Taxable sales surge 11.2 percent

Looks like the utilities business is pretty strong in Nevada's hinterlands.

It's tough to figure out exactly why -- it could be big equipment purchases for anything from a solar power plant to a water-pumping station -- but utilities-related purchases in two rural counties spurred major gains in the Silver State's taxable sales in December.

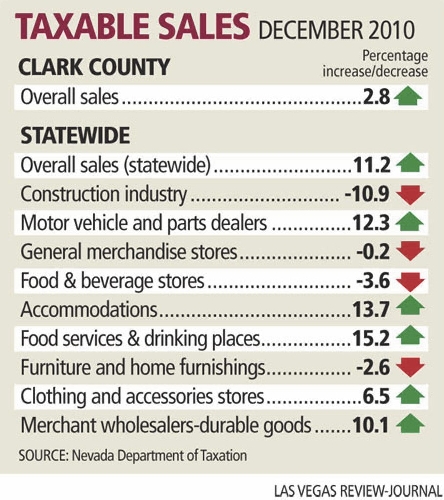

Nevada's merchants improved their taxable sales in the month by 11.2 percent, moving nearly $4.1 billion in tangible goods in the month, the state Department of Taxation reported Wednesday. That's up from $3.7 billion in December 2009.

In Clark County, sales rose a more modest 2.8 percent, to $2.7 billion.

Roughly $250 million of Nevada's $400 million increase in year-over-year sales came from purchases in the utilities sector in Humboldt and Elko counties, said Brian Gordon, a principal in local research and consulting firm Applied Analysis.

That means the statewide improvement could be an anomaly thanks to some unusually high and relatively isolated purchasing activities in a single industry.

Still, the rest of the taxable-sales picture shows solid gains, including in some key consumer-oriented categories, Gordon noted.

Sales among bars and restaurants jumped 15.2 percent statewide and 17.6 percent in Clark County, while retail sales inside hotels and motels increased 13.7 percent both statewide and in Clark County. Clothing and accessories stores saw sales grow 6.5 percent across the state and 7.7 percent in Clark County, and transactions by dealers of cars and car parts gained 12.3 percent statewide and 11.1 percent in Clark County.

"Consumer spending appears to be bouncing around on what would be a bottom, given the flattening job market," Gordon said. "Unemployment is not improving, but the pace of decline is slowing, and there's a general sense that the worst may be behind us. With the pullback in consumer spending during the downturn, people have been cautious for so long. It appears we're resuming some normal level of sales activity."

The construction industry continued to show sales declines, though December's statewide falloff of 10.9 percent ran well below the 30 percent and 50 percent skids that visited the sector during the recession's depths. The smaller decline probably comes from year-over-year comparisons, as December's sales were measured against 2009's especially hard times, Gordon said.

Taxable sales remain below their peak levels, though they're creeping slowly back toward those highs.

Taxable sales reached a record $4.7 billion statewide in December 2006, and a record $3.5 billion in Clark County in December 2007.

The last time Nevada's taxable sales surpassed $4 billion was in August 2008, just after the recession's dawn.

Revenue collected from taxable sales helps fund prisons and schools, among other public services.

Gross revenue collections from sales and use taxes came in at $315 million in December, up 8 percent when compared with December 2009. The general-fund share of sales and use taxes was $81 million, up 8.4 percent over a year ago.

Through the first six months of fiscal 2011, which began July 1, the general-fund portion of sales and use taxes ran $8.8 million, or 2.3 percent, above expectations of the Economic Forum, a nonpartisan group that forecasts revenue for state budgeting purposes.

Contact reporter Jennifer Robison at jrobison@reviewjournal.com or 702-380-4512.

TAXABLE SALES

• Record $4.7 billion statewide in December 2006

• Record $3.5 billion in Clark County in December 2007

• The last time Nevada's taxable sales surpassed $4 billion was in August 2008.