Money Show speakers laud investment potential of marijuana

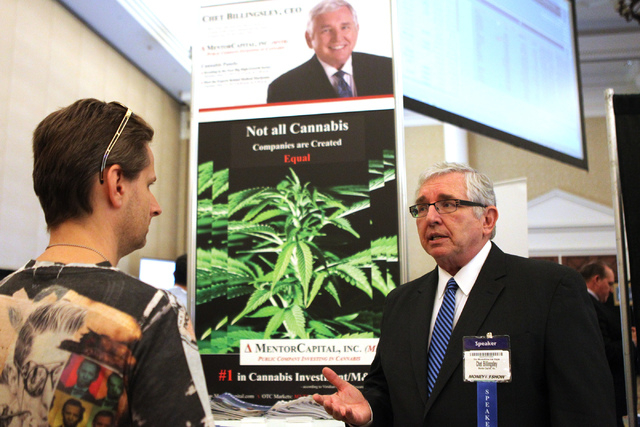

As different forms of cannabis are rapidly legalized across the United States, corporations involved with the drug have exponential growth potential, speakers at the first-ever Cannabis Investing Symposium said this week at the 34th annual MoneyShow in Las Vegas.

“The cannabis market will never be as small as it is today,” said marijuana advocate Cheryl Shuman, founder of Beverly Hills Cannabis Club, to a room of nearly 150 investors at Caesars Palace. “The people sitting in this room are going to be the billionaires of 2016.”

Fifteen speakers participated in the symposium, a daylong workshop dedicated to investment in marijuana-related businesses. The event focused on a popular narcotic plant, not yet legal in Nevada or most of the United States.

Michael Markowski of Dynasty Wealth Investing, a Fort Lauderdale, Fla., firm, said as more states move to legalize the drug, marijuana stocks will surge around the 2016 presidential election.

And as dialogue surrounding pro-marijuana candidates and cannabis-related legislation increases, public response and awareness of the industry will also grow, sparking a bullish marijuana market, Markowski said.

“The fervor is going to come back,” he said.

The cannabis industry, which Monday’s panel said was valued at $5 billion, could become worth up to $100 billion in 10 to 15 years, said Penn Financial Group President Matt McCall, the symposium’s master of ceremonies.

Cannabis is one of the few industries to see consistent investment from millennials, McCall said. Although millennials are generally not as involved in stocks as previous generations, 18- to 25-year-olds are investing more in cannabis than in any other industry.

“They understand cannabis,” McCall said. “They like to invest in what they know.”

Michael Berger, president of Technical420, a cannabis research firm, recommended GW Pharmaceuticals (ticker: GWPH, Nasdaq), Two Rivers Water &Farming Co. (ticker: TURV, over-the-counter) and Insys Therapeutics Inc. (ticker: INSY, Nasdaq) as top marijuana-related companies for investment.

“They have a deep pipeline of products that is going to lead to incremental revenue growth in the next decade,” Berger said of GW Pharmaceuticals, his top choice for investors.

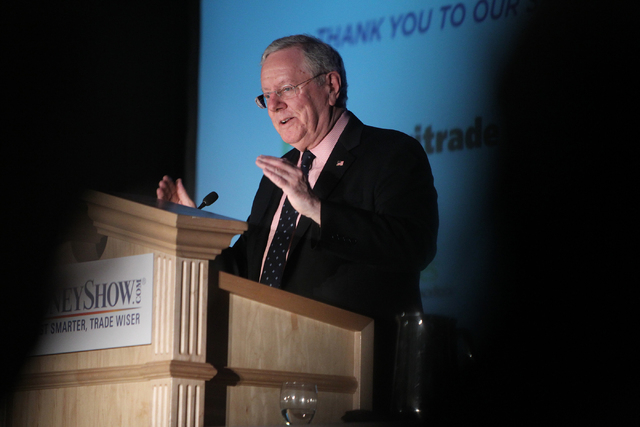

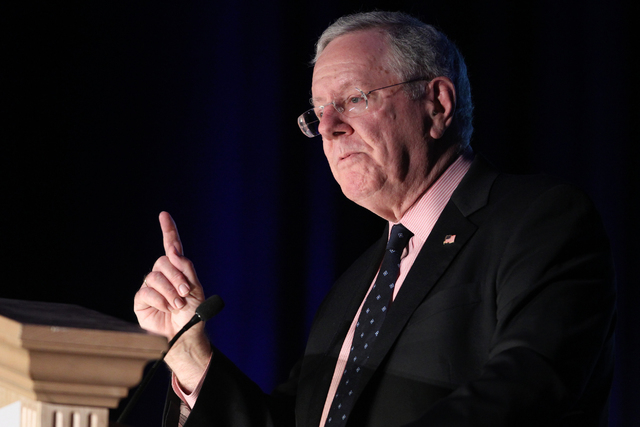

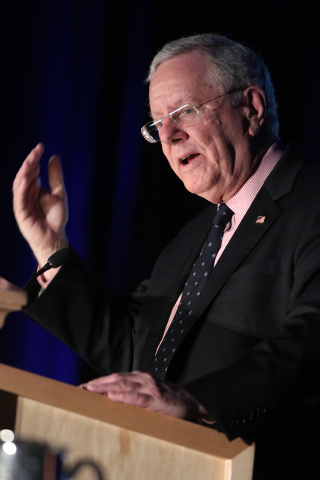

Tuesday’s MoneyShow speakers included Forbes Media CEO Steve Forbes and Digital Power Group CEO Mark Mills.

Speaking to about 1,000 people, Forbes praised recent income tax cuts in Great Britain and advocated a flat-rate income tax across the United States.

Federal regulation has stunted national economic growth by 50 percent over the past 40 years, Forbes said, costing the country $8 trillion of “lost output.”

“Imagine having $8 trillion more in our economy today,” he said. “Life would be a lot better.”

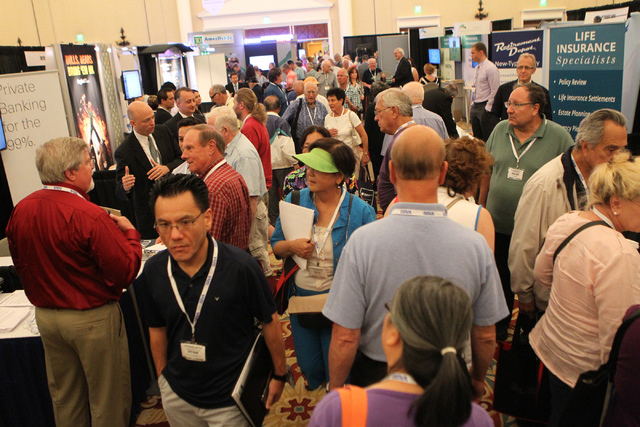

The show was expected to draw 6,000 investors from around the globe with portfolio sizes from $250,000 to $10 million, MoneyShow President Aaron West said.

Eighty-three percent — or nearly 5,000 participants — have portfolio sizes over $250,000, and 15 percent or about 900, are worth more than $2.5 million.

The MoneyShow drew 150 speakers from companies such as Forbes, Dow Jones, Fox Business and MarketWatch. The four-day show, which is open to the public, ends Thursday.