Taxpayers’ 2013 obligations unknowable until after election

You probably have no idea what your tax bill will be in 2013.

But don't feel too bad about that: Your accountant doesn't know, either. In fact, neither does the Internal Revenue Service.

Nobody has any idea what federal tax rules will reign next year, thanks to a confluence of events including a too-close-to-call presidential election and looming tax increases and budget cuts. It's all created a level of uncertainty that tax experts say they've rarely, if ever, seen, and the poor clarity has important economic implications.

"I don't think any other election has had a potential outcome so important in terms of where tax policy is going," said Lyndsay White, a tax manager and certified public accountant with the Las Vegas accounting firm of Houldsworth Russo & Co. "We're in a perfect storm of tax sunsets and expirations and political change. People are trying to weed through everything to understand how this will impact their take-home pay and plans for the future."

That's especially true for small businesses. About 95 percent of Houldsworth Russo's small-business clients have profits taxed as personal, not corporate, income. So look at individual rates if you want to know what will happen to most businesses' taxes, White said.

At this point, what will happen isn't clear. Nor is it the first time taxpayers went into November with few clues about next year's taxes. Budget stalemates in Washington have become routine, though the presidential election has intensified 2012's standoffs. That fractiousness hurts the struggle to move beyond recession, economists say.

"If we look at how economies recover from downturns, it's through growth in confidence and increases in investment spending," said Steve Brown, director of the Center for Business and Economic Research at the University of Nevada, Las Vegas. "And fiscal uncertainty impedes investment."

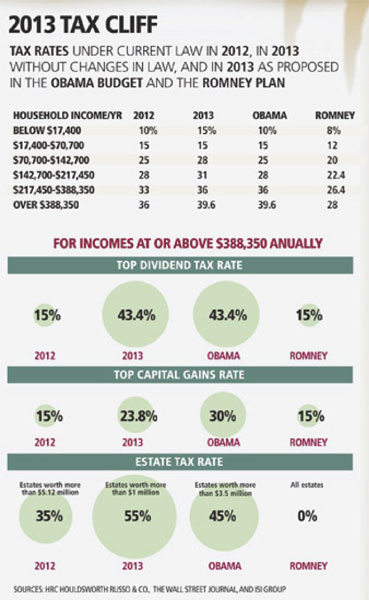

Both candidates have plans for more stable taxes. Neither camp has given details on tax tweaks, but they've offered enough information for basic analysis of proposed rates, as well as what would happen if lawmakers do nothing to change tax codes before January.

IMAGINING SCENARIOS

Using data from San Francisco research consultant ISI Group and The Wall Street Journal, Houldsworth Russo & Co. crunched numbers on three scenarios for a hypothetical married couple earning $60,000 a year in wages. That couple will owe $5,205 in federal tax in April based on 2012 laws that tax their first $17,400 in earnings at 10 percent, and the rest at 15 percent.

Under Obama's proposals, that calculus wouldn't change in 2013, because the couple's income tax would stay at 2012 levels, with an effective income tax rate of 12.9 percent. With Romney's plan, the burden would fall to $4,512 in 2013, thanks to a rate drop from 15 percent to 12 percent on income above $17,400, for an effective tax rate of 11.1 percent.

Neither of those blueprints is guaranteed, though. The election could leave different parties in charge of Congress and the White House. The resulting gridlock could push taxpayers toward a "fiscal cliff" of federal budget cuts and tax increases that experts say would slice into spending and investment.

Should a new or re-elected president fail to get his plan through Congress, levies could spike in January as Bush-era tax cuts expire. Those sunsets would create bigger tax burdens than either presidential candidate proposes.

Post-fiscal cliff, that $60,000-a-year couple would see their tax burden jump nearly $900 in 2013, to $6,075, as the rate on their first $17,400 surged from 10 percent to 15 percent.

Plus, rates would rise from 25 percent to 28 percent on incomes of $70,700 to $142,700, and from 28 percent to 31 percent on earnings of $142,700 to $217,450. The top tax rate on dividends, which provide income for legions of retirees, would spike from 15 percent to 43.4 percent, including a 3.8 percent investment tax to help fund Obamacare. The top capital gains rate would reset from 15 percent to 23.8 percent. The estate tax would rise from 35 percent on assets of $5 million or more to 55 percent on estates worth as little as $1 million.

But tax rates aren't the major problem. The big issue is that accountants can't say which alternative will play out. It's practically impossible to advise clients on what they'll owe in 2013, and that confusion makes it tough for small-business owners and consumers to write budgets beyond December.

"It causes major uncertainty in the financial capacity to invest or hire. Uncertainty makes people more cautious," White said. "They put the brakes on until they know how laws will affect them."

What's more, taxpayers have had to tap those brakes a lot in recent years.

THE TROUBLE WITH STOPGAPS

Congress - the Senate in particular - hasn't passed a budget since 2009. Lawmakers have relied instead on a series of stopgap continuing resolutions to fund government a few months at a time. The results haven't been pretty. In 2010, Congress didn't pass a spending bill with tax tweaks for both 2010 and 2011 until late December. Because it takes up to two months for the IRS to print tax books and returns with updated details, the agency didn't get filing paperwork on the streets until well into 2011. More than 50 million U.S. taxpayers, mostly teachers and filers who itemized expenses or deducted college tuition, couldn't file returns before mid-February. That delayed billions in refunds.

Each year also brings renewed debate over the alternative minimum tax, a levy designed to keep super-rich Americans from deducting away their tax bill. The tax threatens to ensnare as many as 30 million additional middle-class earners annually, including couples making as little as $45,000 a year. So far, Congress has always fixed the tax, but not before tangling over whether to make the fix permanent or year-to-year (the latter has always won out).

And then there was 2011's debt-ceiling crisis. Congress tacked $2.4 trillion onto the federal government's $14.3 trillion borrowing limit, but not before haggling for weeks over the tax increases and federal spending cuts that make up today's looming fiscal cliff.

"This constant patching of tax policy is getting a little bit dated. It's taking a toll on people," White said. "It feeds into their uncertainty about the future, which in turn feeds into their willingness to spend money, or their ability to plan and save. And those aren't very good things for an economy to be as strong as it could be."

Laird Noble Sanders, owner of the four-employee Lake Mead Boat Storage in Henderson, attended a Houldsworth Russo seminar Thursday on possible tax rates. He said he'll carry on regardless of rates, but he blasted lawmakers for their impermanent solutions.

"If I ran my whole business waiting for them to come up with a budget, I'd go crazy," Sanders said. "It disappoints me they're asking a small-businessperson like myself to run a business, and the only way I can do it is on a budget. I know what my income is. I can't write a blank check. I couldn't say to my workers, 'If I don't have a budget, I'll have to lay you all off,' and then suddenly come up with the money and say, 'I can keep you all now.'

"It's disgusting that the people we send to Washington don't do the fiscal management we send them there for," he added. "If you can't look out for the interest of the people, why did you ask us to send you there?"

Sanders and other taxpayers shouldn't expect more stability soon, Brown said. A lame-duck Congress is unlikely to pass sweeping tax reforms regardless of who wins the White House. That makes yet another stopgap, six-month spending resolution the most probable outcome, he said. While that would pull taxpayers from the edge of the fiscal cliff, it wouldn't end the uncertainty that keeps businesses from investing in equipment, software and buildings.

"Companies don't want to make investments that might be hit with heavy taxes three months after they've made them," Brown said. "Businesses face not only uncertainty over what's going to happen to their cost structure, but also what's going to happen to their customers' cost structure. It's difficult for businesses to run enough scenarios to come up with robust investment decisions."

In some cases, that uncertainty clarifies how taxpayers should act today.

"At least we know what 2012 looks like," White said. "If you need a piece of equipment and you have a (deduction) available now, you can take it. A tax deduction you can take today is always a good thing. We wouldn't necessarily advise delaying into a year of uncertainty just because things might change."

Contact reporter Jennifer Robison at jrobison@reviewjournal.com or 702-380-4512. Follow @J_Robison1 on Twitter.