With gold prices high, production tactics shift

CARSON CITY -- Nevada mines aren't running out of gold, although production continued to drop last year as it has throughout the decade.

Because of the high price of gold, mines are using lower-grade ore to produce the precious metal, said John Dobra, a University of Nevada, Reno economics professor.

"It's the economics of the situation," Dobra said. "They couldn't make money using lower grade ore before. So why waste it now? They are letting the higher grade ore sit there and (instead) taking the lower grade while prices are high."

The Nevada Division of Minerals, in its just-released annual Major Mines report, found that Nevada mines in 2009 produced mineral commodities worth $5.8 billion, a drop of $300 million from 2008.

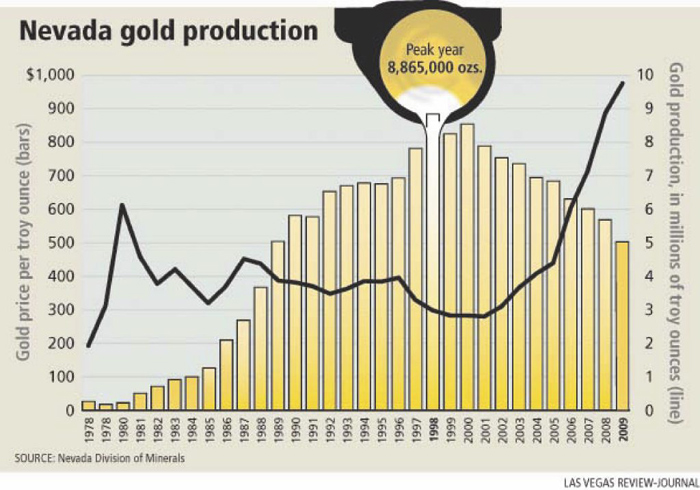

About $4.9 billion of the 2009 mineral value came from gold. Nevada mines produced 5,033,000 ounces of gold during the year, down 12 percent from 2008.

About 75 percent of the gold produced in the U.S. comes from Nevada mines. About 24 percent of the gold is found in underground mines, while the rest comes from strip mines.

Gold production has been steadily declining since 2000, when it topped 8.5 million ounces. All-time peak production came in 1998, when 8,865,000 ounces were produced.

"It's nothing to be alarmed about," said Tim Crowley, president of the Nevada Mining Association. "It is the function of doing business. We are purposely mining lower grade ore and trying to provide sustainability for the industry. It costs more to mine lower grade ore, but when the price is up you can afford to do it."

Ore is the rock that contains the gold. By crushing rock and then treating it with water, cyanide and other chemicals, the gold is released and can be recovered. Typically less than an ounce of gold is found in each ton of ore.

Gold sold for an average of $972 per ounce in 2009, but this year the average price has been $1,217, Dobra said.

The decline in gold production won't hurt Nevada tax revenues in the coming legislative session, Crowley and Dobra said.

Miners pay a 5 percent net proceeds of minerals tax on gold and other minerals. That tax during the current fiscal year tax is expected to be $85.35 million, up from $76 million in the last year. Net profits taxes are figured by taking the value of the mineral and reducing that figure by the allowed deductions for the costs of extraction, processing, transportation, marketing, equipment repair and depreciation, benefits to employees and other items.

"Net proceeds taxes will grow and grow," Crowley said.

Moves to increase mining taxes by changing how the net proceeds tax is calculated are expected in the 2011 Legislature as the state faces a shortfall of at least $1 billion. Past attempts by the Progressive Leadership Alliance of Nevada to extract more mining taxes have failed .

Dobra estimated two years ago that the mining industry paid $224 million in other taxes, such as sales, property and payroll taxes.

The best is still ahead, predicted Alan Coyner, administrator of the Nevada Division of Minerals.

"I think we will see future increases in gold prices," he said. "As long as we have this tremendous debt load and a weak dollar, I think we will see strong gold prices. In times of economic crises, people tend to turn to gold."

He expects Nevada will continue to produce about 5 million ounces of gold per year.

Contact Capital Bureau Chief Ed Vogel at evogel@reviewjournal.com or 775-687-3901.