Sales steady during October

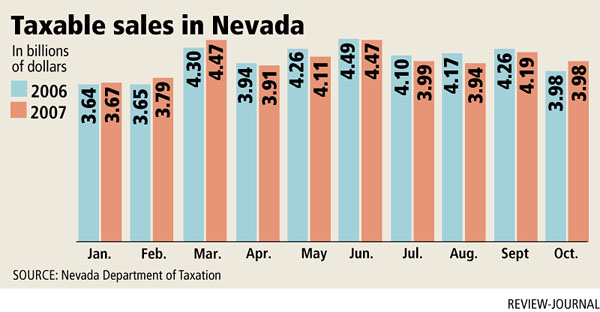

CARSON CITY -- If a 4.3 percent jump in taxable sales in October reported by the state on Friday sounded too good to be true to budget-trimming government agencies, that's because it was.

Details in the monthly report released Friday by the Department of Taxation quickly disabused anyone of the notion that Nevada's economy was suddenly on the rebound.

Most of the increase over October 2006 was attributed to accounting adjustments made to the October 2006 reporting period. After factoring out those changes, taxable sales grew 0.06 percent in October 2007 over the same month last year, the agency reported.

Even so, it was the first growth seen in taxable sales this fiscal year and the first positive report since March.

But the modest October increase did not equate to an increase in sales taxes, which continue to be well below projections and which are playing the biggest role in the state's projected revenue shortfall of $440 million over the next two years.

Sales tax collections in October totaled $296.6 million, a drop of just less than 1 percent from October 2006. Compared to the May 1 Economic Forum projections, the general fund portion of the sales and use taxes is 3.2 percent, or $34 million, below the forecast amount for the first four months of this fiscal year.

The expected revenue shortfall caused Gov. Jim Gibbons this month to announce spending reductions of 4.5 percent per year across virtually all agencies, including public education.

In a statement accompanying the report, Gibbons said there was some evidence for optimism in the numbers: "The October 2007 sales tax figures indicate that many sectors of Nevada's economy are showing signs of improvement, bolstered by strong tourism activity mirroring gaming results for the same month."

Statewide taxable sales in October totaled just less than $4 billion. For the fiscal year, taxable sales total $16.1 billion, down 1.5 percent over the same four-month period last year.

Clark County taxable sales totaled just under $3 billion in October. For the fiscal year, Clark County, with nearly $11.9 billion in taxable sales, is down 0.1 percent from the same period in 2006.

The largest increases in taxable sales statewide were seen in food services and drinking places, up 6.7 percent over October 2006, hotel and motel accommodations, up 27 percent, rental and leasing services, up 23 percent, clothing and accessory stores, up 8.9 percent, and machinery and manufacturing, up 52.7 percent.

Other taxable sales categories highlighted in the report include the construction industry, up 10.6 percent; durable goods, up 1.9 percent; motor vehicle parts and dealers, flat at 0.0 percent; general merchandise stores, down 3.2 percent; food and beverage stores, up 4.3 percent; and home furniture and furnishings, up 10.4 percent.