Tax measure deal includes good news for Nevadans

WASHINGTON — Congressional leaders on Wednesday promoted a bipartisan deal on a $650 billion tax measure that included making permanent a provision allowing Nevadans to continue deducting state and local sales taxes from their federal taxable income.

Another rare bipartisan agreement also was reached on a $1.1 trillion spending bill that would keep the federal government open through the rest of the 2016 fiscal year.

Barring a last-minute snag, both bills should win final congressional approval by week's end.

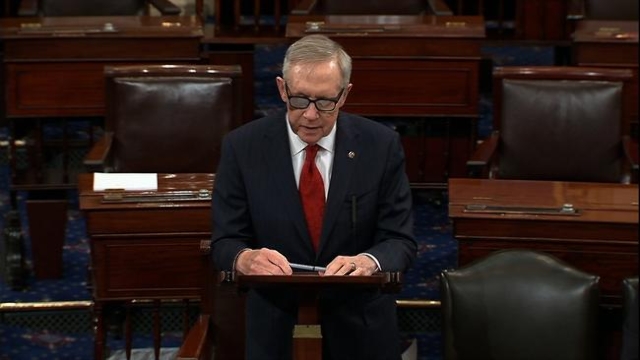

"This compromise isn't perfect, but it is a good compromise for the American people," Senate Democratic Leader Harry Reid of Nevada said during his floor comment, urging support for the omnibus spending bill.

Reid singled out the bill's provisions that would extend tax breaks for wind, solar, geothermal and other technologies and protect more than 100,000 jobs in the clean energy sector.

"A five-year extension of wind and solar tax credits will promote growth and help curb carbon emission by roughly 25 percent by the year 2022," he said.

Reid expressed hope Republican leaders in both chambers will move the legislation quickly.

According to the schedule announced by the legislative leadership, the House is expected to vote Thursday on the tax extender bill followed Friday by the spending bill.

Once they both get to the Senate, the two bills are expected to be combined for one vote on Friday.

Heller gets Cadillac Tax delay

Sen. Dean Heller, R-Nev., had pushed for a total repeal of the so-called Cadillac Tax on the more expensive health care plans, but the bipartisan compromise endorsed only a two-year delay.

"This is a great start, but we cannot ignore the fact that middle-class Americans will still bear the burden of a 40 percent excise tax," Heller said.

"For the next two years, we will use this victory as momentum toward fully repealing the Cadillac tax."

More than 50 targeted tax breaks — routinely called tax extenders — are rolled into one bill that Congress routinely passes every year or two.

The provision with the most significant impact for the average Nevada family is the provision that would allow them to continue deducting state and local sales taxes.

Roughly 280,000 Nevadans — about 22 percent of the state's taxpayers, according to the Internal Revenue Service — have claimed the deduction previously.

Efforts to make that and other tax extenders permanent have been tried in the past but lost momentum.

Sen. Orrin Hatch, R-Utah, chairman of the Senate Finance Committee, credited the efforts of several senators, including Heller in making that change possible this year.

Heller introduced a bill in January to make the sales tax provision permanent with Sen. Maria Cantwell, D-Wash.

Cantwell at the time described the issue a matter of fairness for 11 million taxpayers nationwide.

Titus wanted more time

Rep. Dina Titus, D-Nev., also cited the sales tax provision among those she supported in the tax-extender bill.

"Those are good things," Titus said in an interview.

However, she questioned making other tax provisions permanent, adding she wanted more time to review the bill before saying how she would vote.

Rep. Cresent Hardy, R-Nev., said he backs the tax extender bill but remained undecided on the spending bill.

"I support the tax-extender bill," Hardy said in an interview. "It gives certainty to businesses."

When asked about the spending bill, Hardy said he wanted to be a team player and support the recently elected House Speaker Paul Ryan, R-Wis., but was concerned about provisions that did not make it into the final version of the measure.

As an example, Hardy cited provisions that he said would have blocked efforts on clean water enforcement by the U.S. Environmental Protection Agency.

He said EPA's approach, if left unchecked, would cost jobs in the mining industry.

In his floor remarks, Reid had praised Democrats' success in rejecting a number of so-called riders that Republicans had wanted to include in the legislation.

He said one of those would have eliminated protections for clean air, water, land and climate.

Contact Jim Myers at jmyers@reviewjournal.com or 202-783-1760. Find him on Twitter: @myers_dc