MGM to delay opening of $3B MGM Cotai until ’17

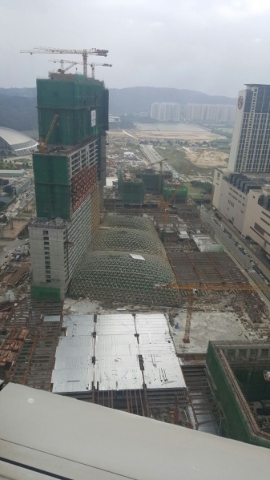

MGM Resorts International said Thursday it would delay the opening of the planned $3 billion MGM Cotai until the first part of 2017 because of Macau's struggling casino business and the planned openings of other multibillion dollar resorts in the region.

At the same time, MGM Resorts Chairman and CEO Jim Murren said the company's strong convention and leisure business and an overall increase in Las Vegas visitation helped its Strip resorts. CityCenter, which includes Aria, had cash flow of $106 million, its best cash flow quarter in the development's history.

In a quarterly earnings call, Murren cited the company's booming convention business in Las Vegas. MGM Resorts completed its 350,000 square foot expansion to the Mandalay Bay convention complex and announced plans to expand the Aria convention center some 200,000 square feet by 2018.

The capacity is needed because Mandalay "will outgrow the space in a couple of years," Murren said. He added that the company "booked a half-billion-dollars" of new convention business for 2016 and 2017.

"I want to clear up any confusion," Murren said at the outset of a conference call with analysts. "It was a great quarter for MGM and for the year."

In an interview following the conference call, Murren said MGM Resorts is developing a master plan to add convention capacity on the Strip, where it controls more than 3 million square feet of conventions, meetings and conference space. He said Bellagio, MGM Grand and Luxor could seen convention expansion opportunities.

"What do we see in the market? We're creating experiences and giving people reasons to come to Las Vegas," Murren said.

In Macau, MGM Resorts International recorded a net loss of $1.47 billion in the fourth quarter after taking a noncash impairment charge related to the casino company's Macau holdings.

The Las Vegas-based company said the $1.5 billion charge was because of "market conditions" in Macau, where the Chinese gaming enclave's overall gaming revenue has fallen for 20 straight months. The net loss translated into a loss per share of $1.38. A year ago, MGM lost $287.4 million, or 70 cents per share.

Revenue from MGM Resort's MGM Macau property fell 30.6 percent.

The Macau results offset increases in results from the company's Strip and regional gaming properties.

In the quarter, which ended Dec. 31, companywide revenue fell 8.1 percent to $2.2 billion. The company's Strip resorts saw revenue increased 2.2 percent to $1.3 billion, MGM Grand Detroit saw revenue grow 8.3 percent and its Mississippi casinos grew revenue 2.9 percent.

Murren focused on the company's cash flow for the quarter and the year. He said the figure, which takes in account earnings before items such as taxes are removed, grew 36 percent in the fourth quarter to $586.2 million and 47 percent to $1.69 billion for all of 2015, the company's best year since 2008.

But Stifel Nicolaus Capital Markets gaming analyst Steven Wieczynski said results at MGM's luxury Strip resorts excluding Bellagio, "were somewhat soft."

MGM shares closed down $1.67, or 8.32 percent, to end the day at $18.86 on the New York Stock Exchange.

"While shares slumped following results largely around Macau, we continue to see MGM as well-positioned to benefit from its continued investment on the Strip and leading market share up and down the spectrum," said Credit Suisse gaming analyst Joel Simkins.

For all of 2015, MGM Resorts total revenue fell 9 percent to $9.2 billion. The company's Macau property saw revenue decline 33 percent to $2.2 billion.

MGM said it was ahead of pace on achieving its Profit Growth Plan initiatives, which the company predicts will bring in an additional $300 million in cash flow by the end of 2017. Murren said the company expects to achieve $200 million in additional cash flow by the end of this year.

Meanwhile, MGM Resorts said it has "substantially completed" the review process with the Securities and Exchange Commission toward an initial public offering for its 70 percent-owned real estate development trust. The company said the SEC will continue to review the filings and may issue additional comments in the future.

MGM plans to place 10 properties in to the REIT, named MGM Growth Properties, including seven of its Strip resorts. Murren said the results from those properties in the last three months of the year, "would have made a great quarter for (MGM Growth Properties)."

Contact reporter Howard Stutz at hstutz@reviewjournal.com or 702-477-3871. Find @howardstutz on Twitter.