March mixed for gaming stocks

Publicly traded gaming companies gave investors a slew of mixed messages during March.

The average daily share price for two casino operators that derive most of their revenues from Asia blossomed during the month. Three of four gaming equipment manufacturers also experienced marked stock price increases.

But other companies, including the two largest Strip casino operators, saw small declines.

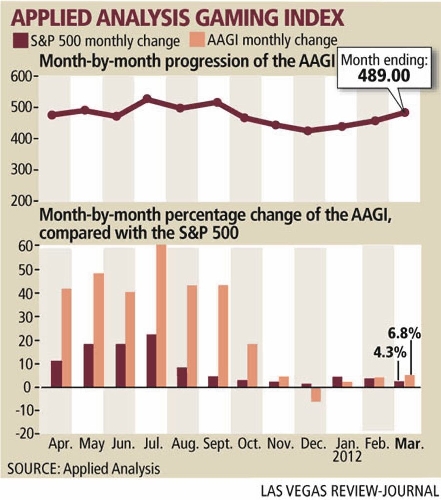

The average daily stock prices were followed by Las Vegas financial consultant Applied Analysis for the company's Gaming Index, which rose almost 7 percent over February's close. The index tracks more than 300 market variables and economic indicators.

"With limited financial reports from operators and manufacturers, pricing movements were largely sourced to regulatory changes, expectations for gaming expansions into new markets and broader investor speculation," Applied Analysis principal Brian Gordon told the firm's clients in a research report.

The index includes 12 companies, eight casino operators and four manufacturers by adding Caesars Entertainment Corp. and Shuffle Master Gaming.

Caesars launched a small initial public offering in February and filed paperwork with the Securities and Exchange Commission for an additional stock sale earlier this month.

Las Vegas Sands Corp. (up 9 percent) and Wynn Resorts Ltd. (a nearly 8 percent increase) had the largest percentage increases among casino operators in March. Las Vegas Sands collects about 80 percent of annual revenues from holdings in Macau and Singapore. Wynn Resorts has two casinos in Macau.

MGM Resorts International, which operates the 600-room MGM Grand Macau, saw its average daily stock price decline by 1.3 percent, but that didn't concern analysts. The company raised $1 billion from unsecured bonds to restructure a portion of its $12 billion of debt.

Macquarie Securities gaming analyst Chad Beynon told investors MGM Resorts has spent the past 18 months "cleaning up" long-term debt that had near-term maturities.

Beynon said the company's bright spot has been the MGM Grand Macau, which has "developed into a major player in Macau."

CityCenter, however, is the company's "albatross, in our view," he said.

Beynon said shares of MGM Resorts would be trading "higher by several orders of magnitude" without the project.

"That being said, the property is not going away, and MGM Resorts has the ability to make several tweaks to drive visitation and profitability," Beynon said. "T he company continues to improve operations in Macau and build upon the nascent Las Vegas Strip recovery."

Two regional casino operators, Penn National Gaming and Pinnacle Entertainment, had modest average daily share increases in March.

Janney Montgomery Scott gaming analyst Brian McGill said Penn National would capitalize on growth opportunities. The company is moving forward on casino developments in Columbus, Ohio and Toledo, Ohio.

"We continue to like Penn National, as the two Ohio casinos are closer to opening," McGill said. "After a strong February, we believe the company is poised to report strong first-quarter results. In the long-run, we believe Penn could move to over $60 (per share) given the potential of the two casinos in Ohio."

March was the right month to add Shuffle Master to the Index. The table game maker and gaming equipment manufacturer saw its average daily stock price climb 17 percent over February.

Stifel Nicolaus Capital Markets analyst Steven Wieczynski said Shuffle Master has "several attractive growth catalysts" that could drive above-average increases in earnings per share.

More than 50 percent of Shuffle Master's sales came from outside the U.S. casino market during the first quarter, Wieczynski said, which "makes the company less dependent on one particular product or gaming market ."

Contact reporter Howard Stutz at hstutz@reviewjournal.

com or 702-477-3871. Follow @howardstutz on Twitter.