Likely voters find state spending decisions difficult

Editor's Note: Impact Nevada -- a collaboration of the Las Vegas Review-Journal, 8NewsNow and Vegas PBS -- polled Nevadans on their spending and taxing priorities and preferences. Complete information from the poll is available at impactnevada.com. This the final of seven parts. Vegas PBS will broadcast an overview at 7:30 p.m. Monday and 12:30 a.m. Tuesday.

CARSON CITY -- The more Nevadans think about the state's projected $3 billion revenue shortfall, the more they want to cut spending and increase taxes.

At least that's what the Impact Nevada survey found when 600 likely voters around the state were polled from Sept. 6-16.

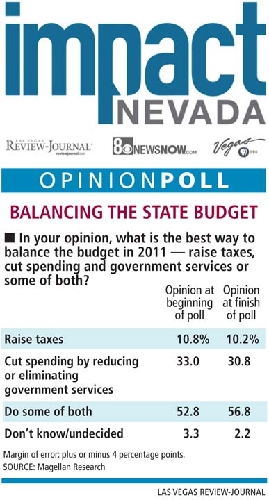

When respondents were asked at the beginning of the poll how they would deal with the projected revenue gap that state government faces in 2011, 10.8 percent said raise taxes, 33 percent said cut spending or eliminate government services, and 52.8 percent said do both.

But about 18 minutes later, after respondents finished 27 other questions, the percentage of those who favored tax increases coupled with spending cuts jumped by 4 percentage points, to 56.8 percent, according to the poll, which has a margin of error of plus or minus 4 percentage points.

In all, 67 percent said they favored taxes or taxes coupled with spending cuts.

"I think the poll forced people to make hard decisions," said Marvin Longabaugh, president or Magellan Research, the polling company. "They realize there is no way to get it done without having to pay a steep price. They realized saying no to tax increases was not reasonable."

More than 82 percent of Democrats and 52 percent of Republicans took the position that some tax increases are needed in 2011.

Longabaugh said people were eager to talk about how they would handle state budget problems, with the average voter taking 18 minutes to discuss the questions. A poll that long would typically take 14 minutes to complete, but voters wanted to talk more, he said.

Few if any polls ever have asked residents how they would manage state spending, he said.

With tax revenues declining in the wake of the worst recession in generations, legislators cut spending by more than $1 billion during three special sessions in the past two years. The two-year budget approved in June 2009 was balanced largely by using $800 million in federal stimulus funds and nearly $1 billion in temporary tax increases.

Longabaugh said he was surprised by the poll's results because he thought most people would favor only cutting state spending.

But just 31 percent took that position.

So where do we go with these results?

The survey won't provide a lot of help for legislators and the new governor when they begin working on the next two-year budget in February, Longabaugh said.

That's because there was no consensus among voters.

"It's the American way," Longabaugh said. "They can't say what taxes they want or what they want to cut."

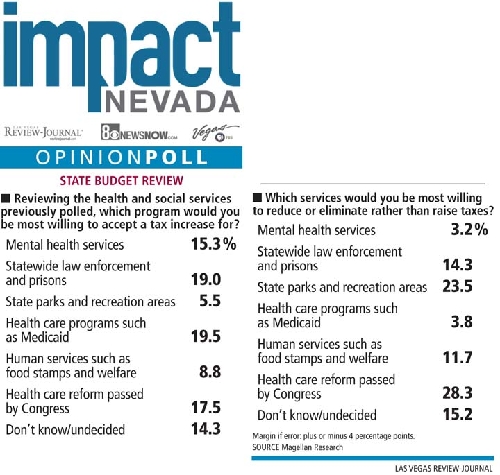

Just 3 percent said the state should cut or eliminate mental health services, while only 4 percent said Medicaid.

Twelve percent would back cuts to food stamps and welfare, 14 percent to law enforcement and prisons, almost 24 percent to parks and recreation and 28 percent named the health care law passed by Congress.

The poll also found little support for raising taxes to fund those programs.

About 20 percent would take tax increases to better fund Medicaid and 19 percent to improve law enforcement and prisons. About 18 percent backed tax increases to help fund the new health care reform law and 15 percent supported increases to improve mental health programs.

Only 9 percent wanted to pay more taxes for food stamps and welfare programs and about 6 percent backed them for state parks and recreation.

Those percentages are hardly a mandate to make spending cuts or increase taxes for these health and social service programs.

Poll respondents also weren't much help in their suggestions about what taxes could be increased.

No tax increases received widespread support. Gaming and mining tax increases are the most favored, but fewer than 30 percent even back them.

Voters especially detest taxes most people would have to pay: property tax increases, sales taxes on services and a general sales tax increase. None of them has support of more than 10 percent of respondents.

But the results still can guide legislators since they now know that most residents have not taken tax increases "off the table," said Eric Herzik a political science professor at the University of Nevada, Las Vegas. "They can move to balancing cuts and taxes."

State Senate Majority Leader Steven Horsford, D-Las Vegas, already has said he envisions $1.5 billion in tax increases and $1.5 billion in spending cuts in 2011.

"The poll shocked a lot of people," added Assemblyman Tick Segerblom, D-Las Vegas. "Nevadans do not want to see their state destroyed. We are going to limit tax increases, but preserving schools, highways and our quality of life is more important than saving corporations a few bucks."

Assembly Majority Leader John Oceguera, D-Las Vegas, said the results show residents are aware of the negative effects of a two-year hiring freeze and previous spending cuts made by state government.

"The waits at the DMV are longer. The poll shows they are willing to maintain services at current levels," Oceguera said.

But some residents -- and gubernatorial candidates Brian Sandoval and Rory Reid -- just don't agree with the poll findings.

Both Sandoval and Reid said support for higher taxes is not what they have found on the campaign trial.

Sandoval intends to make $2.5 billion in budget cuts. Reid has presented a balanced budget plan that would cut spending by $1.8 billion and anticipates revenue over the next two years will increase by more than $600 million. His plan does not include tax increases.

Longtime Las Vegas resident Michael Portch was angered by the poll's findings.

He said he cannot believe that most people would consent to any tax increases at this time.

Portch questioned whether the questions were designed to secure a favorable response on tax increases.

He said he wants all union contracts with public employees brought to an abrupt end.

"Rehire at private sector compensation, wages, insurance, sick days, etc.," Portch said.

Longabaugh has heard from people who share Portch's concern about tax increases.

"Their hostility was unbelievable," he said. "They were irate, feeling somehow that we decided ourselves to call for increased taxes. I suggest they talk to their neighbors."

Mary Lau, president of the Retail Association of Nevada, said the Impact Nevada poll results are not consistent with a poll of 500 Nevadans conducted for her organization in late September.

Questions asked for the Retail Association, however, were slightly different than those asked by Magellan Research.

Her poll found 43 percent of respondents want spending cuts, while 41 percent favor tax increases.

The Retail Association poll also found 70 percent of people see waste in government and want spending cuts.

"People still think there is a lot of waste and fraud in government," Lau said. "Governor Gibbons sent the Legislature (in 2009) a balanced budget, but they went out and jacked it up."

Political scientists were not surprised that gubernatorial candidates and some legislators are reluctant to talk about taxes before the Nov. 2 election.

"Particularly this close to the election, candidates are not going to jump on the let's-raise-taxes bandwagon," Herzik said.

David Damore, a professor at UNLV, agreed, saying mentioning tax increases before an election is a political sin.

The problem with the Impact Nevada poll, according to Damore, is that it did not determine where spending should be cut or what taxes should be increased.

Before passing tax increases, legislators must tell voters specifically what benefits they will receive, he said.

Over the years, 80 percent or more of voters across the state have supported bond elections that raised taxes for specific things, like schools or roads, he said.

"If you ask people if they want taxes for a certain thing, they say yes, but not to tax increases in general. They have to be sold on the benefit they will receive," Damore said.

Segerblom said that is exactly what he will do in 2011. He intends to introduce legislation to increase the gasoline tax by 2 cents per gallon each year for the next five years.

Gasoline taxes have not been increased since 1993. A 10-cent increase hardly makes any difference, Segerblom said, pointing out prices can fluctuate that much in one day.

Higher gasoline taxes would allow the state to sell $1 billion in bonds for highway construction, he said. The highways that would be fixed with the money could be listed by the Nevada Department of Transportation.

But Oceguera, likely the next Assembly speaker, emphasized that before any tax increases are discussed, legislators need "to look at the reform side first."

Money can be saved by consolidating programs, setting spending priorities and eliminating obsolete programs, he said.

"We need to look at what those numbers add up to," Oceguera said.

Carole Vilardo, president of the Nevada Taxpayers Association, which represents a variety of businesses, supports that approach.

"If they don't show they are making cuts, then they won't have support for taxes," Vilardo said. "You can't tax yourself out of the problem and you can't spend your way out either."

Contact Capital Bureau Chief Ed Vogel at evogel@reviewjournal.com or 775-687-3901.

News, poll results