Nevada Supreme Court upholds tax initiative

CARSON CITY - The Nevada Supreme Court handed off to legislators a Nevada State Education Association business tax petition Thursday, in effect crying "Let the tax battle begin."

The justices' 7-0 decision, which found the language in the petition's 200-word description sufficiently advised signers of its intent, means legislators in the first 40 days of the 2013 session must consider adoption of a tax that would bring in $800 million a year for education.

While there was no doubt that taxes would be the central theme of the 2013 session, which starts Monday, the court decision moves the issue to the beginning, not the end, of the session. By March 15, legislators must decide whether to approve or punt the tax petition to voters.

The tax would impose a 2 percent margins tax. Businesses could deduct some but not all of their expenditures before calculating the tax, and the first $1 million of their earnings would be exempt. Because it is not a business profits tax, some businesses that are losing money would be required to pay it.

Gov. Brian Sandoval is on record opposing new taxes.

"I believe that raising taxes at this time is the wrong thing to do because businesses are still struggling, unemployment is still unacceptably high, and raising taxes would harm our fragile economic recovery," Sandoval said.

"Education is a priority for me, and my budget proposal increases general fund education spending by $135 million and targets the funds towards English language learners and working to improve our high school graduation rate, among other items. For these reasons, I remain opposed to this proposed tax increase."

Assembly Speaker Marilyn Kirkpatrick, D-North Las Vegas, said in December that she has problems with the teachers union tax and might come up with an alternative option. She presided over several hearings in 2011 on a business margins tax plan that went nowhere.

The Senate Democratic Caucus issued a statement that it would review the initiative petition and look for a way during the session to fund public education better.

If legislators do nothing, then the

$800 million tax plan would be placed before voters in the 2014 general election. But legislators could come up with a competing tax plan that would be an alternative for voters to consider on the same ballot. The question that receives the most votes, if it is a majority, would be put into effect in 2015.

BUSINESS OPPOSITION PERSISTS

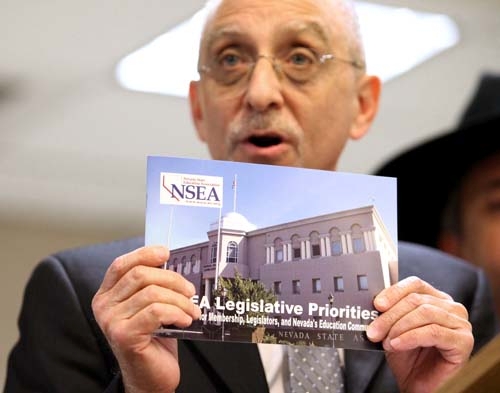

The high court's decision was praised by the Nevada State Education Association.

"We are certainly happy that the court ruled unanimously that our initiative met constitutional standards," said Gary Peck, executive director of the association. "The decision makes clear that 147,000 Nevadans who signed on understood perfectly well what we are attempting to do. And it reflects the will of Nevadans to fix a broken tax structure so that we can invest adequately in our K-12 system and truly give every kid in our state a chance to learn and succeed."

But Bryan Wachter, director of government affairs for the Retail Association of Nevada, said his group is disappointed in the ruling and will embark on an education campaign "to let the Legislature and the public know this is a bad tax; a flawed tax."

"If it doesn't create a new recession in Nevada, it may extend the one many of us believe we are not out of yet," he said.

There is a reason why states other than Texas have not adopted the tax, and why the Texas Legislature spends every session trying to fix it, Wachter said.

Ray Bacon, executive director of the Nevada Manufacturers Association, doubts sufficient signatures would have been collected if the 2005 Legislature had required petitioners to say in the title of their petition that it called for a tax increase. The Legislature changed some petition gathering requirements that year, but not the tax title requirement.

The association, which was party to the challenge to the initiative petition, will have to sit down with other members of the group to evaluate how to go forward, he said.

"It is called the education initiative," Bacon said. "It does not guarantee it will do anything for education."

A group called the Committee to Protect Nevada Jobs - led by the Las Vegas Chamber of Commerce and the Nevada Taxpayers Association - has been fighting the tax plan since the teachers union began collecting signatures last year. At one point, a district judge threw out the petition, but the union refiled after making minor changes and gathered about 150,000 signatures, more than twice the number needed to send the plan to legislators.

HARDESTY'S RULING

The main argument in court by the Committee to Protect Nevada Jobs was the language in the description of effect did not properly tell voters that taxes might not go to public education. The goal of the teachers union has been that the business taxes be used to supplement existing education spending, but legislators would be free to back out what they now spend on public schools and shift the money to other state expenditures.

In the decision written by Justice James Hardesty, the court ruled 200-word descriptions cannot cover everything in an initiative petition.

"It must be a straightforward, succinct, and nonargumentative summary of what the initiative is designed to achieve and how it intends to reach those goals," Hardesty wrote. "Given that limited purpose and the 200-word restriction, the description of effect cannot constitutionally be required to delineate every effect that an initiative will have; to conclude otherwise could obstruct, rather than facilitate, the people's right to the initiative process."

Nevada has had the initiative process since 1912. The procedure allows public groups - usually when their elected officials have not acted on changes they want - to gather signatures and force the Legislature to consider their ideas.

A prime example was the public move to limit smoking in most restaurants and bars after the Legislature refused to act session after session.

There are more than 20,000 words in the actual teachers tax petition.

Under the petition, a business first would deduct $1 million of its total earnings. Then it would calculate its "margins" by deducting the lesser of 70 percent of its total revenue or by adding the costs of its goods purchases and the compensation paid to employees. The 2 percent tax would be imposed on that final figure.

If the tax proposal is approved by the Legislature in 2013, the liability would start in 2014 with the first collection due in January 2015. If approved by voters in November 2014, the liability would start in 2015 with the first collection due in January 2016.

Contact Capital Bureau Chief Ed Vogel at evogel@reviewjournal.com or 775-687-3901. Contact reporter Sean Whaley at swhaley@reviewjournal.com or 775-687-3900.

Nevada Supreme Court ruling on tax initiative for education