Study: More than 9,000 jobs went uncreated as companies couldn’t find big industrial sites

Build it, or they won’t come.

That’s the upshot of a new report that, for the first time, tallies local job growth that never happened because of a shortage of large industrial buildings.

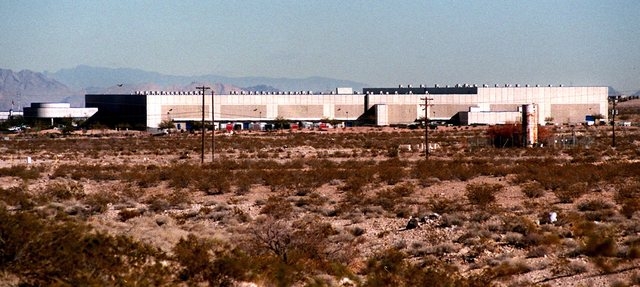

The Las Vegas Global Economic Alliance was scheduled to release the study this morning inside its southwest Las Vegas headquarters to about 100 local policymakers and commercial real estate professionals.

The economic development agency’s analysis found that at least 9,325 jobs went uncreated across the Las Vegas Valley in the past 12 months, as at least 75 companies passed over the city for regional competitors with more big industrial sites.

That missing jobs base is equal to peak construction employment at CityCenter, or to three-quarters of Nevada’s 12,200-worker metals-mining industry. It’s also equivalent to a third of the 27,900 jobs local employers created year over year in February.

“The size of that missed opportunity is surprising, and those are direct jobs,” said Jonas Peterson, the alliance’s chief operating officer. “If you run the multiplier effect of constructing those buildings, of the supply chain, of the families that would come with that workforce, the numbers are huge.”

The alliance developed its numbers from an RCG Economics survey that asked economic-development experts and real estate brokers how many clients looked for big buildings here in 2013.

Their finding? There’s definite interest in Las Vegas among companies looking to relocate or expand, but 93 percent of serious clients were manufacturing or warehousing businesses that need big spaces. About 70 percent said they needed 100,000 to 300,000 square feet, while 28.6 percent said they need more than 300,000 square feet.

That’s a problem because the city has few places for them. It has just 10 spaces of 100,000 square feet or more on the market today. In contrast, it has more than 1,650 industrial units at fewer than 25,000 square feet.

Las Vegas fares poorly compared to other markets. The city’s 54 square feet of industrial space per capita in the fourth quarter was the second-lowest among 10 regional cities studied in the report. Reno ranked first, at 171 square feet per capita. Salt Lake City was No. 2, at 117 square feet. Other regional markets with better industrial space per capita included Los Angeles, Phoenix, Denver and California’s Sacramento, Orange County and Inland Empire regions.

Las Vegas’ total industrial inventory was just over 100 million square feet at the end of 2013, compared with roughly 75 million square feet in Reno-Sparks — a metropolitan population about one-quarter of Las Vegas — and about 275 million square feet in Phoenix. The valley has about 1 million square feet of big space under construction, compared with 4 million square feet under way in Phoenix and 17 million square feet happening in the Inland Empire, Peterson said.

“We have some catch-up to do,” he said.

INVENTORY SHORTAGE HURTS

John Restrepo, principal of local research firm RCG Economics, said factors that have held back local, large-scale industrial development include relatively high land prices, lack of railroad access and too little emphasis on building big spaces.

“We were not focused on making sure space was available,” he said. “We were so wrapped up in growing and supporting the resort industry.”

The city is paying for that lack of focus: When the alliance asked why businesses skipped over Las Vegas in 2013, the shortage of building inventory was the top answer, with 93.8 percent of companies citing it. Incentives from other states placed second, with 80 percent saying giveaways are a competitive problem for Nevada. Other, more distant factors included lack of labor, uncertainty over taxes and concerns about construction permitting and entitlements.

Dan Doherty, a Colliers International broker who participated in the survey, said he’s had clients “walk away multiple times” in the last year because of the space shortage. One, a manufacturer, wanted 300,000 square feet. Three others were e-commerce businesses in the market for 350,000 to 700,000 square feet. Potential tenants are fighting over the city’s two 200,000-square-foot spaces on the market now, Doherty said, and there’s nothing for the “slew of tenants” looking for up to 700,000 square feet.

That’s not to say no one is building big spaces. But everything large that’s under construction is build-to-suit, or custom-made for specific companies. There’s the 193,000-square-foot Konami Gaming expansion near McCarran International Airport. FedEx is wrapping up construction on a 296,000-square-foot logistics center in Henderson’s South 15 Industrial Center. And T.J.Maxx parent TJX Cos. is adding 300,000 square feet to its North Las Vegas distribution center.

The problem is, many companies can’t or won’t do build-to-suit projects. It can take 15 months to design the plant, get plans through city or county approval processes and actually build. It’s tough to get businesses to commit to that kind of timeline when they need to move sooner, Doherty said. They also want to kick the tires on potential new space.

“The analogy I use is buying a car. When was the last time you bought a car without seeing it? You can’t even go to the Internet and look at multiple pictures or zoom in on the rims,” Doherty said.

“It’s a challenge from the get-go. Companies have no building to see, feel or touch, and no way to see if it meets the characteristics they need, the qualities they like and a location that works.”

FIX BEGINS WITH FRANK TALK

Fixing the issue will also take frank talk among real estate professionals, economic development experts and public officials — a conversation the study is meant to start, Peterson said.

“It’s really going to require a communitywide response to address the issues, from privately held land (availability) and zoning for industrial rather than residential, to pricing, financing and incentives,” he said. “The first step is recognizing and quantifying the issue. Now, we want to dig deeper into those constraints and find solutions together.”

More immediately, Peterson said alliance officials hope the report will encourage developers to finally move forward with a handful of spec projects that could come out of the ground soon.

Mike Montandon, the former North Las Vegas mayor who’s now president of commercial development trade group NAIOP’s Southern Nevada chapter, said market forces could help move projects along.

“If someone can put together the land and construction costs for a price that makes the rent work, then they’ll build it,” Montandon said. “Right now, residential land prices are pushing out industrial uses. When people recognize that there’s value in industrial land, the economics will come together. It feels like we’re pretty close to that point. Sitting around the table with NAIOP members, the discussion of people being close to building spec is happening more often.”

Doherty said he’s working with a local developer to get going on a 350,000-square-foot spec building in the middle of South 15, which he’s marketing. He said a couple of other developer groups are looking at local spec projects, at least one of which he said should break ground in 2014.

“If we can make more people aware that we are losing opportunities in Southern Nevada because of a lack of inventory, then you’ll have more lenders, developers and guys like me calling and asking what they need,” Doherty said. “We’ll eventually get multiple projects under construction. We’ll start growing again and develop our economic base.”

Contact reporter Jennifer Robison at jrobison@reviewjournal.com or 702-380-4512. Follow @J_Robison1 on Twitter.