Senate, House pass $1.5T tax bill; House must revote Wednesday

WASHINGTON — Republicans passed a sweeping tax-cut package Tuesday that slashes rates for businesses and individuals and gives President Donald Trump his first major legislative victory since taking office.

Democrats were united in their opposition to the package, which they said unfairly gives big breaks to businesses and wealthier Americans at the expense of middle- and working-class families. They also criticized the measure for adding a projected $1.5 trillion to the nation’s debt.

But the bill, which will impact Nevada communities, businesses and residents, was pushed through Congress by Republicans who campaigned on tax reform and reducing the corporate rate. Republicans maintain that the tax overhaul will spur economic growth and job creation and increase American wages.

The House passed the bill 227-203, largely along party lines. The Senate followed with a 51-48 vote.

Three items in the bill were taken out after the Senate parliamentarian ruled they violated budget rules. The House has scheduled another vote Wednesday to agree to the changes and move the bill to the president, who is expected to sign it soon.

Senate Majority Leader Mitch McConnell, R-Ky., called the package of tax cuts one that helps people of all incomes, with all seven brackets seeing reductions in rates and the standard deduction nearly doubled to $12,000 for single filers and $24,000 for couples.

“We take money out of the pockets in Washington and put it in the pockets of middle-class Americans,” McConnell said.

Republican leaders touted the measure as one that would make U.S. corporations more competitive, prompting investment to create jobs and raise salaries. They said it was needed following a sluggish economic rebound from the Great Recession.

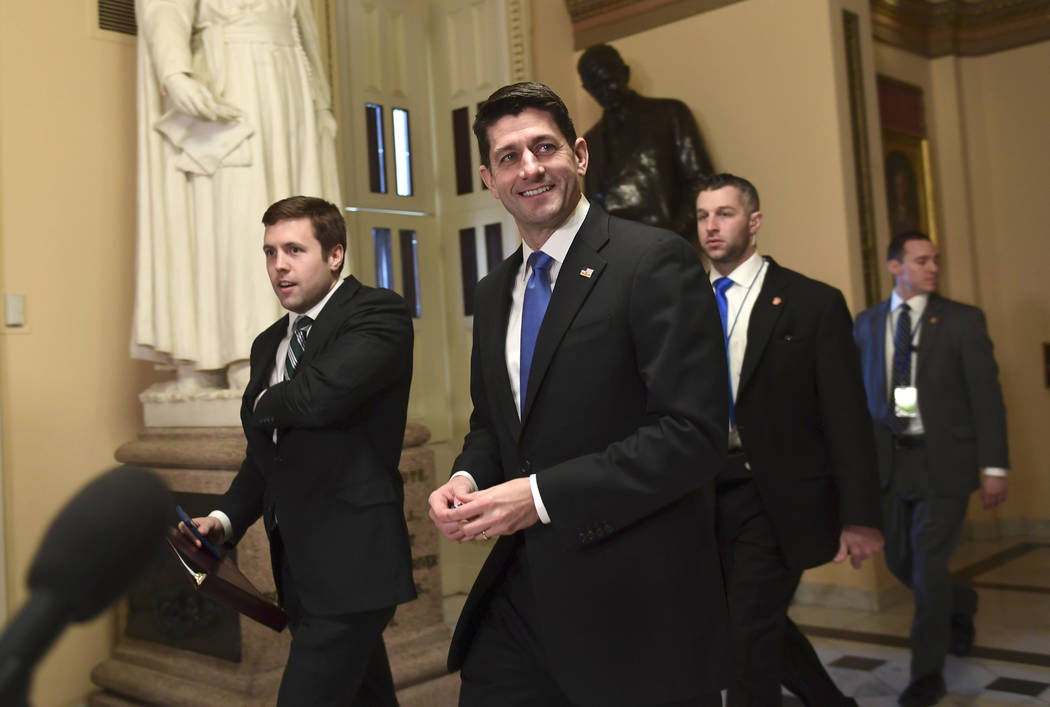

House Speaker Paul Ryan, R-Wis., said the tax bill would help the country “get back to real sustained growth.” The corporate tax rate would be permanently reduced from 35 percent to 21 percent.

Nevada delegation votes party line

Tax cuts in the bill for individuals would phase out and households earning less than $75,000 would see an increase in taxes in 2027 if the cuts are not made permanent.

Rep. Dina Titus, D-Nev., paraphrased the actor Clint Eastwood in describing Republican promises of tax relief for average Americans as “pissing on our boots and calling it rain.”

She said state and local programs would be on the chopping block because of a reduction in revenue.

Nevada’s congressional delegation voted along party lines in the House and the Senate.

Sen. Dean Heller, R-Nev., and Sen. Catherine Cortez Masto, D-Nev., voted with their respective parties.

In a Senate floor speech, Heller said the tax cuts would help those in Nevada, where the median income is $7,000 lower today than in 2007.

“So it’s fair to say that — in Nevada at least — the recession has never really ended,” Heller said.

In the House, Rep. Mark Amodei, R-Nev., voted for the measure, while Democrats Titus, Rep. Jacky Rosen and Rep. Ruben Kihuen voted against it.

The bill would repeal the individual mandate in the Affordable Care Act, known as Obamacare, eliminating the tax penalty for those who do not purchase health insurance.

While Republicans championed that change as removing a mandate on Americans to purchase a product they may not want, Democrats argued the repeal would fundamentally cripple the system that provides subsidies that allow the most vulnerable to buy insurance plans.

Rosen said that “reckless” repeal would “spike premiums and cause thousands of Nevadans in my district to no longer have health insurance.”

McConnell said the Senate would act on legislation to stabilize the insurance markets, a concession sought by Sen. Susan Collins, R-Maine, for her vote on the bill.

Still, eliminating the mandate is expected to result in 13 million more Americans without insurance coverage by 2027, and a 10 percent increase in premiums on public exchanges each year, according to the Congressional Budget Office.

Entitlement reform next?

Meanwhile, Kihuen said the rising debt would also force cuts in Social Security, Medicare and other social programs. Senate Republicans have vowed to waive rules that would force mandatory cuts in social programs because of the tax bill.

But Ryan and other GOP leaders said the House will eye entitlement reform next year with the aim of reducing federal spending on social programs.

Recent public opinion polls show the majority of Americans disapprove of the GOP tax plan. A Monmouth University poll released Monday showed those surveyed 2-to-1 against the plan. Those that said they disliked the plan characterized it as one that benefits the wealthy.

Democrats said they plan to use the unpopular tax package against Republicans at the polls. GOP lawmakers, however, campaigned on tax reform and cuts, and Senate Republicans said before the vote that delivering on that promise would have a popular result.

Republican lawmakers, and Trump, also see the tax overhaul as a victory following missteps and failure to repeal Obamacare after nine years of promising to do so.

Heller, who faces GOP primary opposition from Las Vegas lawyer Danny Tarkanian, has trumpeted his input from his seat on the Senate Finance Committee, which wrote the Senate version of the bill.

Rosen is seeking the Democratic Party nomination for the Senate seat held by Heller, the only Republican running for re-election in a state that was carried by Hillary Clinton in 2016.

Heller pushed a doubling of the child tax credit to $2,000 and a provision that makes it easier for companies to reward employees with stock options.

The Nevada Republican said he also worked to prevent the final bill from including House language that would have eliminated the tax-exempt status of bonds used to finance sports stadiums, like the $1.9 billion facility in Las Vegas for the NFL Raiders franchise.

Titus also sought to block that House language, despite her opposition to the bill.

Cortez Masto criticized Republicans for failing to consult with tribal leaders when crafting the plan and including tax parity to tribal governments.

Contact Gary Martin at gmartin@reviewjournal.com or 202-662-7390. Follow @garymartindc on Twitter.