Boomerang buyers who lost it all see life after foreclosure

Greg Bailey got an amazing deal on a home in Summerlin.

Bailey, a local real estate agent, snagged the 2,470-square-foot beauty with city views in a September short sale for $230,000 - less than half of its $730,000 peak value.

But this isn't your typical story about a moneyed investor swooping in with fistfuls of cash to snatch homes from the clutches of distressed homeowners.

You see, Bailey, too, got caught up in the market's animal spirits, and is barely two years out of foreclosure himself.

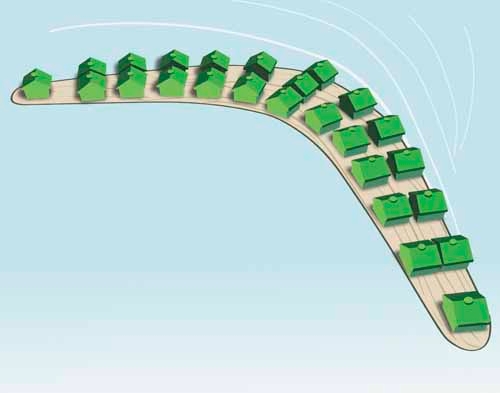

Bailey is at the leading edge of a growing demographic: boomerang buyers, or locals who lost their home to foreclosure or short sale, but are jumping back into the market just two to three years after default.

Their numbers are small now; real estate agents and home builders say boomerang buyers don't yet make up a big share of their clients. There's evidence, though, that their ranks are set to rise noticeably, and that could have implications for local home sales and neighborhood vitality.

"It is definitely something people in the business are talking about," said Dennis Smith, president and CEO of local analysis firm Home Builders Research. "It is happening. These people are coming back, especially because it's cheaper to own than to rent in a lot of cases."

Gauging potential effects means figuring out how many boomerang buyers are pacing the sidelines, waiting to get back in the game. If numbers are any indication, they are a substantial, untapped source of prospective buyers.

The Las Vegas Valley's homeownership rate was 64 percent in 2000, and jumped to a high of 68.8 percent as housing boomed in 2006. By March, homeownership had slid to 48 percent.

It's tough to say how many of those homeowners-turned-renters lost property to foreclosure or short sale, but Brian Gordon, a principal in local research firm Applied Analysis, said defaults were "probably a significant contributor" to the rental surge.

About 130,000 local households have lost a home to foreclosure or short sale in the downturn so far. And because the city's population hasn't fallen, it's likely that many locals who defaulted are still here.

Those former homeowners are finding their way into offices of local mortgage companies and builders.

ANOTHER CHANCE

Rick Piette, owner of Premier Mortgage Lending in Las Vegas, said his company has funded nearly 200 loans in the last year through its Another Chance program for recently foreclosed buyers. That's up from 10 or 12 Another Chance loans in the prior 12 months.

"It took a while for people to accept that there was financing available," Piette said. "Now, we're busy as heck. Our phones are ringing off the hook."

Geoff Gorman, vice president of sales for Harmony Homes, said his company began to see an uptick in formerly foreclosed shoppers last spring. Today, 30 percent to 50 percent of visitors to the builder's local new-home subdivisions were either foreclosed on or went through short sale. So far, they are mostly just looking. Some of them don't realize they have to wait a while to buy. Others have already done their time, and are kicking the tires.

At a recent subdivision opening in Mountain's Edge, a big share of traffic came from defaulted former owners who couldn't buy today, but who planned on buying in six to eight months, after they had reached the two- or three-year mark following their foreclosure.

But wait a minute - don't major financial crises stay on your credit report for up to 10 years? Well, yes. If you're willing and able to pay a price, though, and you have few other risk factors in your borrowing history, you can get back into the market relatively quickly.

Typically, if you're buying within two years of foreclosure or short sale, you'll need 20 percent down, and you may be looking at a mortgage interest rate of 6.99 percent, about double today's going rate of 3.5 percent. And forget about the loose paperwork standards of the boom. Lenders want full documentation, with verified income statements.

It also helps if foreclosed buyers were employed through the recession, Piette said. If borrowers have good payment histories outside of foreclosure, that's in their favor, as well.

"If they were poor payers before (default), then they don't fit our programs," he said.

Bailey, who didn't borrow through Premier Mortgage, said he was surprised when he realized he could buy again just 24 months after he lost his home.

"I really thought that my life was over financially," he said.

CAUGHT OFF GUARD

Bailey's problems began soon after he bought his home.

Bailey said he knew the market couldn't keep appreciating at its breakneck, boom-era speed, but he - like many others - didn't see housing's cliff-dive coming. For Bailey, the market's free fall was a "double whammy." Not only did he buy a home at the peak, but his and his family's income came from housing. Revenue from the family's real estate brokerage plummeted to "absolute zero," and the company burned through $200,000 in reserves. Bailey ran up credit card debt trying to pay expenses and keep the business open.

At home, things were just as tough. The 1,200-square-foot Summerlin house Bailey had purchased for $260,000 in 2006 was worth $115,000 by 2009. With no income and burgeoning credit card bills, he had no way to make payments.

"But it was at the beginning (of the crash), and getting the bank to talk was impossible. They just kept sending me these nonsensical packages," he said. "I couldn't talk to anybody who had any kind of answer, so I ended up asking them to take back the property."

Bailey's home was formally foreclosed on in July 2010. He became a renter, and stayed one until September, when he closed on his new home in The Paseos in Summerlin.

To make the deal happen, Bailey put down 20 percent and is paying a little more than 6 percent interest. He also had to pay 3 percent of his mortgage's value in loan-origination fees, compared with 1 percent to 2 percent for the average buyer.

The cost was worth it for him.

"I just wanted to be a homeowner again," he says. "I wanted to do my own flooring and landscaping and have that pride of ownership. I wanted to have an asset."

Observers say more and more locals want the same thing.

"People who have been in that situation (default) are actually anxious to buy," Gorman says. "They're nervous not to buy. They're worried that prices are possibly going up. A lot of people lost a lot in the housing bust. Today's prices and interest rates potentially make it possible to make some of that back up someday. I can't help but think that today's prospective buyer is thinking that."

WHY GAMBLE AGAIN?

Locals who have lived here five years or more have heard that refrain before: We'd better jump in now before we're priced out! That panic drove people into a frothy market and set up the epic collapse.

Is it a good idea to follow that logic again, especially with potential buyers who have such a big, recent black mark on their record? After all, the vast majority of locals were never foreclosed on or short-sold their homes. Why gamble so soon on those who did?

Two reasons, experts say.

First, today's lending climate is so strict that truly risky borrowers still can't get a break.

"If someone got themselves into a situation that didn't really work out, I'm not going to judge as to whether they're worthy" of buying again, Gorman said. "But if they're financially capable of qualifying to buy in today's much more difficult borrowing atmosphere, then I think they deserve a home."

Second, getting the market close to where it was before boom and bust depends on giving lower-risk buyers a second chance, said Bailey, who folded his family's brokerage into Coldwell Banker Premier Realty, where he now works.

"Anything that normalizes the market is good," he said. "You should have a certain percentage of owner-occupiers, and a certain percentage of investors and tenants. Once that becomes normal, the whole system will work."

How normal the system might be, and how well it might work, are questions still up for debate.

Increasing numbers of local buyers who went through default won't necessarily help solve one of the market's big problems: vast tracts of abandoned homes. More than 85,000 of the Las Vegas Valley's 771,000 houses, condos and apartments were empty in the second quarter, for a vacancy rate of 11.1 percent, according to the Center for Business and Economic Research at the University of Nevada, Las Vegas.

Empty housing stock won't fall if more locals buy, because those buyers are simply vacating a rental to move into their new place.

It's a net-zero for inventory, said Gordon, of Applied Analysis.

What would help is if boomerang buyers from California and other states begin moving here in larger numbers to buy and live in a home, Gordon said.

Even if boomerang buyers don't dent the housing inventory, they could have an effect on communities across the valley.

"There are positives when you think about pride of ownership, which can positively impact neighborhoods, including some neighborhoods that were hard-hit in the downturn and became predominantly renter-occupied," Gordon said. "As the dynamic shifts, we may see increased investments in landscaping and other improvements that will have properties holding their value better or gaining ground."

It's also important to have local buyers in place when investors stop buying more than half of the city's listings, the way they are today, Piette said.

"People ask me if I think I'm making things worse" with second-chance loans, he said. "My response is, 'I don't think things can be any worse.' We have to stop looking backward and start looking forward, and part of that is getting Nevadans back into houses."

Greg Bailey said getting back into a house was an end to a trial-by-fire that eventually made it possible for him to begin a new life.

"Now, I sit on my porch and look at my view of the city, and I feel like it just had to be," Bailey said. "There was a light at the end of the tunnel."

Contact reporter Jennifer Robison at jrobison@reviewjournal.com or 702-380-4512. Follow @J_Robison1 on Twitter.