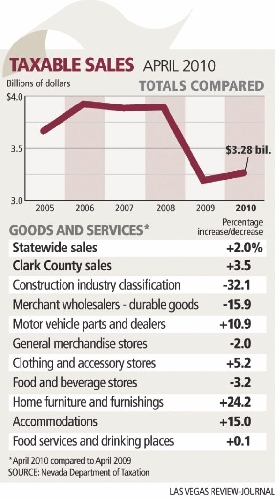

Nevada's taxable sales, which measure the dollar value of goods bought through the state's merchants, totaled

$3.3 billion in April, up

2 percent from April 2009, the state Department of Taxation reported Monday.

Taxable sales in Clark County came in at $2.5 billion, up

3.5 percent from $2.4 billion a year earlier.

It's the first improvement since August 2008, when taxable sales rose 3.1 percent. But those earlier gains came exclusively from a tax-amnesty program that encouraged retailers to cough up back taxes on sales they had closed months or years earlier. Without that reprieve, real taxable sales fell 3.6 percent in August 2008.

The last time taxable sales actually increased year over year, without amnesty programs or other accounting anomalies? April 2008.

The newest numbers are "a sign that no longer are we expected to see this free-falling in terms of consumer spending," said Brian Gordon, a principal in local research and consulting firm Applied Analysis.

Showing sales gains year over year in April were consumer-oriented categories including dealers of cars and car parts, up 10.9 percent; clothing retailers, up 5.2 percent; furniture stores, up

24.2 percent; and accommodations, including hotels, up 15 percent. Transactions in some of those areas, including clothes and furniture, have risen steadily since early 2010.

Industry-focused sectors continued to slump in April, with purchases from wholesalers of durable goods stumbling 15.9 percent and construction spending slipping 32.1 percent. The dip in construction expenditures, though sizable, was well below the 60 percent drops the sector experienced at the height of the recession.

One month does not form a trend, Gordon said, but the fact that consumer spending has stopped plummeting could mean people are ready to return to more traditional buying patterns.

"Part of the uptick may be attributable to recession fatigue," Gordon said. "Consumers are tired of staying home and being overly cautious given the economic uncertainty that swirls around. They're looking to establish some normalized lifestyle, and that may include eating out, spending at furniture stores or buying clothing for the summertime."

At Furniture Markdowns on Decatur Boulevard, sales are up around 10 percent in 2010, employee Mike Paulson said.

Paulson credited the better business to a spike in home sales. His company sees a lot of consumers who have purchased foreclosure properties. They are mostly buying sofas and dining-room sets, and many of them say they put off buying for so long that springing for new furniture has become a necessity, he said.

"We're keeping our fingers crossed, but since the first of the year, things are looking better. Each month seems to be better than last year. We're just hoping it continues," Paulson said.

Still, Nevada has billions of dollars to go to return to its taxable-sales peak.

The Silver State's merchant transactions reached a record $4.7 billion in December 2006, 43 percent higher than April's total.

Sales in Clark County hit a high of

$3.5 billion in December 2007, just as the recession began. That's 40 percent beyond April's amount.

Taxable sales in April 2009 fell 18 percent statewide and 17 percent in Clark County year over year, a bleak base-comparison number that helped push the most recent April's totals into growth territory.

The average invoice price at Furniture Markdowns remains below pre-recession levels by about 25 percent, as consumers remain budget-conscious, Paulson said. Sales would have to jump roughly 50 percent to return to their averages before the downturn.

Taxable sales also remain down for the state's fiscal year, which began July 1. Transactions were off 11.9 percent in the first 10 months of fiscal 2010 when compared with the same period of fiscal 2009.

Gross revenue collections from sales and use taxes totaled $255.9 million in April, a 6.4 percent improvement over April 2009. Collections are off

6.6 percent year over year in the first 10 months of fiscal 2010.

Taxable sales help fund prisons and schools, among other public services.

Gov. Jim Gibbons said in a statement that federal stimulus funds have helped the Nevada economy start its revival.

He pointed to April's Nevada Appliance Rebate Program, which gave participants $200 toward replacing older appliances with new Energy Star models, and said his energy office has committed more than 75 percent of allocated funds for energy-efficient and green-power projects in the state.

"We will be persistent in using all available resources to stimulate and promote the road to Nevada's economic recovery," he said.

Gordon said taxable sales should "bounce around" in coming months, with some months posting increases and others showing declines.

"We wouldn't expect to see any material jumps or quick increases, but at the same time, it's unlikely we'll see the bottom fall out from under us," he said.

Contact reporter Jennifer Robison at jrobison@

reviewjournal.com or 702-380-4512.