Southwest Exchange receiver accuses law firm, partner of multiple misdeeds

The receiver for Southwest Exchange, the Henderson-based financial company that collapsed in 2007 owing $98 million to 130 real estate investors, is suing regional law firm Snell & Wilmer and accusing the law firm's managing partner in Las Vegas of participating in a fraudulent scheme.

The lawsuit, which was filed for Southwest Exchange receiver Larry Bertsch and others, accuses the Phoenix-based law firm and partner Patrick Byrne of legal malpractice, breach of contract, breach of fiduciary duty and other civil matters.

Attorney Steve Morris, who represents Snell & Wilmer, denied the allegations.

"The allegations contained in the complaint are false and are not based on the facts," Morris said in a statement. "The complaint is nothing more than a litigation tactic intended to pressure the firm and its partner, Patrick Byrne, into settling claims that simply do not exist."

Byrne didn't return calls for comment Friday.

The lawsuit, which was filed June 13, contains one of the most complete outlines yet of the alleged scam that led to insolvency at Southwest Exchange.

The Henderson firm was an accommodator that held money for investors seeking to postpone taxes on profits from the sale of real estate. Under Internal Revenue Code Section 1031, real estate investors are allowed to delay payment of taxes on real estate sales if they do not touch the proceeds of the sale but send the money directly to a third-party firm like Southwest Exchange. The seller later typically directs the accommodator to send the money to the seller or another property.

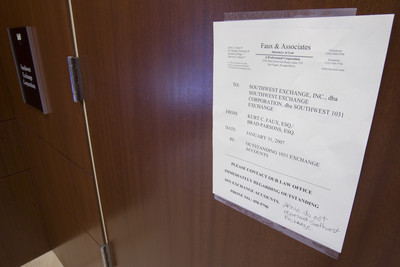

Snell & Wilmer represented Southwest Exchange from 2000 until January 2007 when the accommodator became insolvent and closed, according to the lawsuit.

Byrne represented both Betty Kincaid and Donald McGhan when McGhan purchased Southwest Exchange from her for $3 million in 2004. Byrne failed to disclose to Kincaid that he was representing McGhan, the lawsuit says.

After buying Southwest Exchange, McGhan immediately looted $52 million in trust assets from clients, according to federal court papers. McGhan used most of the money to buy Eurosilicone SAS, a breast implant maker in France, for McGhan's publicly traded company, Medicor, another Snell & Wilmer client, the lawsuit says.

Byrne and two others agreed to lend money to McGhan for part of the $3 million Southwest Exchange purchase price at the annualized rate of 830 percent.

In June 2004, Byrne agreed to lend McGhan $1.3 million for six days in exchange for a $130,000 fee, a trip on McGhan's leased jet and a pledge of McGhan's 5.5 million shares of Medicor stock. That loan was repaid.

By the time Southwest Exchange failed in 2007, McGhan had taken another $46 million in client funds, making the total loss $98 million, the civil complaint says. It also says McGhan and associates created a Ponzi scheme in which early investors are paid with money from later investors.

"When the real estate market cooled toward the end of 2006, funds flowing out of SWX exceeded funds being deposited at SWX and the Ponzi scheme abruptly collapsed," the lawsuit says.

The lawsuit said McGhan defaulted on another loan from Byrne.

Byrne twice extended the loan, which the lawsuit says prolonged the existence of Southwest Exchange.

Byrne didn't foreclose on the loan in 2006 but insisted McGhan pay him $100,000 weekly. The lawsuit says that Byrne received a total of $5.3 million in client funds from McGhan.

In October 2006, McGhan acquired Qualified Exchange Services, a 1031 accommodator based in Santa Barbara, Calif., and began diverting money from the new firm's clients, the lawsuit said.

Snell & Wilmer failed to incorporate a provision of Nevada statutes that states that it is a felony for Southwest Exchange to transfer or commingle client money without written consent of the client, according to the lawsuit.

The lawsuit seeks an unspecified amount in damages. It was filed by Hollister & Brace of Santa Barbara and three Las Vegas law firms, Bailus Cook & Kelesis, Kummer Kaempfer and Prince & Keating.

Snell & Wilmer was established in 1938 and has 400 lawyers working out of six law offices around the western United States, including one at 3883 Howard Hughes Parkway in Las Vegas, according to the firm's Web site.

Contact reporter John G. Edwards at jedwards@reviewjournal.com or 702-383-0420.