STRIP VS. STRIP

MACAU -- Buddy Lam remembers when the Cotai Strip was nothing more than a two-lane road that crossed a small patch of reclaimed land, allowing Macau residents to venture over to Coloane Island. When the waters of the South China Sea rose or the Pearl River Delta overflowed, the Cotai Strip flooded.

So Lam, who grew up in Macau, never imagined his career would land him in the middle of the Cotai Strip as associate director of communications for The Venetian Macau, the world's largest casino.

The Cotai Strip today looks nothing like Lam remembers it.

Chinese engineers spent almost five years reclaiming 250 acres of land to turn the Cotai Strip -- named for its location between the islands of Coloane and Taipa -- into an industrial area.

Las Vegas Sands Corp. officials had other ideas. The company was building the Sands Macau on the Macau peninsula, about 10 minutes from the Cotai Strip by car. When executives first saw the site, they viewed the reclaimed land as a blank canvas where the casino company could replicate the heart of Las Vegas.

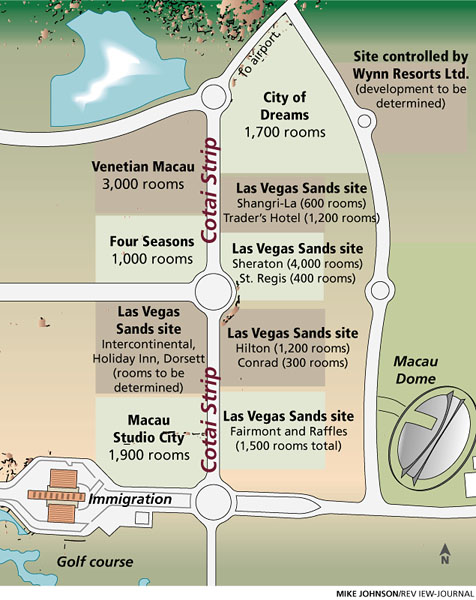

Today, the Cotai Strip has more than 20,000 hotel rooms in various stages of construction. By 2010, the Cotai Strip will resemble the center of the Las Vegas Strip, with more than a dozen hotel-casinos ranging from a boutique size with just 300 rooms to megaresorts with 4,000 rooms.

Las Vegas Sands is spending more than $12 billion on 11 different hotel-casino projects along the Cotai Strip. Two other companies are spending almost $5 billion combined on two other large Cotai Strip development sites.

In other words, think of MGM Mirage's massive CityCenter project, under development on the Las Vegas Strip, and multiply it by five.

"Literally, I was here three or four months ago, and the growth in that short period of time is amazing," said Nevada Gaming Control Board member Mark Clayton, who traveled to Macau in September to participate in the Gaming Asia Pacific Summit.

"We speak of how quickly Nevada is growing," Clayton said. "But I think Macau has even taken it to the next level. Those of us who been in Las Vegas and seen our growth realize it is far outstripped by what's happening in Macau."

Las Vegas Sands officials gave Clayton a tour of The Venetian Macau, the company's $2.4 billion hotel-casino that anchors the Cotai Strip.

The Venetian opened Aug. 28 with 3,000 hotel rooms, a 546,000-square-foot casino, 1 million square feet of retail space, more than 30 restaurants, 1.2 million square feet of convention and meeting space and a 15,000-seat sports arena.

But The Venetian Macau is just the tip of Las Vegas Sands' plans for the Cotai Strip.

The company is developing about 150 acres of the Cotai Strip, partnering with some of the world's most famous hotel brands, such as Shangri-la, Traders, Sheraton, St. Regis, Hilton, Conrad, Fairmont, Raffles, Inter-Continental, Holiday Inn and Dorsett.

The well-known hotel operators will put their names on the resorts and operate the hotels. Las Vegas Sands, which owns a lucrative casino subconcession granted by the Macau government, will control spacious casinos inside the properties.

The first Las Vegas Sands joint venture on the Cotai Strip, a 1,000-room Four Seasons, opens in February next to The Venetian. The Four Seasons will also include a retail area that will connect with The Venetian.

The Sheraton, Shangri-la and St. Regis properties are expected to open by the end of 2008, with four others planned for the end of 2009. Las Vegas Sands officials have even trademarked the moniker "Asia's Las Vegas" for the Cotai Strip site.

Also on Cotai, Melco PBL, a joint venture between Australian casino giant Publishing and Broadcasting Ltd., and Hong Kong businessman Lawrence Ho, is spending more than $2.8 billion on City of Dreams across from The Venetian. The site, which includes 420,000 square feet of gaming, will have multiple hotel products, including a Hard Rock and Grand Hyatt.

Up the road from The Venetian is Macau Studio City, which is being built by a consortium of U.S. and Chinese developers. The $1.7 billion venture will include theaters, television and film production studios and 1 million square feet of retail.

Three hotel brands -- W, Ritz-Carlton and Marriott -- and a project by Asian hotel designer David Tang will provide 1,900 rooms. Playboy Enterprises is developing a Playboy Club for the site while Melco PBL has an agreement with Studio City to operate the 200,000-square-foot casino.

Both City of Dreams and Studio City are under construction, with openings planned in 2009.

Former Las Vegas Sands executive David Friedman, who is serving as co-chairman and co-CEO of Studio City, said he doesn't see the project as competition with other developments on the Cotai Strip.

"We're helping to create the critical mass that will drive the growth of Macau," Friedman said. "The more great attractions we can bring to Macau, the more people will want to stay longer to see what has been created. We're not competition. We complement the other projects being developed on the Strip."

Las Vegas Sands, which operates The Venetian in Las Vegas and is opening the Palazzo in December, is banking much of the company's financial future on this potentially lucrative area of Southeast Asia. The casino operator is also spending $3.6 billion on the Marina Bay Sands on the island-nation of Singapore.

"Probably 60 percent to 65 percent of the company's cash flow will come from Asia at some point," said Deutsche Bank gaming analyst Bill Lerner, who also spoke at the gaming summit. "After Singapore, the vast majority of the company's cash flow will be from Asia."

Aliana Ho's job is to make sure the cash continues to flow. A former executive with Hong Kong's tourism commission, Ho is now the senior vice president of destination marketing for The Venetian Macau. Her job is to fill the property's massive convention space with trade shows, meetings and other events.

Forty-four events have been booked over the next two years at The Venetian Macau. The first major trade show took place this month. The Venetian's sports arena hosted an NBA exhibition series last week involving the Orlando Magic, Cleveland Cavaliers and the Chinese National Team.

The joint venture hotels are also expected to have meeting and convention space, but not as much as The Venetian.

"Cotai is one of the world's largest tourism projects. The opportunity is tremendous," said Ho, who marketed Hong Kong as a tourist destination for much of her career. She represented Hong Kong for several years in New York City.

"What we're trying to do here is build a new destination and attract new market segments to the Cotai Strip," Ho said. "Previously, Macau was perceived as a short visit or day-trip destination. With our project here, we think the whole dynamic is changing."

Ho and other Venetian executives tout the company's experience in the meeting, incentive, convention and exhibition business, which has been dubbed the MICE market. She said that business model, successful in Las Vegas where the company's Strip casinos are attached to a large convention center, would also work in Asia.

"The Las Vegas model is what we want to follow here," Ho said. "A lot of destinations are fighting for that market. With our facilities here, this is the ideal place for the MICE business."

The booming Asian economy is centered on China and the Cotai Strip properties could be the answer to a growing convention market.

"The whole world is eyeing China as an economic powerhouse," Ho said. "Being here on the Cotai Strip is something like heaven sent. We are right at the mouth of the Pearl River Delta and we're close to all the major access points, such as the Hong Kong airport, which has over 2,000 international flights a day."

To help bring customers directly to the Cotai Strip, Las Vegas Sands built and opened a new ferry terminal adjacent to the Macau International Airport on neighboring Taipa Island. The company will operate a fleet of almost two dozen high-speed ferry boats between the terminal and ports in Hong Kong.

The other goal is to bring additional flights into the underused Macau International Airport.

"The infrastructure is going to catch up and make Cotai more accessible," Lerner said.

More development is also possible on Cotai. Wynn Resorts controls a 52-acre site behind the City of Dreams location. The company has said it might build up to three hotel-casinos on the location.

Harrah's Entertainment, which doesn't own a gaming concession or subconcession, entered the picture in September, buying the Macau Orient Golf Course behind the Studio City and near the Lotus Bridge, one of the primary entry locations to Macau from mainland China.

MGM Mirage and its joint venture partner, Hong Kong businesswoman Pansy Ho, are exploring potential development sites on the Cotai Strip.

Many Macau observers and gaming analysts believe development on the Cotai Strip will lead to the creation of two Macaus -- the Cotai Strip for longer-stay destination customers and the Peninsula region for the day-trip market.

"A different customer will come to Cotai," Lerner said. "There's also going to be more nongaming ingredients as well."

Casino executives on the peninsula, such as Wynn Macau President Ian Michael Coughlin, don't believe there will be a tremendous split in the market.

"It's early and I don't think The Venetian has proven its case quite yet," Coughlin said. "The large volume properties will get their portion of the day trip market."

Contact reporter Howard Stutz at hstutz@reviewjournal.com or (702) 477-3871.

Editor's note: Review-Journal gaming reporter Howard Stutz and director of photography Jeff Scheid traveled to Macau to see how some of Nevada's largest gaming companies have helped the Chinese enclave pass the Strip in annual gaming revenues.

MacauLas Vegas, Half a World AwayIn Depth Package

THE SERIES Sunday: Macau is in the cross hairs of a multibillion-dollar building boom largely fueled by Nevada's major gaming companies, which are exporting Las Vegas-style casinos into a market starving for action. Monday: Thanks to the growing casino industry, unemployment is just 3 percent in Macau. But where will all the workers come from to staff the new casinos now under construction? Tuesday: More than 80 percent of the table games in Macau are dedicated to the game of choice for Asian gamblers: baccarat. But the use of slot machines is growing, and Nevada's slot makers are trying to capitalize on the market. Today: Macau's Cotai Strip has more than 20,000 hotel rooms in various stages of construction. By 2010, the Cotai Strip will resemble the heart of the Strip in Las Vegas. Thursday: American gaming giants Las Vegas Sands Corp., Wynn Resorts Ltd. and MGM Mirage are establishing footholds in Macau. But an Australian company, in partnership with the son of Macau's casino pioneer, is ready to challenge the experienced casino operators.