Gambling stocks get January jolt

The gaming sector mirrored the rest of Wall Street last month, which several analysts termed as the best January in more than a decade.

All 10 publicly traded casino operators and slot machine manufacturers charted by Las Vegas-based financial adviser Applied Analysis posted gains in average daily stock price during the month, which ended Tuesday.

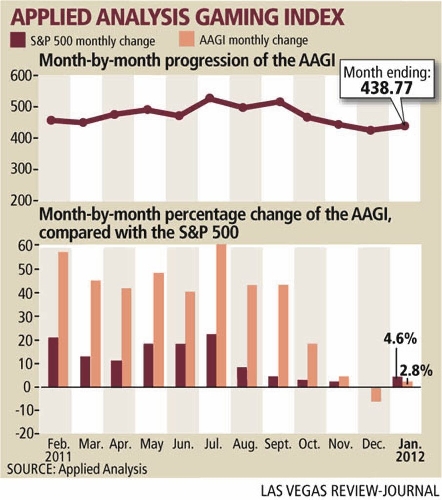

The performances pushed the company's Gaming Index, which considers some 300 market variables, up almost 12 points to close at 438.77.

Two companies, MGM Resorts International and Boyd Gaming Corp., showed double-digit increases in average daily stock price, beating other companies, such as Wynn Resorts Ltd., and Las Vegas Sands Corp., which have large holdings in Asia.

Applied Analysis principal Brian Gordon said the investor speculation suggested value was being assigned to the companies whose holdings are more Las Vegas-centric than the rest of the publicly traded sector.

MGM Resorts operates 10 Strip casinos, including Bellagio, MGM Grand and Aria, the centerpiece of the CityCenter development. Boyd Gaming focuses on the locals market with its Coast Casinos brand and Sam's Town property. The company also operates regional casinos in the south and Midwest and half-owns the Borgata in Atlantic City.

"While the operating environment remains somewhat fragile, increased stability in the market provides a strong foundation from which operators will be measured going forward," Gordon said.

Susquehanna Financial Group gaming analyst Rachael Rothman said she wasn't surprised that investors have cooled somewhat on Asia-centric gaming companies, though Macau did grow gaming revenues more than 42 percent in 2011 to $33.5 billion.

"We have seen shares of gaming names with higher China exposure underperform, as expectations for growth in Macau have reset lower," Rothman said. "We expect gaming revenue growth will slow in 2012 and beyond to more sustainable levels."

Both the Dow Jones industrial average and the Standard & Poor's 500 recorded their best percentage jump for the month of January since 1997.

Applied Analysis attributed much on the gaming sector's January stock performance to greater profitability expectations coming from the upcoming quarterly earnings reports, broader equities market performance and a modest bump associated with stronger-than-expected gross domestic product results in China.

Las Vegas Sands, Ameristar Casinos and slot machine maker Bally Technologies report quarterly earnings today while Penn National Gaming and Wynn Resorts Ltd. have scheduled earnings reports for Thursday.

Slot machine makers experienced the same average daily stock price increases as the casino operators, although International Game Technology saw its figure grow just 1.3 percent.

Investors remain somewhat unsure about IGT's $500 million acquisition of an online social gaming company, said one Wall Street analyst.

Stifel Nicolaus Capital Markets gaming analyst Steven Wieczynski said IGT, however, is much better positioned than its competitors to ride out any further declines in slot machine sales by American casino operators.

Wieczynski recently hosted a series of investor meetings with IGT management. In a research note, he recounted that IGT "doesn't paint a rosy picture for the domestic replacement cycle or have unrealistic views there will be a massive uptick in operator slot spending in the near-term."

Still, Wieczynski said the company, which has corporate headquarters in Las Vegas and a manufacturing base in Reno, has taken necessary steps to right-size the business.

"In the end, given IGT's dominant North American market share, improving international presence and attractive complimentary interactive opportunities, we believe the company remains well positioned to outperform its manufacturer counterparts, particularly if North American replacement demand sluggishness persists," Wieczynski said.

The meetings came shortly after IGT said it was acquiring Double Down Interactive, which is the developer of Facebook's Double Down Casino.

"(The) announcement is being viewed skeptically from the majority of the investment community," Wieczynski said. "We continue to believe investor sentiment on the name is lukewarm at best with few expecting upside surprises throughout 2012."

Several factors, however, including game content, lead Wieczynski to believe IGT "should be able to command a greater share of operators' capital budgets in the quarters ahead."

Contact reporter Howard Stutz at hstutz@reviewjournal.com or 702-477-3871.

Follow @howardstutz on Twitter.