County sees record total of property owners appeal assessed values

A record number of property owners have appealed their assessed values this year, a symptom of the recession.

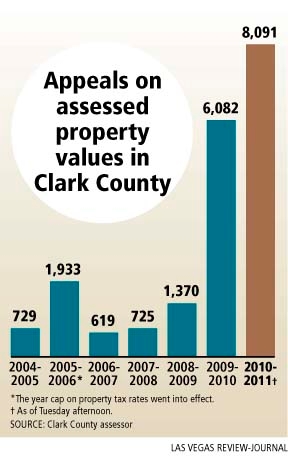

By Tuesday, almost 8,100 owners had filed appeals with the Clark County assessor's office, topping last year's 6,082 appeals.

The volumes in both years dwarf the 1,370 appeals in 2008 and the 725 in 2007.

Sales prices on residential and commercial properties in 2008 fell so dramatically that county staff sometimes did not reduce the assessed values enough to keep pace, said Rocky Steele, assistant county assessor.

Since then, the decline in property values has tapered, but people still want to save money anyway possible in the tough economy, Steele said. Most of the property owners who filed appeals this year did so though the county already had reduced their assessments, he said.

"Because of the downturn in the economy, they are going to try to get them further reduced," Steele said.

Assessed values are figured by using 35 percent of a property's taxable value, which is based on what the structures and land are worth. By law, a property's assessed value cannot exceed its market value.

In November, the median sales price for local homes was $125,000, almost 28 percent less than a year before, according to SalesTraq, a Las Vegas-based market research firm. Analysts expect home prices to drop further in 2010 because of foreclosures and short sales.

Most owners who have watched their properties sharply depreciate in the past couple of years can expect to pay less in taxes. About 661,000 of the area's 730,000 parcels have dipped enough in value to yield smaller tax bills in July, county Treasurer Laura Fitzpatrick said. That number surpasses the 470,000 owners who qualified for tax reductions in 2009 and eclipses the 55,000 in 2008.

But a property owner's boon is the county's bane. The county's latest budget shortfall estimate is $150 million to $200 million and is caused by a loss in tax revenue, mostly from property taxes.

Assessed values must fall to pre-2005 levels before taxes shrink. Five years ago, annual tax increases were capped at 3 percent for residential properties and 8 percent for commercial parcels.

That means a homeowner pays whichever is less: a 3 percent increase from last year's tax bill or the regular tax rate on the most recent assessed value.

Paying the capped rate on last year's bill is cheaper until the assessed values fall below the 2005 threshold, Fitzpatrick said.

Property owners had until Jan. 15 to challenge their assessments for 2010-11. Similar to filing taxes, they had until the deadline to postmark the appeals.

That resulted in appeals streaming into the assessor's office all week, including boxes filled with forms.

Steele said a tax agent who represents commercial property owners often will ship a box of appeals.

The Board of Equalization rules on cases that county officials are unable to resolve. The board had its first hearing of the year Friday and will hold meetings through February.

Property owners who don't agree with the rulings can appeal to the Nevada Board of Equalization. Only a small portion of owners take that step, and only a fraction win their cases, Steele said.

Most people who file appeals with the county are able to avoid appearing before the local board. Last year, 4,228 people who presented their cases directly to staff members won a reduction in their property values, according to county data.

John Czak, 66, recently challenged the assessed value on his Sun City Anthem home and worked out a compromise with the county.

Czak said he thought the assessment was too high, based on comparable homes recently sold in his neighborhood. He researched Zillow, an online service that tracks home sales, and found evidence to back up his claim.

He asked that his $450,000 assessed value be bumped down to the $420,000 range. An assistant assessor offered to reduce it to $440,000, and he accepted.

Czak thought the staff handled his case fairly. "I found them nice to deal with and very helpful in the process," he said.

Joe Hanson, 59, took a shot at arguing his case to the board and lost. Hanson contends his house was assessed $24,000 too high compared with similar homes in his subdivision. But the board told him his house was newer than the others and denied his appeal.

"I thought I had a good case going in," Hanson said. "No matter what case you had, they were going to find a loophole to say, 'No.'"

He said the county has no clear set of guidelines for assessing properties.

Steele disagreed. County staffers compare neighboring sites to figure a property's value and use the Marshall & Swift cost guide to peg what a property's improvements are worth. "It's a pretty simple formula," Steele said.

Those with questions about property assessments can call the assessor's office at 455-3882.

Contact reporter Scott Wyland at swyland@reviewjournal.com or 702-455-4519.