Henderson council talks tax hikes Tuesday

It is time to talk taxes in Henderson again.

A discussion about a potential ballot question to raise city property tax 20 cents per $100 of assessed value will go before the City Council on Tuesday for the first in-depth discussion among the elected officials.

A 20-cent increase would add $122.50 to the tax bill on a $175,000 home.

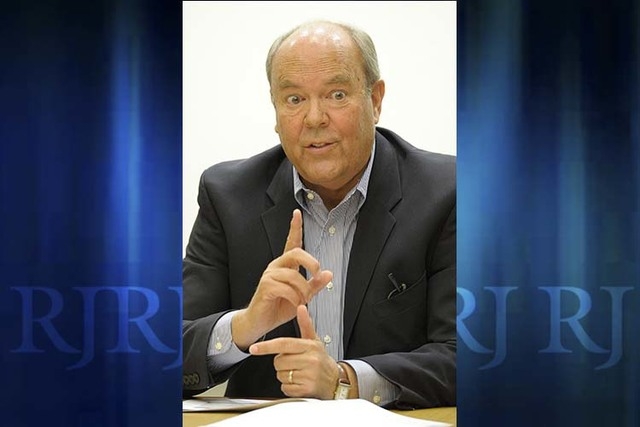

Councilman John Marz said during an Aug. 20 ward meeting that he supports the ballot question because the city needs the revenue to cover infrastructure needs.

“I support a modest property tax increase to fund those things,” Marz said. “The reason I support that is because we have a city we need to be proud of, and we have a city we need to maintain.”

A Special Budget Ad Hoc Committee recommended in February the city consider the tax increase. The city’s low property tax rate of 71 cents per $100 of assessed valuation has not changed since 1991. By comparison, the tax rate in Las Vegas is $1.06 per $100 of assessed valuation, while North Las Vegas’ is $1.16.

While the City Council could decide to move forward with a ballot question Tuesday, voters might not see it until 2016. City Manager Jacob Snow said waiting until 2016 after the Nevada legislative session for a ballot question “would be wise” to see if state lawmakers make any changes to the 2005 law that limits how much residential property taxes could be increased in a year to 3 percent without a ballot question. Commercial property tax increases are capped at 8 percent a year.

“I expect there will be a discussion,” Snow said of the Legislature. “How extensive a discussion or if there’s going to be any bills, we’ll have to wait and see.”

Marz said the city is “coming awfully close to balancing the budget” and won’t be taking from reserve funds next year to cover the operating budget that keeps the city running every day.

Henderson planned to pull $4.6 million from the city’s vehicle purchasing and maintenance fund to balance its $223.1 million general fund budget for fiscal year 2015. That number might be lower as the city has continued to try to find money through department cuts and fee increases in parks and recreation.

Balancing the operating budget doesn’t mean the city “is out of the woods,” Marz said. Henderson still faces a $17 million annual infrastructure deficit during the next 10 years.

Infrastructure includes money to maintain roads and parks and vehicle replacement. The 3 percent increase cap prevents the city from recouping what it lost when property values dropped sharply during the economic downturn, he said.

“At that rate, with what we have lost, it would take us 22 years to get back to where we were five or six years ago in our property taxes,” Marz said.

Henderson’s property tax revenue for the 2015 budget is projected at $59.7 million, down from the peak of $85.7 million in 2009.

The city has received 31 emails opposed to the tax increase and eight in favor of a ballot question.

In an Aug. 25 letter to the city, resident Teressa Conley said she lived in California and “witnessed the deterioration of many cities” when reinvesting in infrastructure became less of a priority.

“Responsible reinvestment is needed given taxes for the city have not increased since 1992,” Conley wrote. “I would ask that the City Council vote to move this decision to a future public vote.” She asked the city include how the taxes will be “reinvested.”

The meeting starts at 6 p.m. in City Council Chambers at City Hall, 200 Water St. The tax proposal is the last on the agenda, although that could change.

Contact Arnold M. Knightly at aknightly@reviewjournal.com or 702-477-3882. Follow @KnightlyGrind on Twitter.